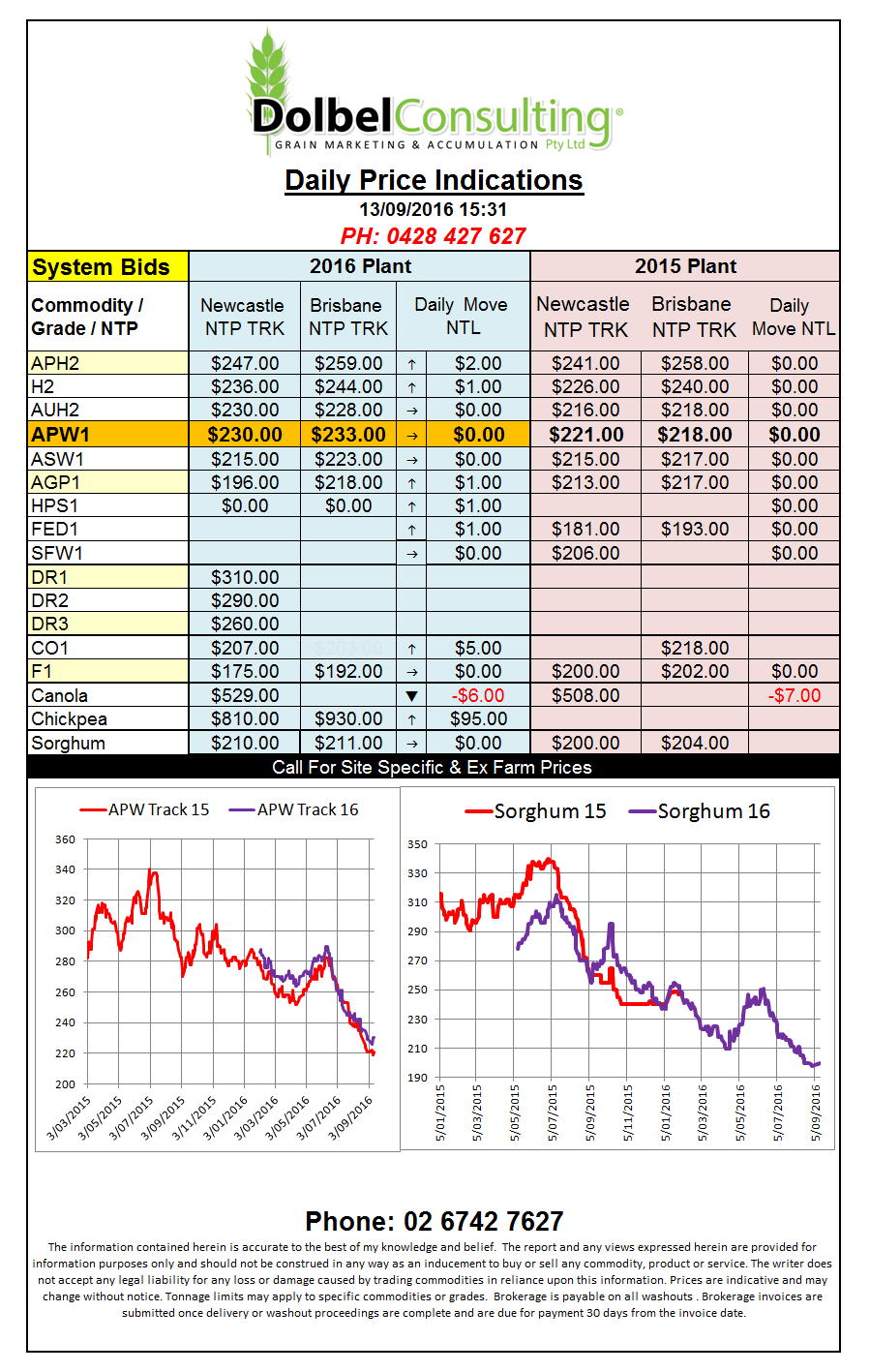

Prices 13/9/16

A fairly non eventful day in US futures considering it was a WASDE day. Wheat eventually came out a winner and soybeans a loser while corn was torn between the two. The weaker soybean market spilled over into canola. When combined with the canola data out last week that increased carry in stocks and yields in Canada futures at the ICE could no longer hold its ground and fell away sharply. Paris rapeseed also slip €3.00 on the nearby contract.

The wheat numbers in the WASDE might be shrouded with a little of the old smoke and mirrors magic but some adjustments are believable. Like the Aussie crop increasing from 26.5mt to 27.5mt. Local punters have pegged the Aussie crop as high as 30mt, just yesterday ABARES official estimate increased to 28.1mt. I’d hate to be an export pool manager next year.

We should continue to see APH spreads increase leading into harvest, which is generally the better time to price the higher grades. The APH – APW spread has bounced around between $10 and $20 since June, not as strong as some of the global reports would lead you to believe it could be.

Some of the other wheat adjustments of interest in the WASDE were Canada +0.5mt to 30.5mt, EU -2.23mt to 145.27mt, Brazil +700kt to 6mt, China -2mt to 128mt. China is a little interesting for corn too, it was pulled back 2mt to 216mt. It would be good to see a sorghum number for China after serious flooding was said to have hurt much of their crop this year.