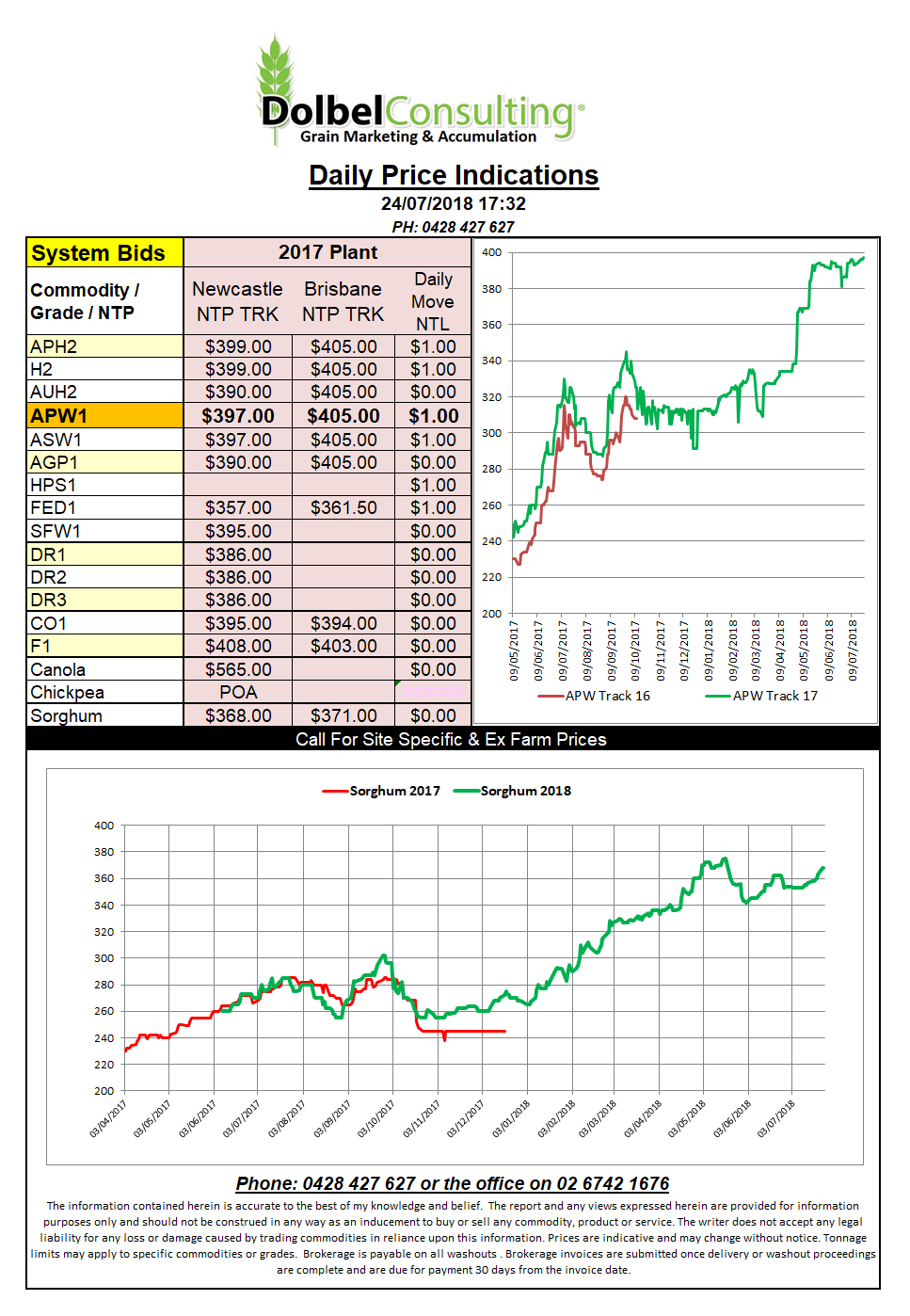

Prices 24/7/18

Chicago corn futures saw a little upside in overnight trade. Last week’s heat in the corn belt seems to have taken a little of the upside yield potential out of the crop but generally the crop remains in pretty good shape.

Demand for US corn is expected to pick up over the next couple of months as logistical issues continue to choke S.American supplies and Ukraine suffers its own production problems. Longer term corn may not paint such a nice picture though as the US farmer walk away from soybeans in favour of corn next year. Something to remember when pricing new crop sorghum.

Still at Chicago we saw mixed wheat futures with soft wheat lower, hard wheat and spring wheat firmer. Weather issues across Europe and Australia are starting to make the punters think good quality milling wheat will be at a premium in 2018-19.

The white wheat producing region in the US Pacific North West has also had some issues. Fire have swept through a number fields, some estimates are as much as 79,000 acres have been lost to the fire. All this in a year where most fields were expected to yield well above average too.

EU milling wheat values have rallied to a 3 year high on the back of dry weather across N.Europe and rainfall across parts of the Black Sea crop which has the potential to severely downgrade their wheat. A high of €195.50 /t (AUD$310) was set at Paris in early trade. MARS reduced EU production on Monday. Total EU wheat production including durum is expected to slip below 140mt this year.