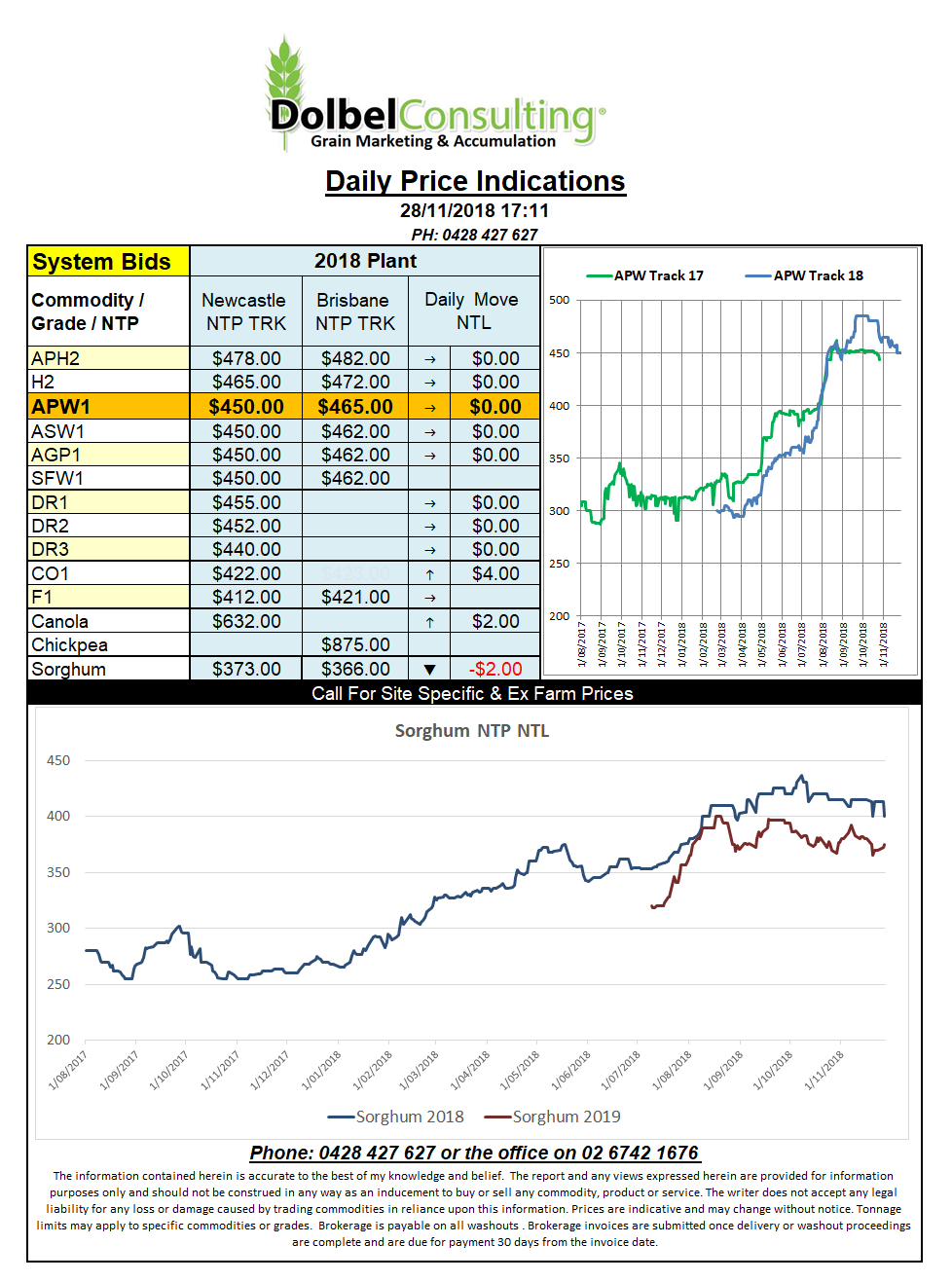

Prices 28/11/18

I’m getting a little sceptical of the US futures market, yeah yeah, I know stop rolling your eyes. It’s not like it’s a revelation or anything it’s just that sometimes it becomes a little obvious. I guess they hand out the odd hard to swallow pill in the physical market (-$92 sorghum / wheat) and if someone picks the pill up and actually swallows it well that’s their call. It’s just over the last few months it appears that when wheat is down soybeans and up and when wheat is up soybeans are down. I understand that these punters make money from volatility so I guess when the markets are this dead it’s hard to make a bob. I’d just like to see fundamentals (not politics and fund managers) have more of an impact I guess.

At Chicago soybeans were firmer across the board dragging both ICE canola and Paris rapeseed higher. Corn done nothing, does corn ever do anything. Wheat saw downward movement in all three grades.

Over in the Black Sea region Ukraine has declared martial law, how that fixes a water blockade has got me beat but that’s the call. The implementation of martial law spooked a few banks who had previously been happy to lend to the Ukraine. Can you see where this is heading now. From a grains perspective the main thing to remember is that the region being “fought “over is only responsible for about 6% of Ukraine grain shipments, so not a huge impact on world trade. The EU might slap Russia’s wrist with some more sanctions.