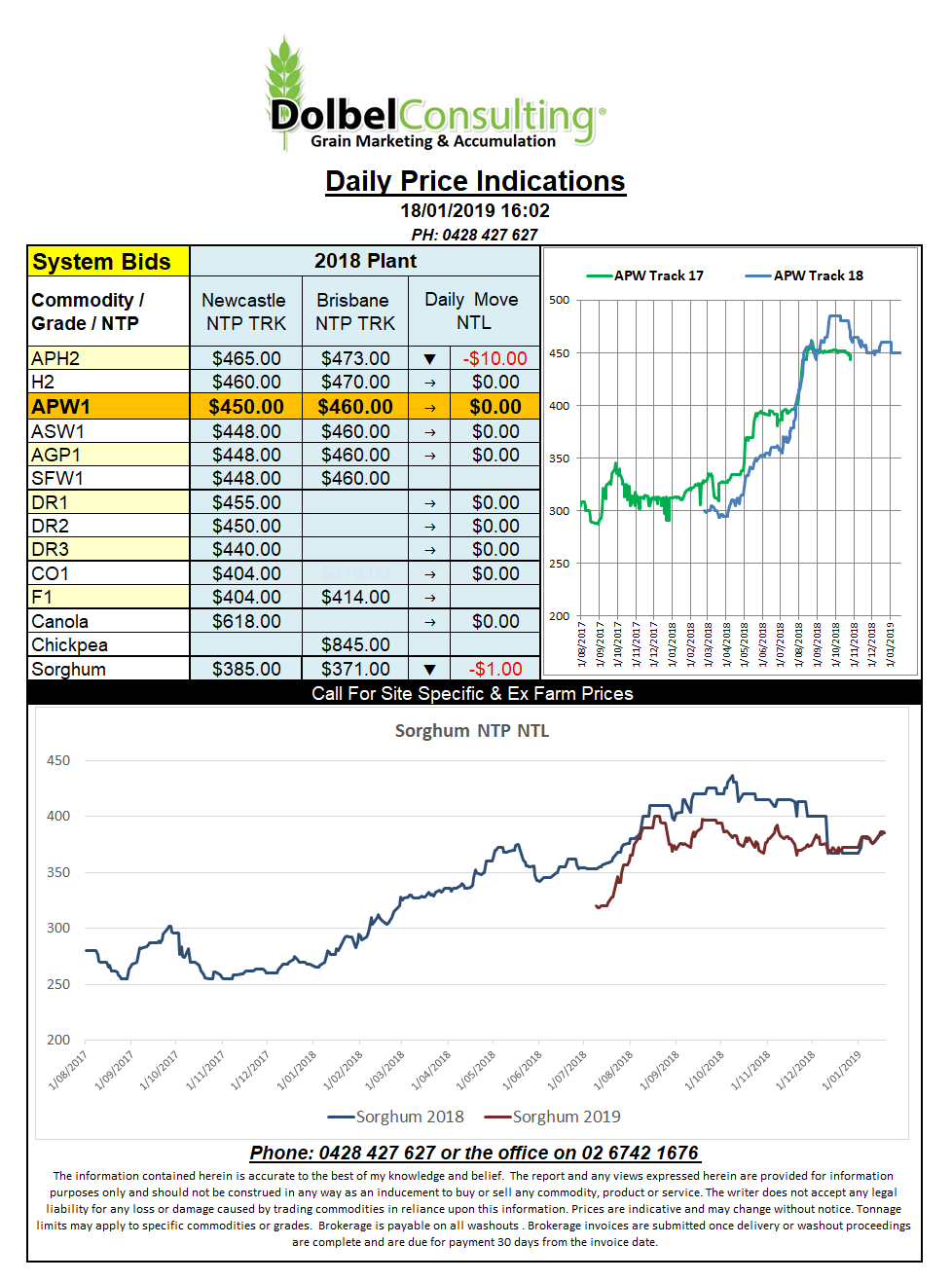

Prices 18/1/19

In the US futures market technical buying was supported by ongoing poor weather across parts of S.America.

The extremes across S.America at present are interesting. Drought continues across parts of the Brazilian soybean regions while further south in Argentina some parts of the country have seen in excess of 500% of average 30 day rainfall.

If the weather forecasters have got something right it does appear to be the correlation between drought here and floods in Argentina. The heaviest falls seemed to have occurred just to the NE of the major soybean and corn production areas but there is a good chance the rain is having a significant impact on summer crops. With bean harvest usually starting around late March and April it may take a while to quantify any impact, if there is any at all. The old saying rain makes grain may yet come true for Argentina.

US wheat futures crept higher and are now just a couple of cents a bushel under the price they were this time last week. The US punters remain optimistic regarding increased US exports on the back of slower Black Sea sales during the first half of this year. To date this is yet to become reality but the punters appear to be happy to go long on the prospect US exports will pick up.

Looking at a CME March 19 wheat chart you can determine the market is fairly neutral at present. You might expect this positioning to remain in place until we see some export and world S&D data out of the USDA.

There is still no sign of the US gov shut down being resolved as they finish day 27.