25/6/20 Prices

The US futures markets behaved a little more predictably last night, corn, soybeans and winter wheat was lower while spring wheat futures picked up a little. Reports that may influence prices for next week include this week’s US export volumes and sales and next week’s quarterly stocks report from the USDA. Winter wheat is seeing an increased volume of farmer selling in the US thus capping any short term attempt to push higher.

China has requested that international shippers of US soybeans and meat sign a certificate claiming that the goods are free from coronavirus. There’s the pot calling the kettle black if I’ve ever seen it. Ironically Tyson Foods has got on board. During the recent coronavirus outbreak in the US Tyson had been repeatedly targeted for its lack of preventative measures used to prevent the spread of COVID19. At the end of the day the certification request by China does appear to simply be another trade barrier though.

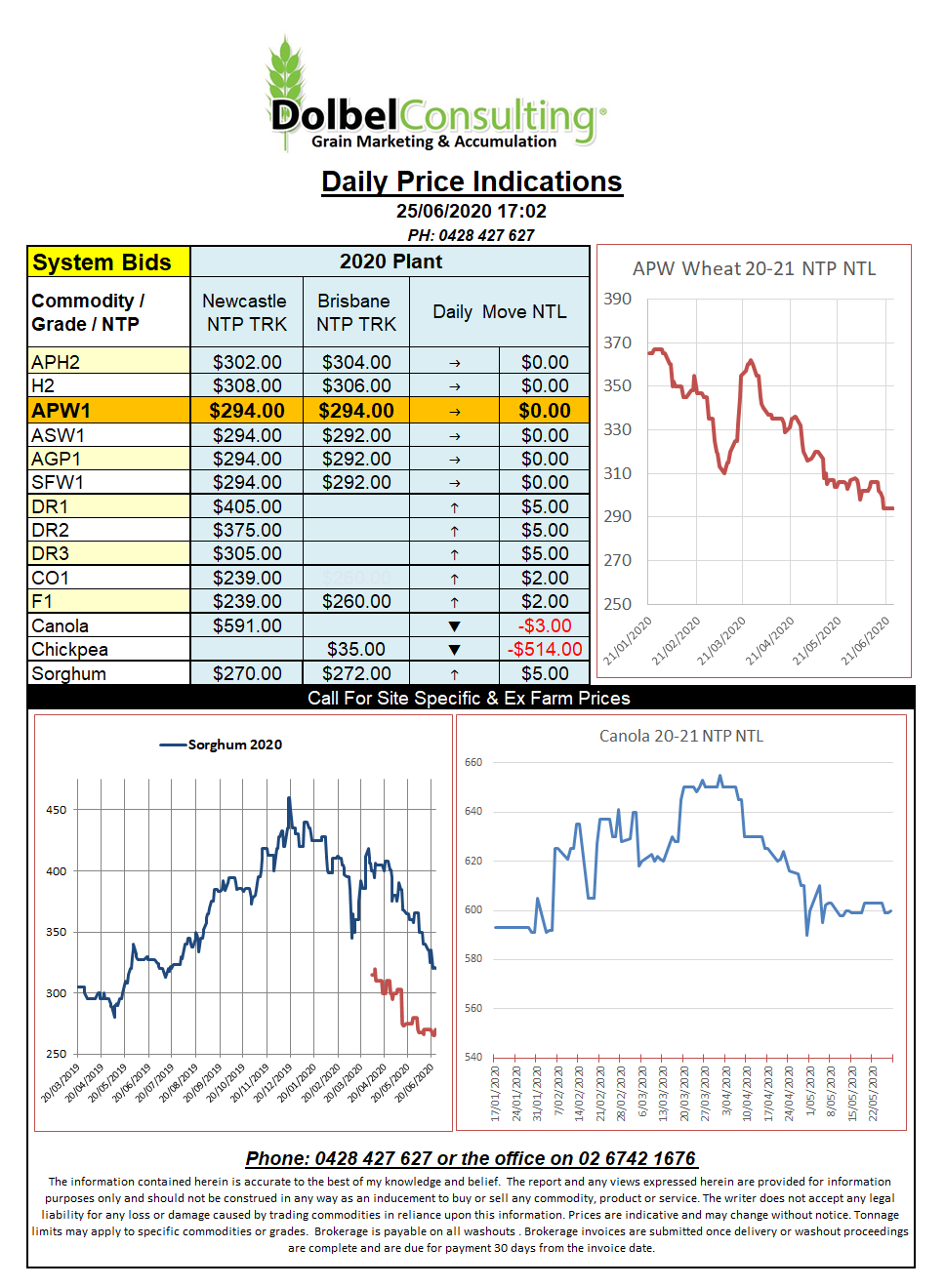

EU markets are basically following the same path as the US markets at the moment, London feed wheat and Paris milling wheat both closing lower. It is the harvest season. Paris rapeseed futures were sharply lower shedding E3.75 in the Feb slot. Recent gains on the back of better crude oil values were handed back, prices now back to exactly where they were last Thursday. The weaker AUD will go some way to buffer the decline in futures but are unlikely to cover the loss in oilseeds so we should expect to see canola a little weaker today. New crop wheat is likely to remain flat or possibly slip a little at the local level. Local durum flat to firmer, Canadian values were flat.