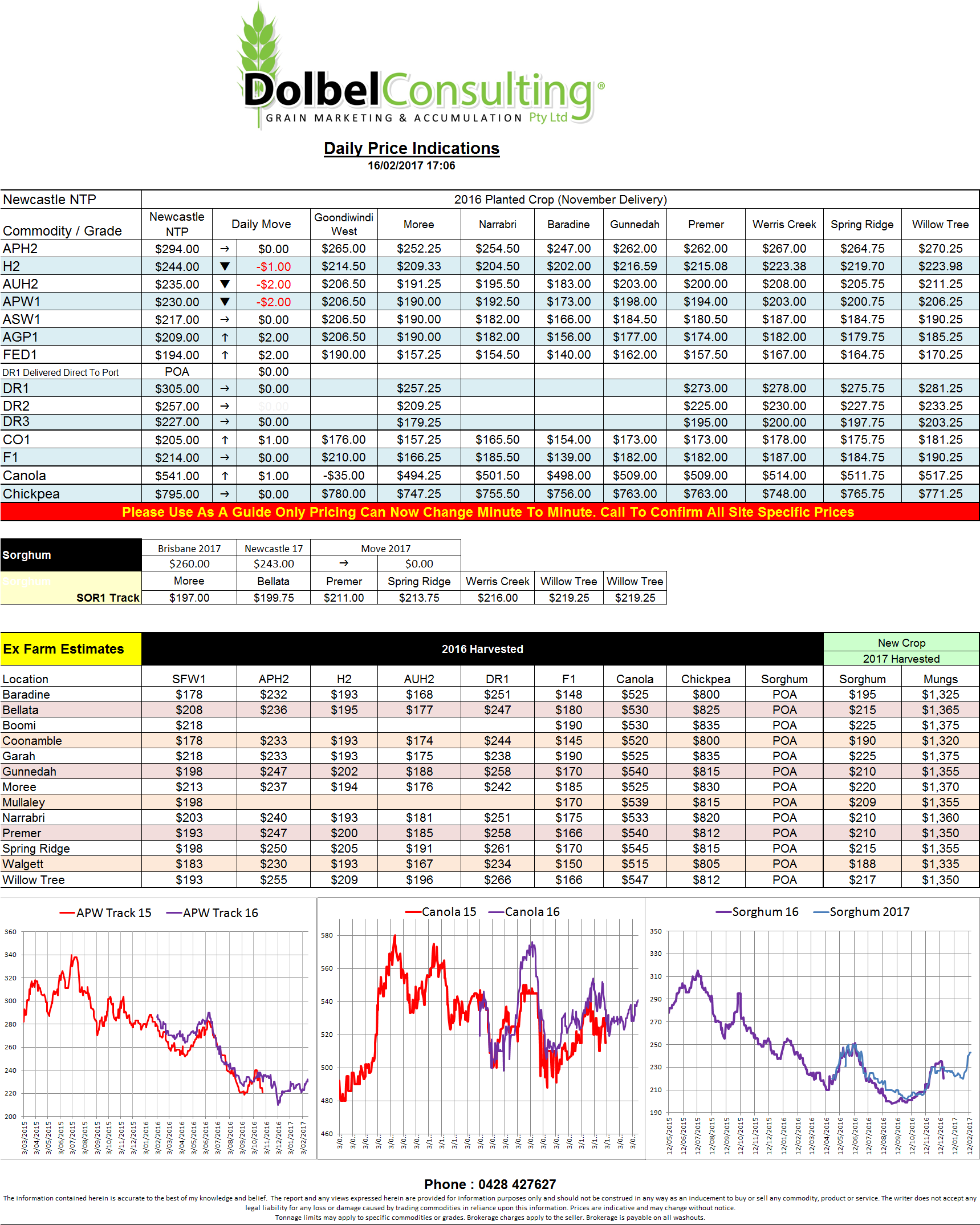

Prices 16/2/17

Talk of a US interest rate rise saw the US dollar firmer again many of the worlds currencies early in the session.

You would normally see strength in the USD make US commodity values slip but the talk last night was value of the Russian rubble.

The rubble has put on 6% this year and is now valued at 56.45 rubble / US dollar. This in turn increases the value of Russian wheat on the export market if Russia doesn’t reduce the domestic price of their wheat to counter the move higher.

Recent tenders do indicate that as the rubble strengthens the price of Black Sea wheat is increasing. This may also tell you that global wheat values are the lowest they can fundamentally be, reaching the cost of production in many locations. Technically there is no such thing as a cost of production so futures can fall as low as the paper trade wishes them too. We have already seen the Kansas wheat contract in the States prove convergence with cash markets as a contract comes to expire is a myth.

The stronger rubble will expose the Russian farmer to the terrible prices the rest of the world has seen this year and may well influence their planting decisions in the near term.

We have also recently seen the massive Black Earth Ag Co sell its Russian holdings to a Russian business. Could this be signalling the end to poor wheat prices and the ability of Black Sea wheat to win every Egyptian tender or simply mean Black Sea farming is as profitable as farming anywhere else in the world !