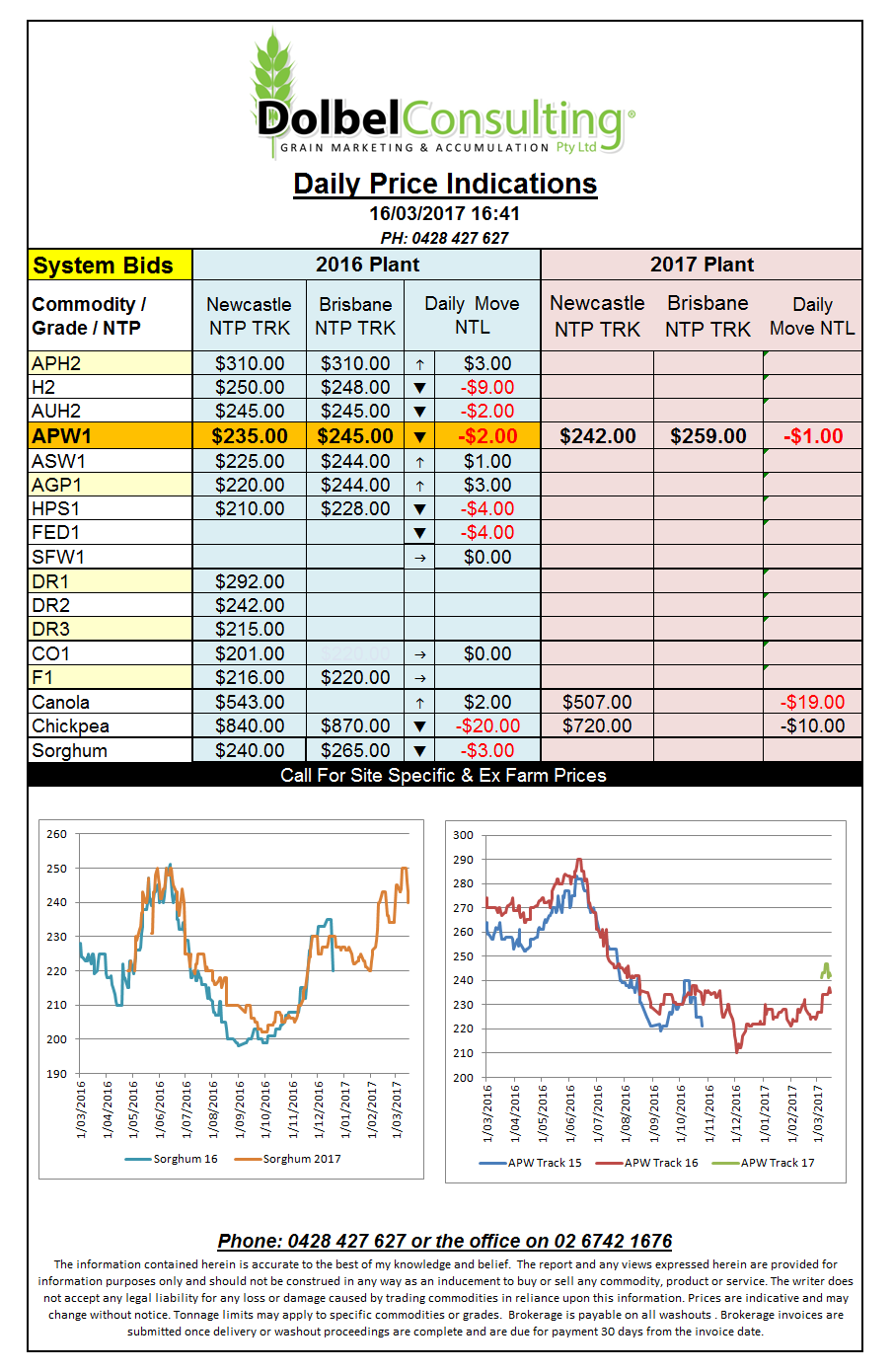

Prices 16/3/17

Well the US Feb spoiled the show last night after doing exactly what the world had expected. Market analyst had factored in an increase of 25 points and that’s exactly what they gave them. The US Fed also suggested two or three more rate hikes of 25 points throughout the year. The US dollar slid, not what average currency punters like you and I may have expected to see.

The big boys of currency street seamed more obsessed with the other detail in the speech that centred around US growth projections and a sustained inflation rate target of 2%.

Is this simply a case of buy the rumour / sell the fact, who knows when it comes to currency.

Grain futures in the US enjoyed the weaker USD and managed gains across corn, wheat and soybeans by the close. Spring wheat futures saw the best gains of the three wheat contracts, up 8c/bu (A$3.80) in May. The punters on the floor at Chicago were a little surprised by the drop in the USD too. Initially straight after the announcement to lift rates 25 points futures fell but as the floor realised that the US dollar was actually falling values picked up again.

After the close it was confirmed Egypt picked up 300k of Russian wheat and 60k each of Ukrainian and French wheat in their last tender. We have to wait until the end of the month to see what Libya has picked up in their 50kt durum wheat tender.