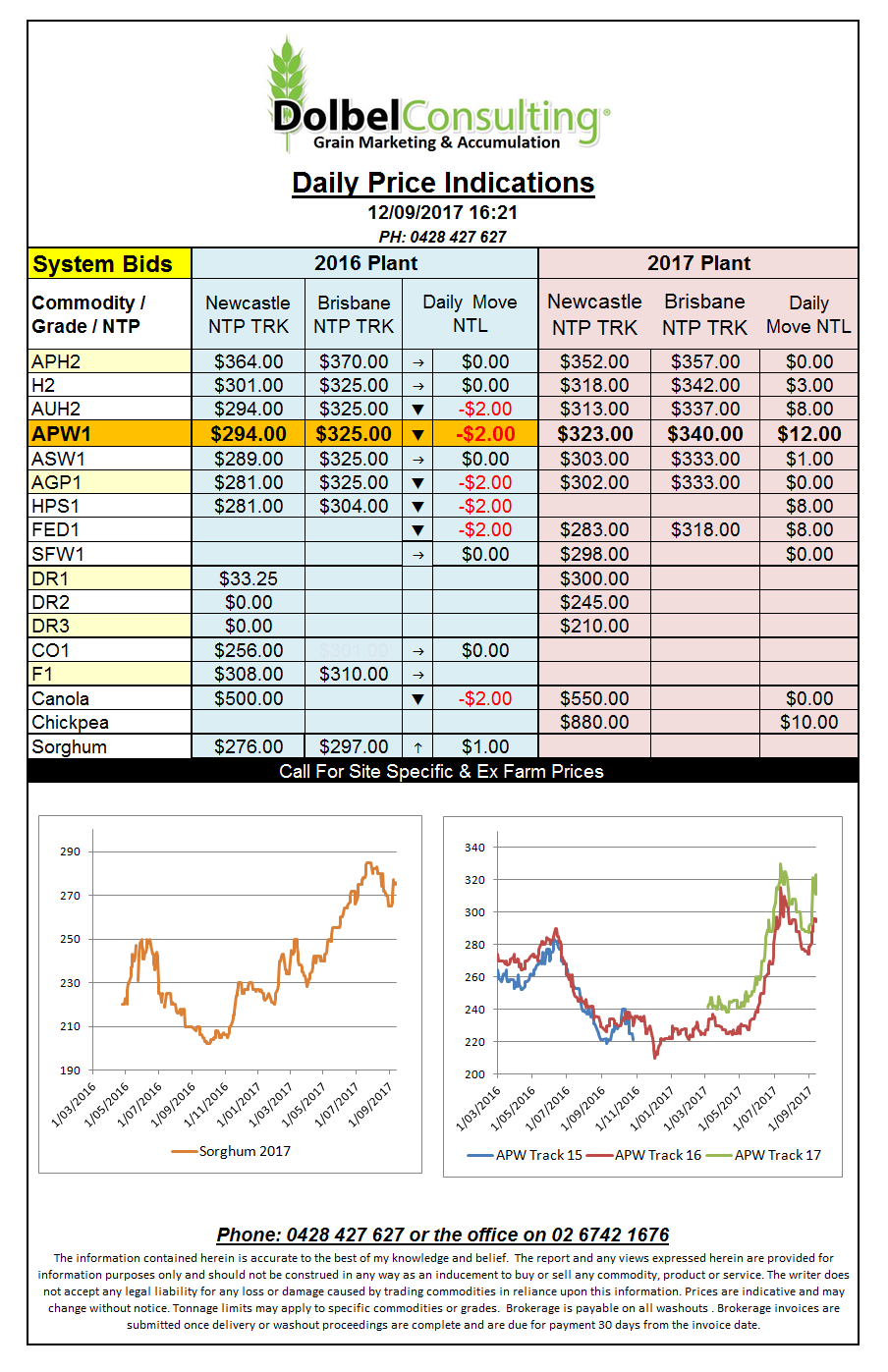

Prices 12/9/17

Basically the US grains futures market is circling, much like a vulture, above what is soon to be the dead corpse of the September WASDE report. The market lacked direction as it waited for the report due out tonight. Most punters believe that the USDA have corn and soybean yield estimates too high so are awaiting adjustments lower. This may or may not create some liquidity later in the week.

Soybeans are finding support from dry weather in Brazil which is delaying planting in the central and SE soybean area but not enough support to prevent nervous punters from closing longs prior to the USDA report.

Canola is also under pressure with both the ICE and Paris contracts shedding a few dollars overnight, this is to be expected during harvest. As with wheat, corn and soybeans in the northern hemisphere canola too is likely to set its seasonal low at harvest this year. The S&D for canola does look a lot better than the S&D for almost every other grain, so a bounce as the northern ports freeze is expected.

In wheat we see support from a shrinking Aussie crop but pressure from a record Russian crop. With world wheat ending stocks expected to increase again this year bread wheat isn’t expected to make anyone super wealthy in 2018. Durum wheat has a much tighter S&D although you may not think so the way some traders keep reducing Aussie bids. This does expose a major problem the removal of the single desk created. Yes we have the ability to check world values, we know what our local values should be but at the end of the day we still only have two choices, sell or not sell.