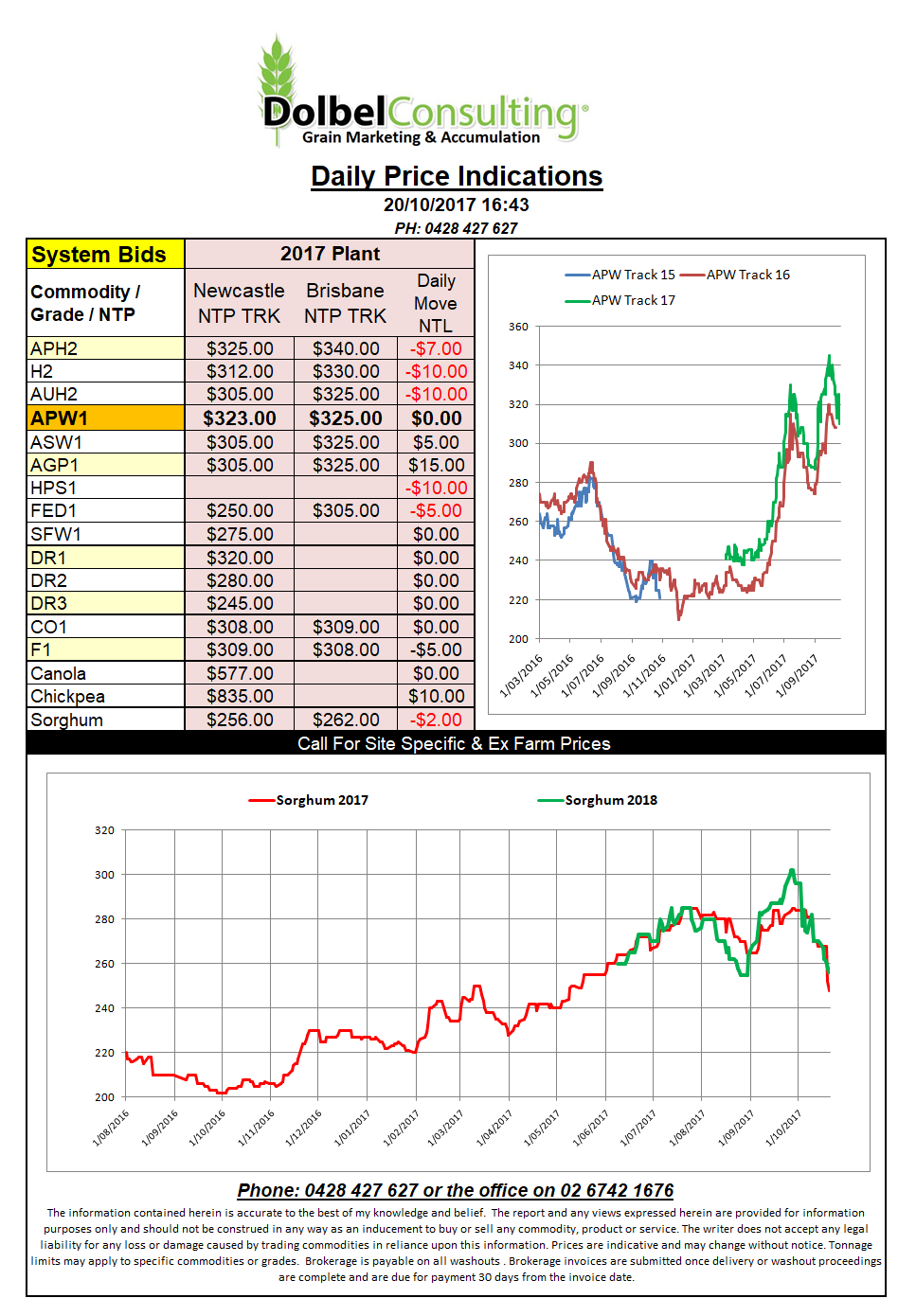

Prices 20/10/17

Realistically the weaker US dollar probably had more to do with some higher closes in US grain futures than any other data. Weekly US export sales were generally a little above trade expectations with corn at 1.255mt, soybeans 1.275mt and wheat 615kt. Although the wheat number was 200kt above the top end expectation the US export sales pace for wheat is still lagging 600kt behind last year which in itself was nothing to write home about.

Russian wheat exports are expected to jump from 32.4mt to 33.9mt in 2017-18. This increase is not expected to be capped by supply but more so from export capability. Overnight Egypt picked up another 230kt of wheat from Russia. The average price comes in at US$199 FOB. Russia continues to be the dominant party in Egyptian business making up 74% of wheat purchases by Egypt this marketing year.

Indian chickpea futures were back roughly the equivalent of AUD$12 / tonne overnight, so since Tuesday that’s +$40, -$5, -$12. This compares to domestic track values here of +$20, +$5. Indian importers are watching the current weather in NNSW and QLD very closely. There is set to be two issues, the first and major being the weather damage caused by rain and the second is the large degree of splits in the early crop. Dry conditions are seeing a high level of splits when moving peas in the early harvested grain.