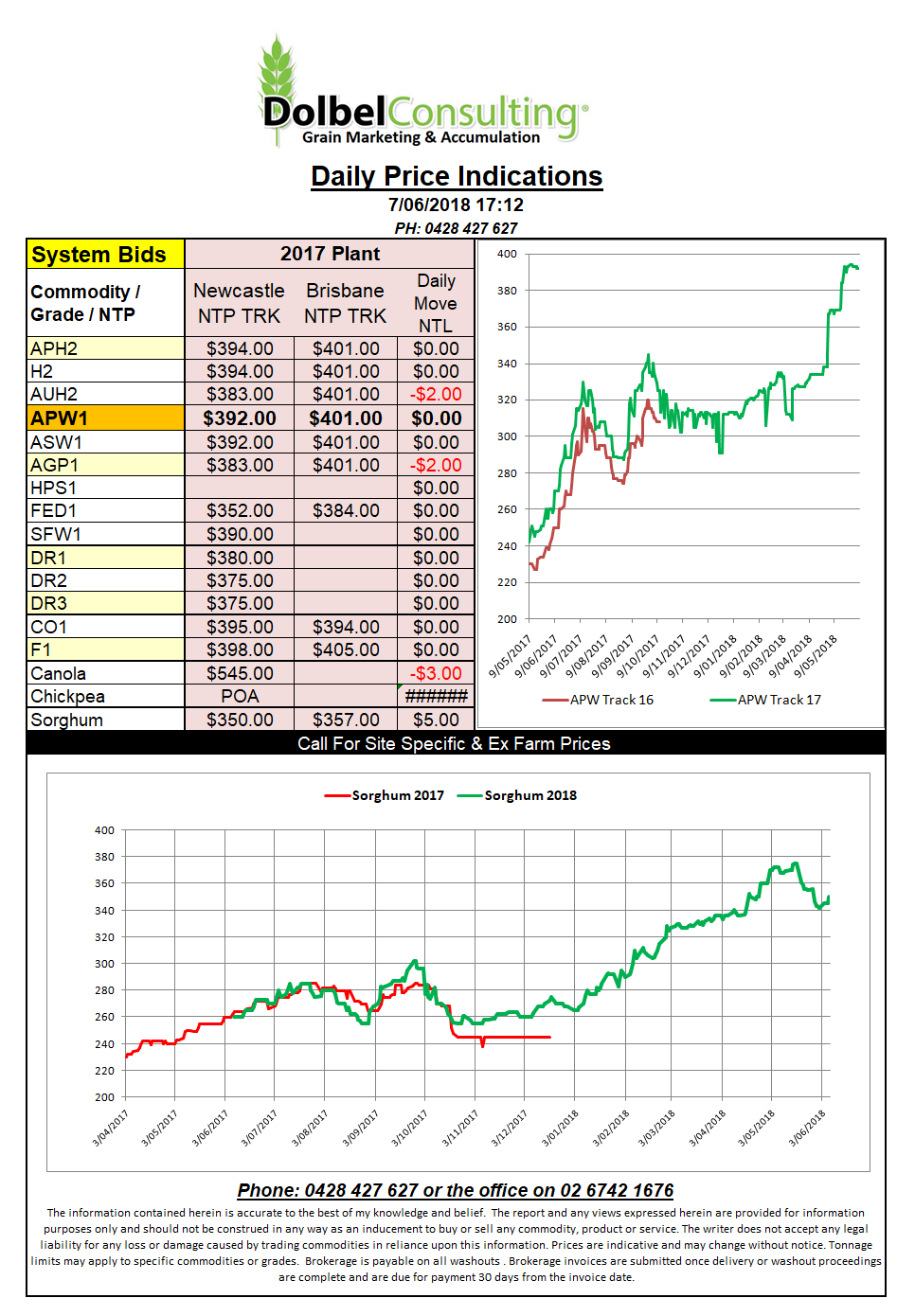

Prices 7/6/18

The trucking strike in Brazil may well kick off again as news that the new minimum freight rates the government only just imposed will be reviewed. The rates were pushed through quickly in order to stop a trucking strike that was crippling fuel, food and grain supplies across Brazil. After consultation with other parties involved in the supply chain it became evident that transport costs had increased as much as 150%, an unsustainable increase that in some cases resulted in additional cost of up to US$40 / tonne for grain.

The Truckers Union has vowed to strike again if the rates are reviewed lower. I guess the US soybean market may continue to find demand from China simply because China may not be able to get supply elsewhere.

In the US wheat found additional support in the futures market while corn and soybeans closed softer. The US summer crops are moving into an all but perfect weather outlook for the next week or two. Wheat on the other hand, although not as bad in the US as initially expected is not great but the greater focus continues to be on the dry weather across the Black Sea states and Australia. With the US dollar value of Russian wheat much higher now than it was 12 months ago and a potentially large carry over from last year’s record Russian wheat crop the impact the dry weather may have on Russian ending stocks may be minimal at first. It may take time to see the impact and possibly as long as the first quarter of 2019. The futures market will undoubtedly consume and regurgitate S&D rhetoric from the Black Sea regions repeatedly between now and then. The most important thing to watch in the near term is actual production.