Prices 9/7/18

Buy the rumour sell the fact, that’s what seems to be driving the US markets at present. US tariffs came into effect yesterday, potentially hurting US / China soybean sales, so what happened, well Chicago beans rallied 38c/bu (AUD$18.85).

To make the move in US soybean futures even more confusing consider that China actually cancelled 432kt of US soybean purchases in yesterday USDA report.

The US market has been factoring the China failure for a while now and some traders are saying that the weaker soybean prices in the US has actually lead to increased sales to other nations in Europe and the Sub Continent.

Wheat and corn futures got a leg up from soybeans and both closed higher on the day. It’s probably fair to assume that wheat also has a healthier outlook from a shrinking global production estimate for 2018 too.

Lots of punters are tipping further wheat reductions in next Thursdays USDA WASDE report. Currently we see the global stocks to use ratio at 35%, in order to see any significant improvement in longer term values we really need to see this slip below 30% and idealistically below 25% would be perfect.

Local markets continue to fumble along with liquidity being a major issue when trying to discover prices.

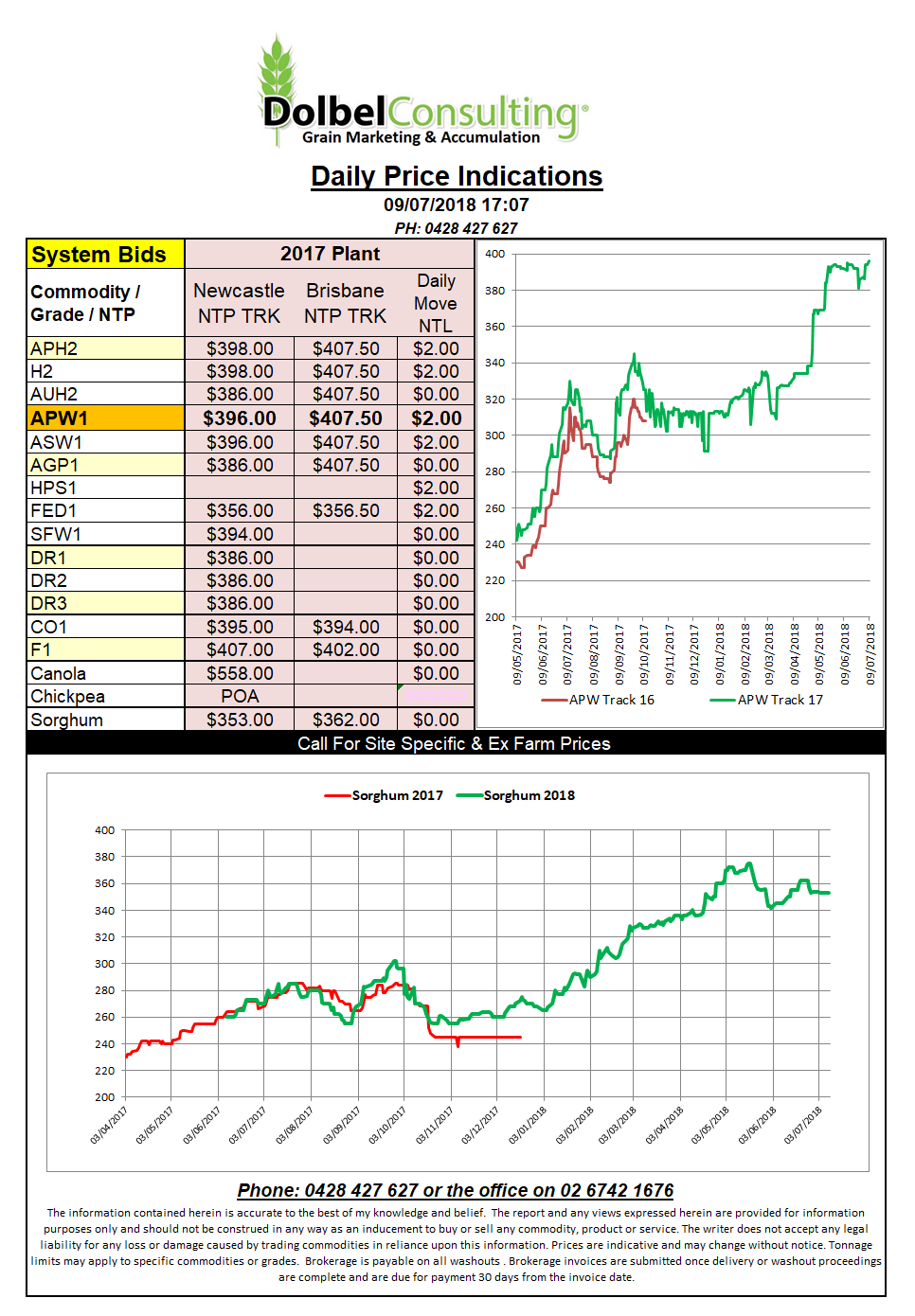

Sorghum into Tamworth was flat at $353 delivered July / August. With some logistical and management issues creeping into execution at present I’m starting to think the July option on the spread is probably not likely. Bids on the track were steady at $353 less rail.

Canola into the feed market was flat but with volume low on the offer side and product from the south hard to execute we may see prices rise further. The sharp move higher in US soybean futures overnight can’t hurt any either. Flat price bids into Tamworth closed the week at $565 delivered. Bids into the Newcastle crusher market were $568 +/- the premium and discount structure.

Wheat out of the system continues to work into the local feed market which is bidding about $390 delivered end user LPP.