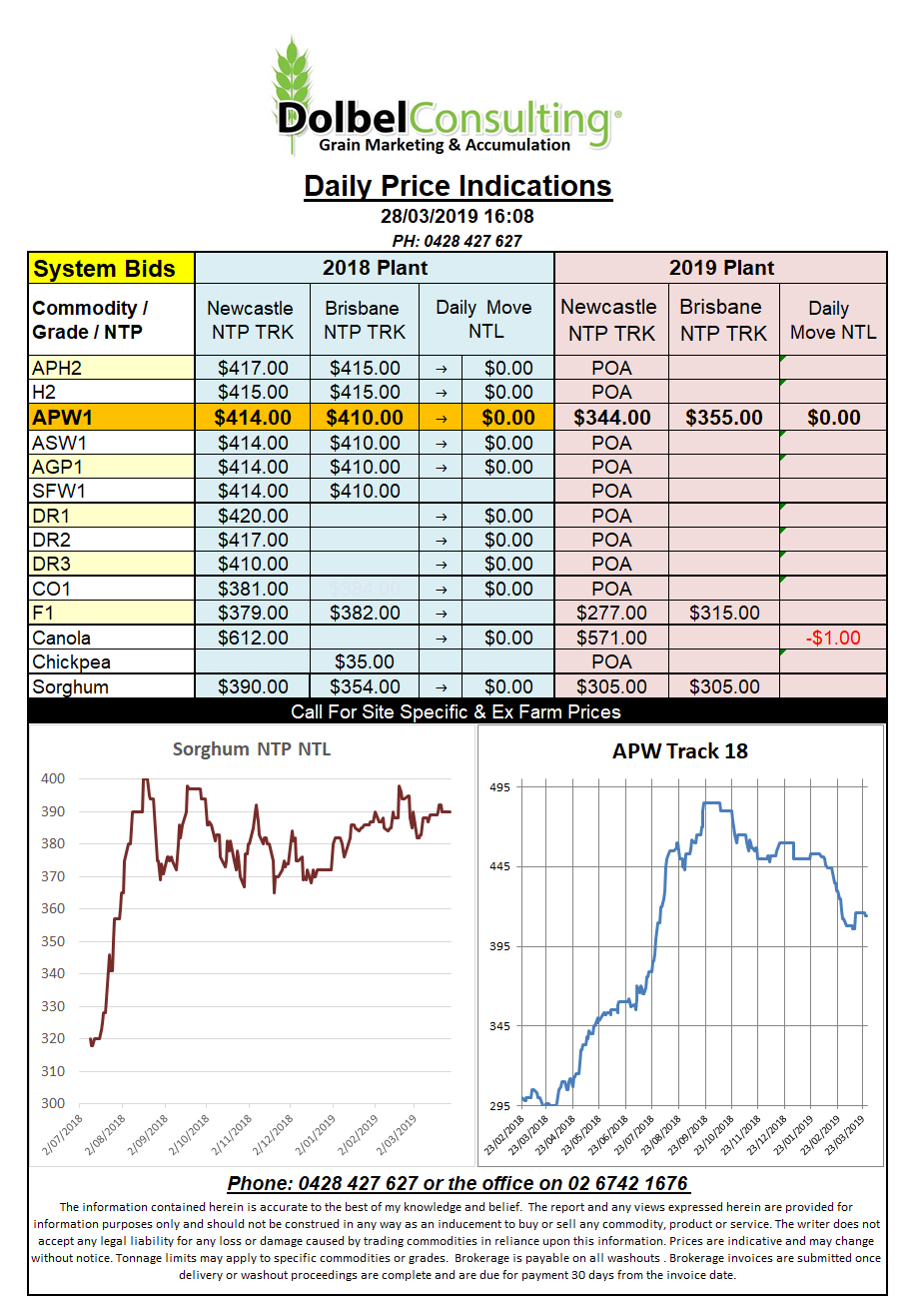

Prices 28/3/19

There’s not a lot of direction to be taken from the US session unless you’re a soybean / oilseed trader. Soybean futures at Chicago shed 13.25c/bu (AUD$7.00/t) on the May and July contracts. Corn found a few cents per bushel downside while wheat futures were mixed but generally a smidge firmer.

There’s talk the market was driven by technical trade, squaring up, ahead of the USDA stocks and prospective plantings report due out Friday morning. Outside markets also put pressure on grain prices. Thoughts of an economic slow down in the US kept the stock market in check with expectations major consumer items, like ethanol, may begin to see stock levels climb.

Transport limitations in the US due to flooding are keeping cash basis bids firm in the Midwest. Just remember rain makes grain.

Looking at US wheat futures the optimism was said to have come from the trade generally expecting to see healthy export sales numbers in tonight’s weekly export sales report.

Over in Europe the funds increased their stake in the futures markets but kept the net position relatively unchanged increasing neither their short or long as a percentage of their book. Does this mean the punters are simply parking money for the short term.

ICE canola is struggling as China add Viterra to the black list of canola importers. The Paris rapeseed contract had held on very well for much of the week but did sell lower last night as ICE canola and Chicago soybeans put pressure on the oilseed market.

There is talk that wheat prices are expected to soften further as we move into new crop harvest in the northern hemisphere.