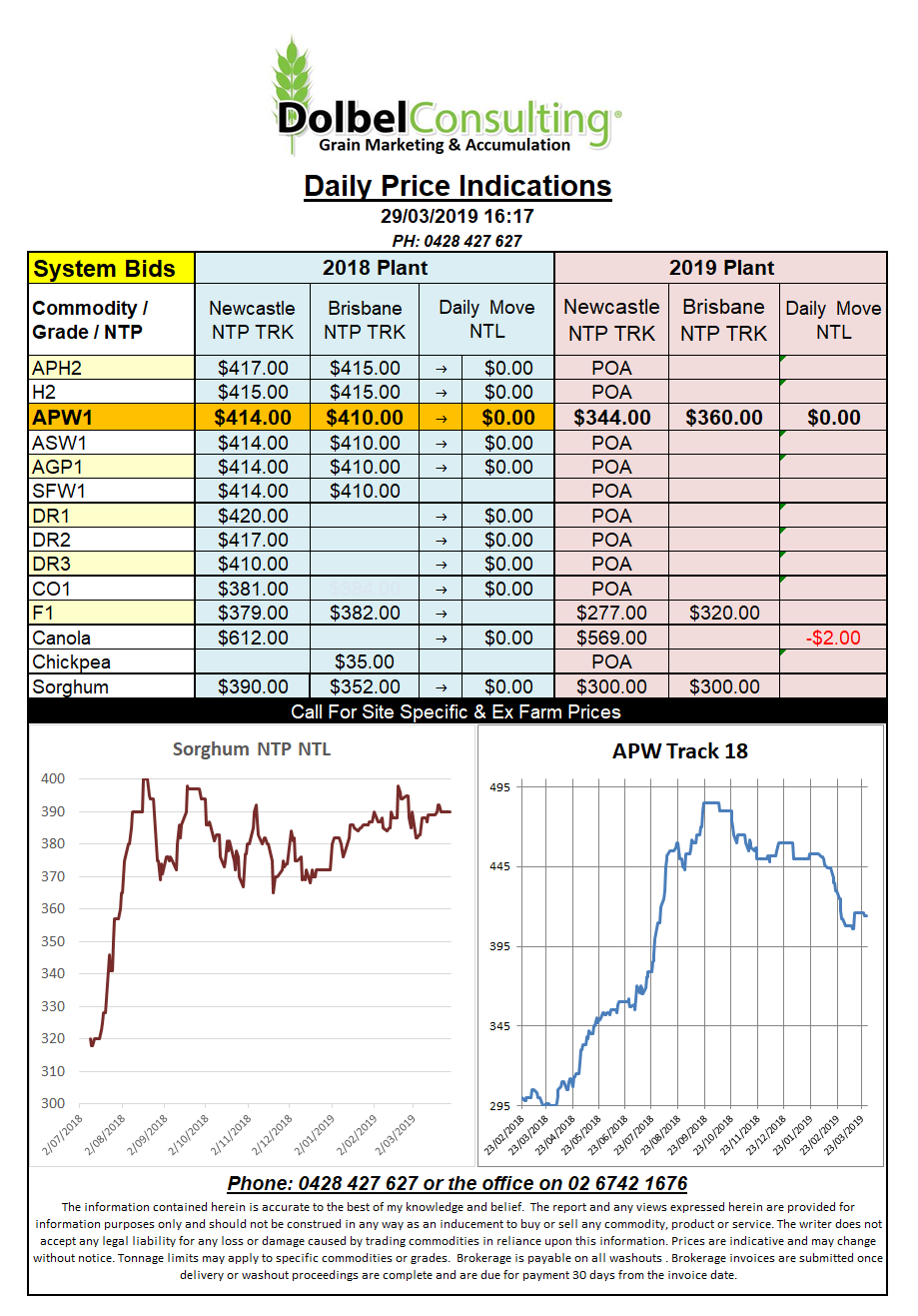

Prices 29/3/19

US wheat futures were generally softer overnight. Bearish pressure came from both new and old crop expectations. Old crop carryover will continue to be too high while 2019 – 20 production will continue to ensure there is enough wheat to go around and the major exporters will need to compete for market share.

The latest International Grain Council data predict Russia to once again be the dominant exporter of wheat in the world potentially shipping around 35mt mainly to nearby importers. The USA are to be a close second with exports expected to be very similar to this year. The EU and Canada are a close 3rd and 4th closely followed by Ukraine and Australia who will potentially increase wheat exports by around 50% given the current drought on the east coast breaks.

The IGC pegged 2018-19 global wheat production unchanged at 735mt. World consumption was reduced a little from last month and came in at 742mt.

There was speculation after a US / Canada / China trade meeting that China will purchase US soybeans and one might assume Canadian canola, in the near term. This saw US soybeans tick a little higher while ICE canola futures enjoyed some rare moves higher. China really cannot afford to restrict Canadian canola in volume and should find a resolution to their disagreements before harvest starts in Canada. Poor Q4 GDP growth in the USA did put some outside pressure on the markets.