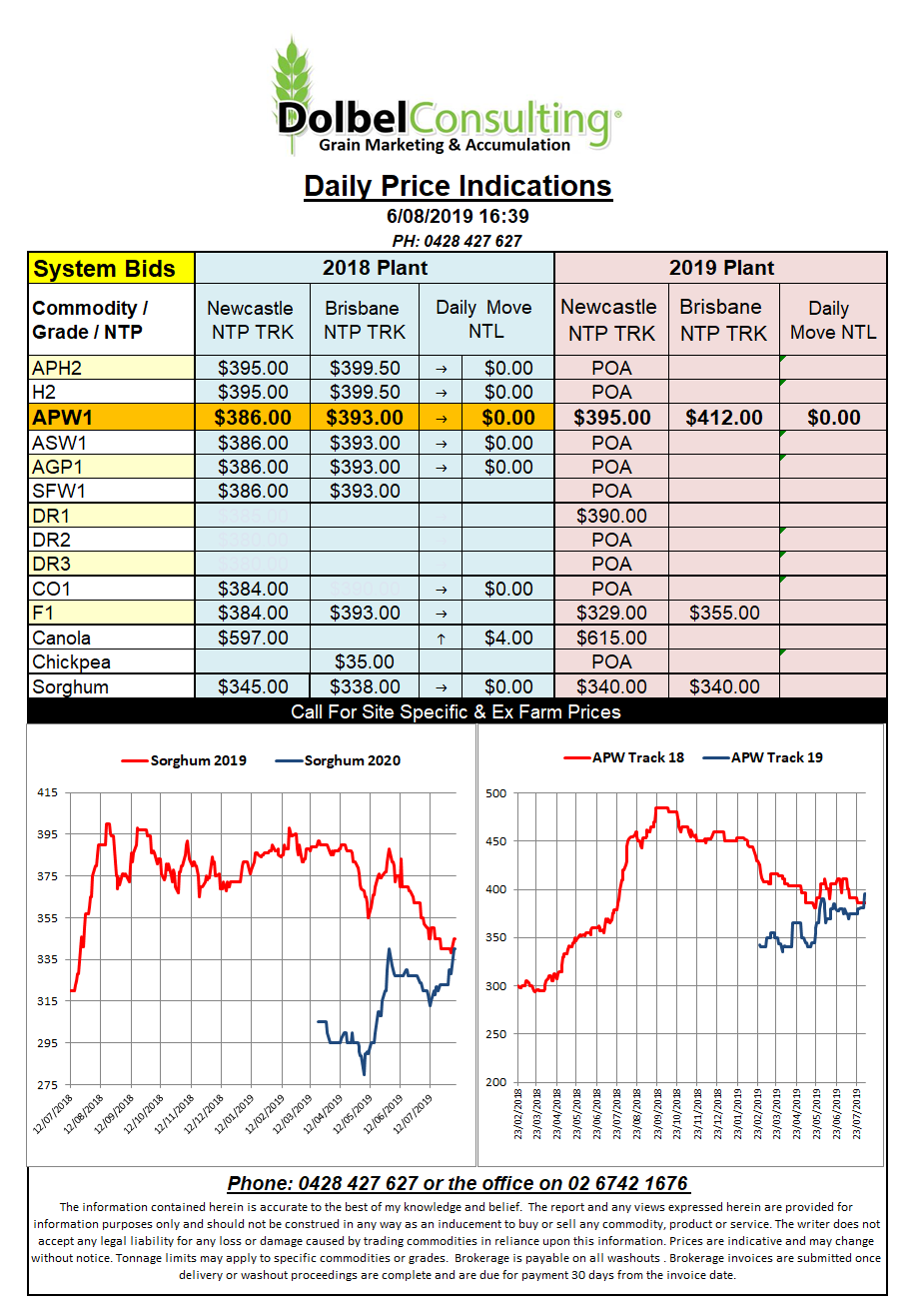

Prices 6/8/19

US ag futures started the session bearish thanks to the China / US trade saga. Soybeans will be the biggest loser in the China deal, futures for the oilseed were flat with outer month contracts closing a smidge lower. Corn and wheat futures at Chicago managed to edge higher with corn leading the way.

The main driver for corn is positioning leading into next week’s World Ag Supply & Demand report from the USDA. The punters are torn between better than expected yields and the possibility of a reduction in sown area in the USA.

The USDA had US corn acres in at 91.7 million in last month reports, most punters just rolled their eyes at that number but they were stuck with it until the August report due out on the 12th. Since the July report private surveys have found area could vary greatly from the July report. Some surveys came in with yields around 10.49t/ha, that’s pretty close to the USDA estimate. Some area reports are suggesting a corn crop area sown closer to 83.5 million acres, well under the 91.7 the USDA are using. That could be over 30mt of corn swinging in the breeze.

In the USDA crop progress report out after the close the amount of corn rated good to excellent dropped 1% to 57%. The G/E rating on soybeans was unchanged at 54% G/E and spring wheat condition remained at 73% after 1% point moved from excellent to the good column. US winter wheat harvest is at 82%, 10% behind the 5 year average for this time in the season.

US weekly week export sales were just under last weeks and at a pace that isn’t concerning at present. Watch the AUD again today.