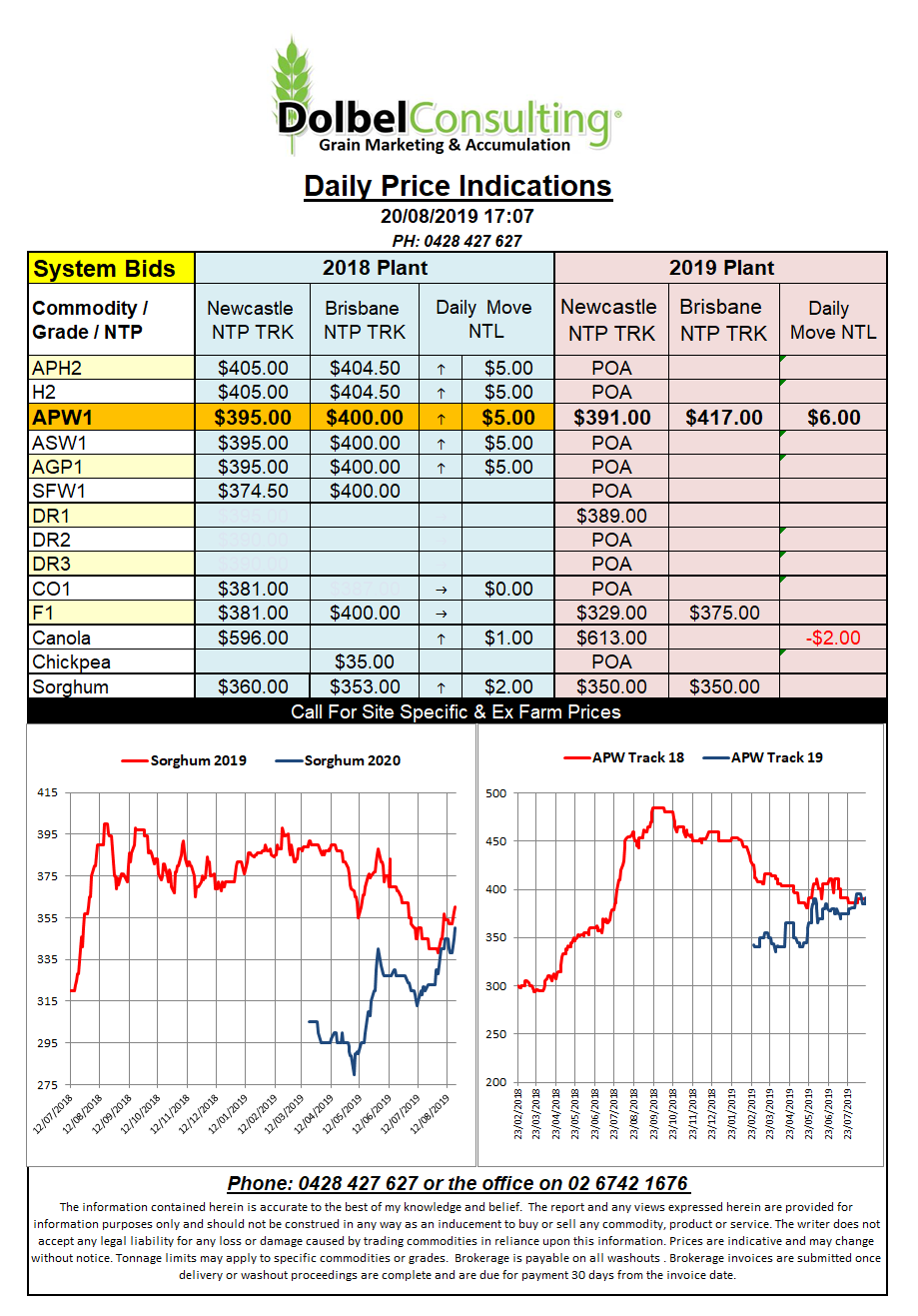

Prices 20/8/19

US grain futures closed in the red yet again, led lower by soybeans. The short term heat in the US is expected to give way to ideal conditions for filling summer crops next week. This paved the way for technical selling.

Currency traders seem transfixed with the inversion in US long term treasury bond yields, an apparent indicator for recession, be it a US or global recession that is yet to be determined. One might also argue a change in US leadership may well avoid a US recession when talking world trade.

Back to grains, corn futures at Chicago are still oversold thus we would expect to see some form of support creep into the market around these levels. Soft red wheat futures at Chicago are in a similar position. Soybeans are the problem from a technical perspective, being neutral they may swing either way thus dragging both wheat and corn along for the ride. An interesting fundamental for soybeans is the fact that S.American soybeans are now starting to price themselves out of the Chinese market. Although Brazil enjoys roughly a US$10 better freight rate to China Brazilian FOB values are some US$35 more expensive that US beans. The US farmer does have to pay a 25% tariff to export to China though, this takes FOB values from the US to about US$405, some US$35 over Brazilian FOB values. If trade barriers with China were eliminated one would expect to see Brazilian values collapse and US exports to pick up dramatically. So from a positioning perspective you might argue someone in the know may well be long US beans and short Brazilian.

The weaker US soybeans market had a negative influence on both ICE canola and Paris rapeseed futures.