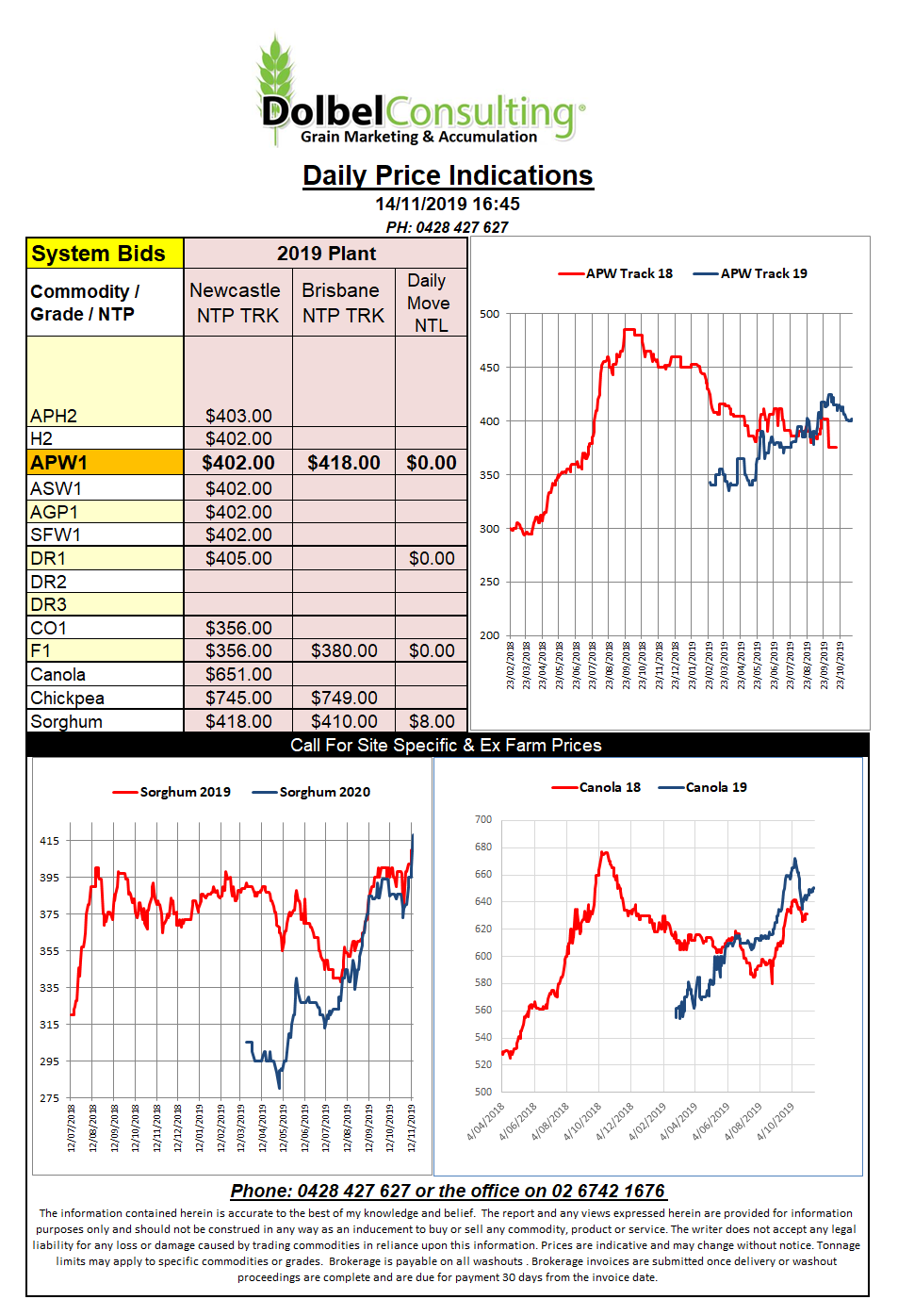

Prices 14/11/19

US wheat futures gave back much of the previous sessions gains on the back of, well reality probably. Profit taking was active after the rally yesterday and all three US grades slipped, in some cases by more than the previous days rally. The USDA did reduce the G/E ratio for new crop wheat as expected but the winter wheat sowing pace was a little better than expected in the weekly crop progress report.

Warm dry weather continues to persist across much of the Black Sea region. The Volga Valley has seen as little as 20% of average rainfall during the last 30 days. The dry isn’t restricted to the Volga Valley though. Many parts of Russia’s key wheat growing regions are persisting with a dry start to their winter crop. To make matter worse day time temperatures have also been unseasonably high with 30 day anomalies as much as 5C – 7C hotter. The conditions persist across much of eastern Ukraine and south into Romania as well.

The EU revised soft wheat exports to no EU members upwards to 12mt. This rise in projected exports combined with last month’s rise see EU and USDA projected exports for the EU block coming in pretty close. If realised we also see a slight year on year reduction to ending stocks as well. This is the key to seeing better values in 2020. We need to see a sharp drop in ending stocks. The dry in Russia may help as may the freeze in the US but the northern hemisphere crops are made in the spring so get ready for the boring months of the northern hemisphere winter for the midterm.