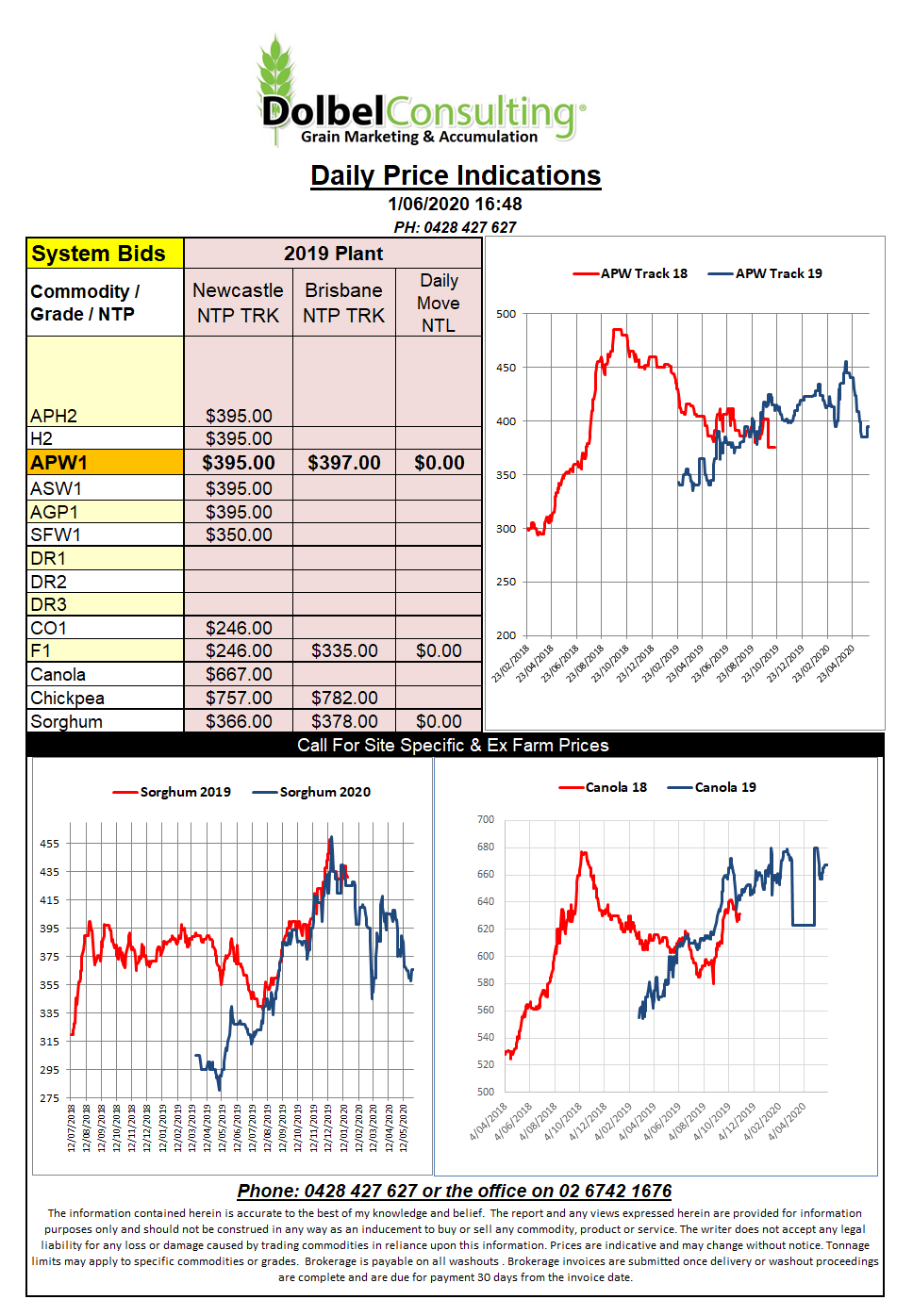

1/6/20 Prices

Another session of sell soybeans and buy wheat at Chicago. Soybean futures found no love as USA and Chinese relations continue to sour. Corn futures were also weaker by the close. Wheat futures for SRW, HRW and HRSW were all higher by the close.

Dry weather across Saskatchewan, the Oklahoma pan handle and much of N.Dakota and Minnesota were on the wires as fundamental drivers. Dry conditions across the eastern Black Sea region in Russia were relieved a little by falls of 20-50mm this week, some say the damage is already done there now so it may take a header to confirm production in that region. Closer to the Caspian Sea was not as lucky with little rain falling there, this area is not a high producing area though.

The EU also reduced their projected soft wheat output from 125.8mt to 121.5mt confirming that the dry start to spring had capped yield potential in France and Germany.

Dry weather has also hampered what was already a small UK winter wheat crop. Wet weather reduced sown area in autumn and now dry weather is preventing perfect grain fill. The UK export program did stall around October so from a stocks perspective things are not tight and demand at present is low due to the coronavirus lock down. Still in the UK the punters are predicting a sharp increase in barley stocks as pub closures there have had a big impact on demand.

Currency countered any move higher in USD FOB offers for Australian APW wheat. At Chicago the Platts contract noted Jan 21 wheat FOB Aussie port at US$231.75, roughly equivalent to AUD$273 ex farm LPP.