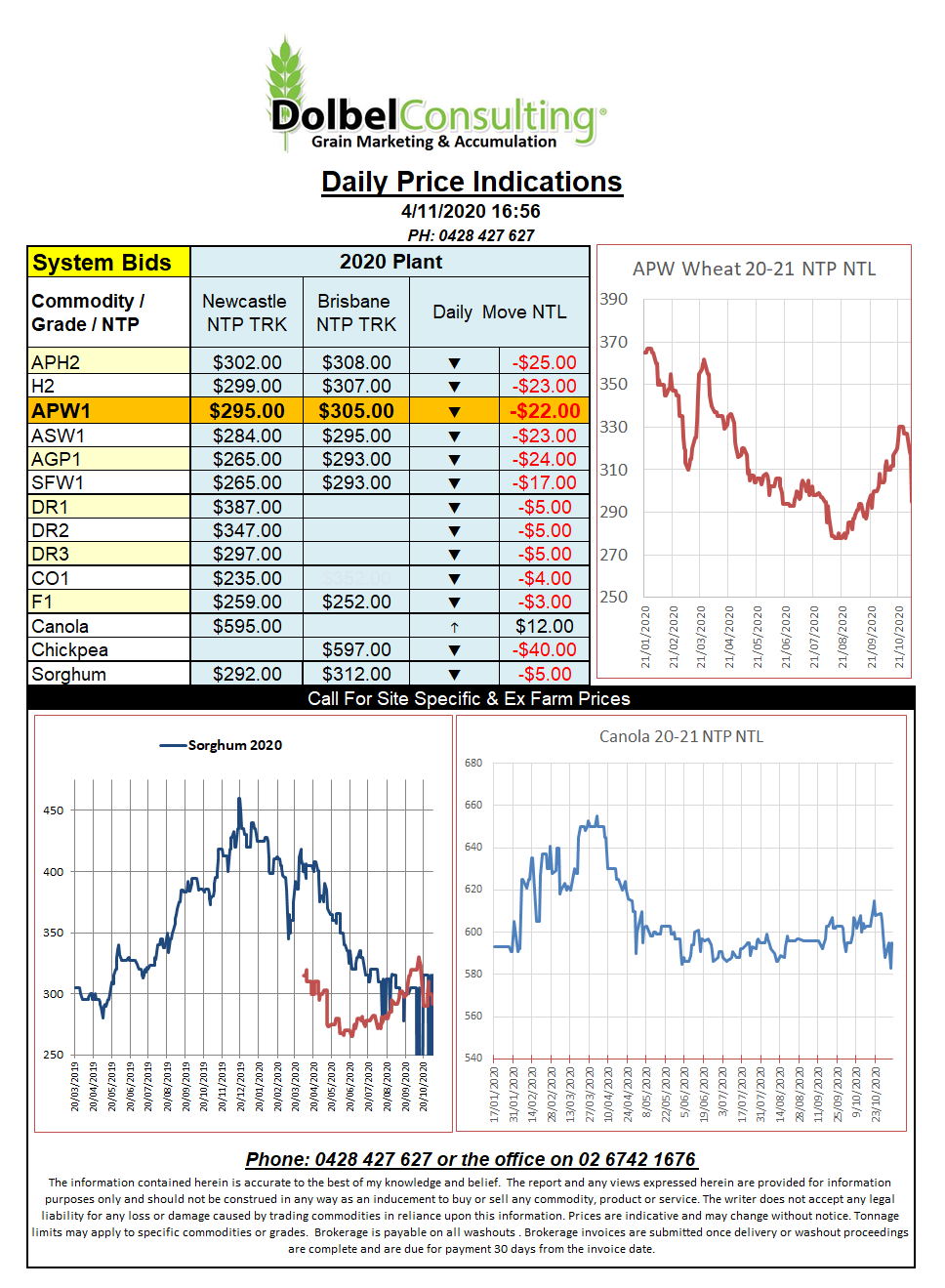

4/11/20 Prices

Both Paris rapeseed futures and ICE canola futures followed Chicago soybean futures higher last night. The higher AUD may counter local gains a little but hopefully the trade will use this opportunity to stop eroding local basis…… lol, who am I kidding.

Tunisia picked up wheat and barley in their tender. The barley was priced at US$234.19 CFR. When compared to local port values this represents a sale of about the same value we are seeing at a local level. On the back of an envelope the price would convert to somewhere around AUD$245 at the port. In WA port values are about $270 FIS, possibly little high to compete with this tender so close to Europe.

In the USA sorghum continued to be offered at about $280 on the CIF Texas river market. It would cost a punter roughly US$50 to get this to China. Bulk ocean freight from Australia to China is about US$18 and our fobbing costs are roughly AUD$25. So a back of the envelope conversion would suggest that Texas sorghum is roughly equivalent to $404 port when taking our current tariff into account.

Dalian corn futures closed at Y2553/t yesterday, that’s about AUD$535 per tonne.

The analyst are suggesting with corn priced as high as it is in China, the corn import quota set so low and demand increasing as hog numbers continue to rebuild, that there is a real chance that their domestic corn supplies will become very tight. The high price has already seen a lot of substitution with both feed wheat and barley being fed instead of corn. Most expect to see import quotas increased.