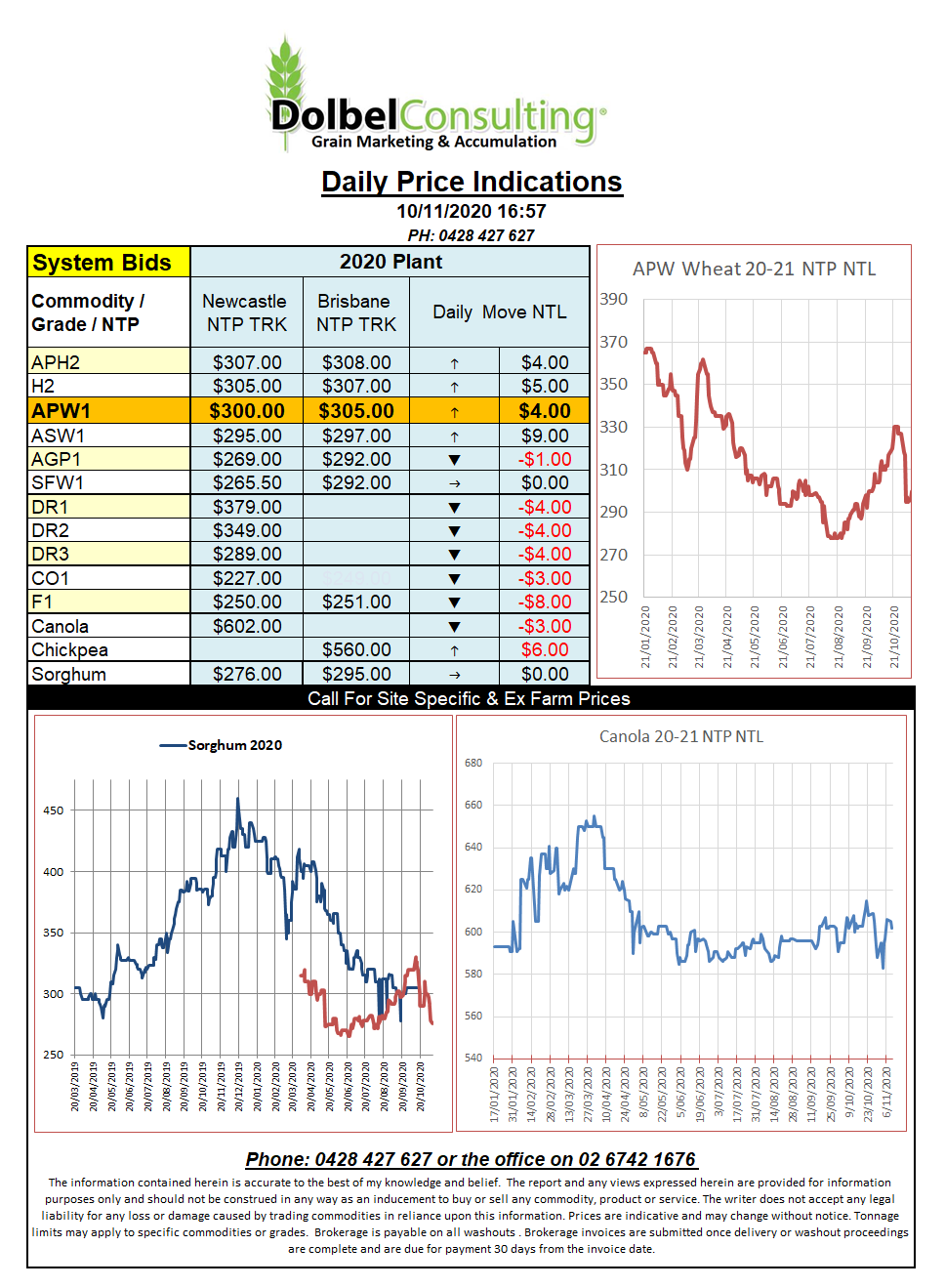

10/11/20 Prices

At Chicago the row crops were a smidge firmer while wheat was a tad lower. The punters appear to be waiting to see if tonight’s WASDE report holds any surprises. Pre report guesses are pretty much in agreement that the Aussie wheat crop will get additional tonnage but no one is pegging an increase in demand to counter this, so we may just see world ending stocks increase again.

Saudi Arabia confirmed they purchased 860kt of 12.5% milling wheat in their latest tender. The average price paid was US$277.53 per tonne. Purchases were made at an optional origin level, buyers call, and covered supply from the EU, Black Sea, USA, Argentina and Australia. Although origin is unconfirmed it is believed that the lions share will go to the EU and Australia. Glencore were down for 65kt at US$283.67 into Dammam port, the highest priced parcel. On the back of an envelope this would come in at roughly AUD$317 FIS port, this is a fair bit lower than current WA port values but $10 – $15 above east coast port bids, so could be shipped from Newcastle zone. NSW wheat bids indicate that H2 wheat could fill even the cheapest leg of the Saudi purchase. Aussie east coast wheat is now some of the best and cheapest wheat in the world.

Looking at cash wheat out of the US PNW we see white club wheat bid on the CiF river market at US$245. If this was destined for Japan Aussie wheat delivered NTL port would need to be roughly AUD$300, yesterday is was bid around AUD$296 port. The conversion for DNS vs APH is even cheaper with DNS values indicating APH should be worth about AUD$340 port, currently bid at AUD$303 – $313.