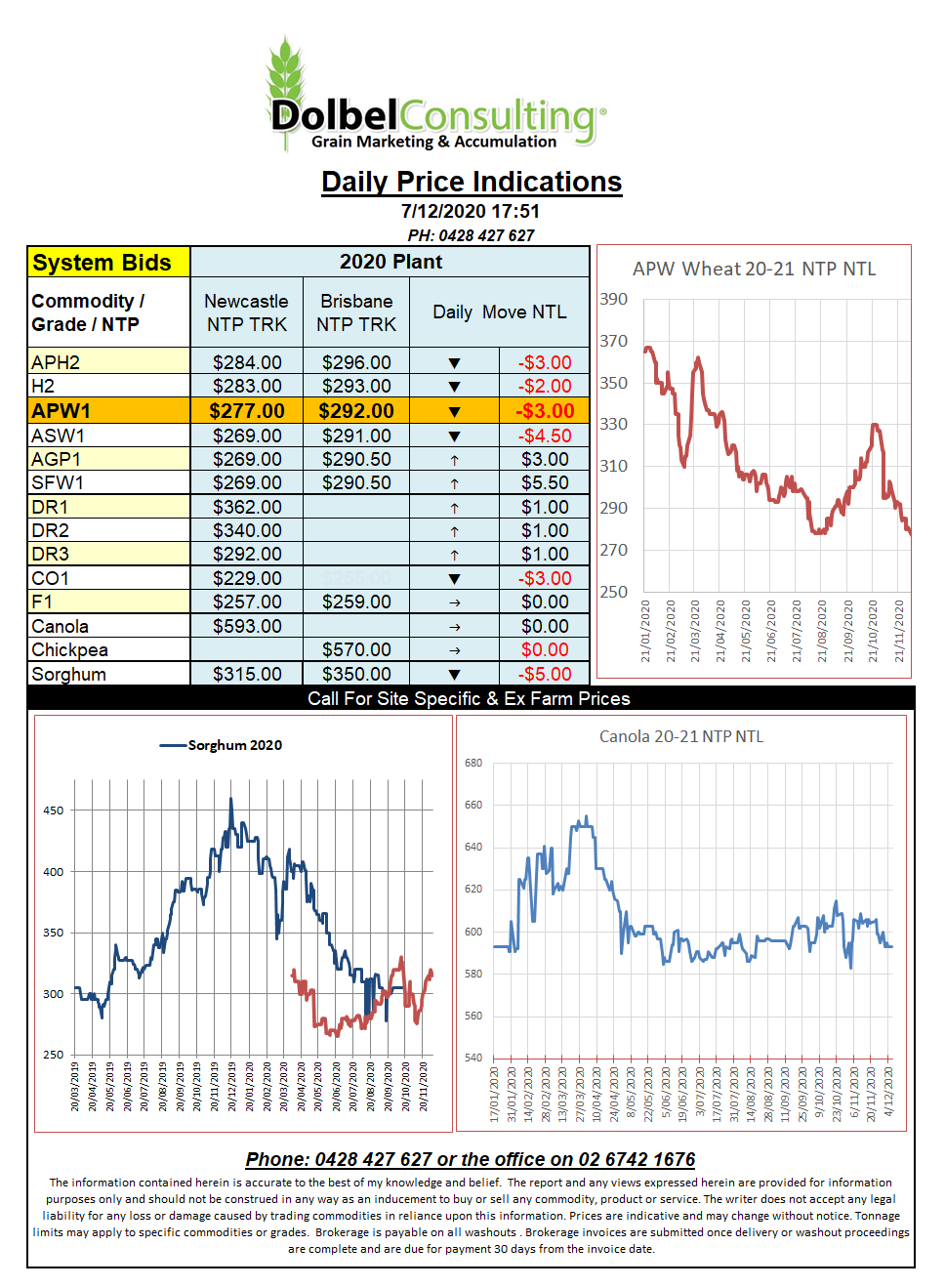

7/12/20 Prices

Chicago corn, wheat and soybeans were all lower by the close.

Even the untraded Platts APW1 Aussie FOB wheat contract at Chicago closed lower, back US$6.00 for a Feb 21 slot. Settlement for the Aussie product was estimated at US$257.50 for a Feb slot, this would roughly equate to AUD$272.38 ex farm LPP for APW1, good selling if you could find a punter to take it. Compare the Platts product to our own ASX product and you see the January contract closing at AUD$283 yesterday. A number equivalent to about AUD$241 for APW1 at Graincorp Gunnedah. Just as a side note the ASX product if delivered and executed out of Gunnedah would land in the Tamworth market for somewhere around AUD$274 delivered. During the week a SFW1 trade short into Tamworth did push to this level before slipping back to AUD$265 yesterday.

Canola futures were once again the big winners with both the Paris and ICE product making some nice gains. The strength of the AUD against the CAD did slip a little so a CAD / AUD conversion does put potential upside in local canola values come Monday at somewhere around AUD$8.70 per tonne but with local basis at -AUD$22.31 yesterday I’ll back a push towards AUD$30 under against a push towards AUD$600 less rail, call me a pessimist or a realist, I don’t care. In 2020 you don’t ask whether the glass is half full or half empty, you just ask why it doesn’t look like water.

Turkey picked up another 400kt of wheat at a few bucks under their previous buy price.