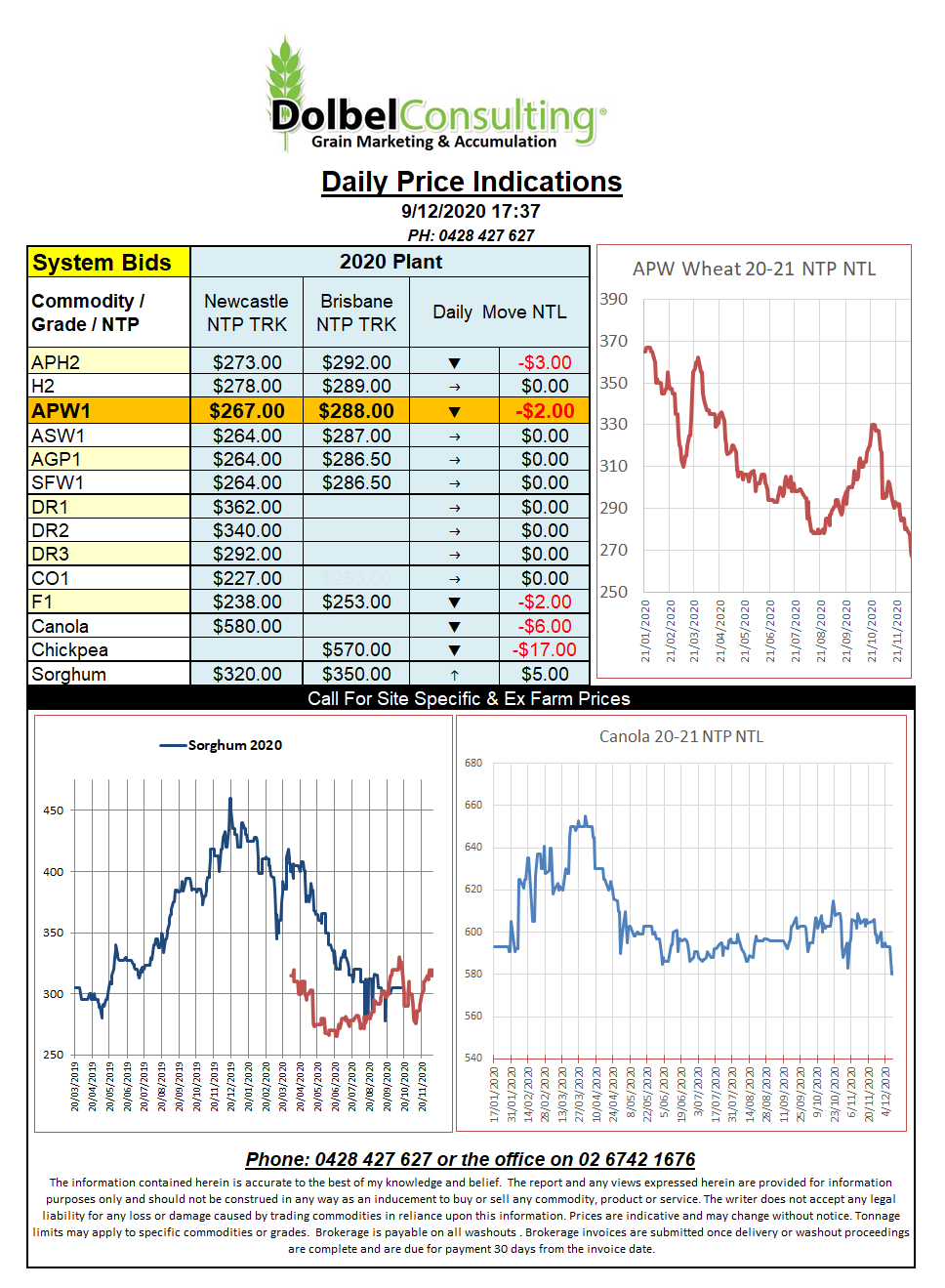

9/12/20 Prices

There’s a USDA WASDE report due out tomorrow night. That came around quick. Those that know me know I like to follow two things when trying to determine market direction. Firstly I’m a firm believer in the fundamentals when talking physical price, cash prices, the laws of supply and demand rule…..well mostly. At the moment we are seeing the law of supply, cash money and physical grain ruling.

The second indicator I put faith into is the stochastic chart for the Chicago markets, this may well be to my detriment at times but I feel when markets are flat this analysis is often helpful. Often in times leading up to big reports, like a USDA WASDE report, the stochastic might help reveal market direction, sometimes even regardless of what is actually in the report. Looking at the stochastic in Chicago March 21 corn, it’s over sold, looking at March 21 soft red winter wheat, it’s oversold, looking at January 21 soybeans, it’s oversold, anyone seeing a trend here. Plotting a few lines on these charts just confuses the analysis, corn does look likely to rally, the fundamentals are also pretty good for corn, Chinese demand, not ideal weather in S.America. Wheat is not so clear, I’m seeing the potential for wheat to go as low as 545c, so back another 25c/bu (AUD$12/t) but there’s a good chance this would trigger significant buying. Soybean, I see it testing 1100c on the downside before bouncing sharply again on basically the same fundamentals as corn. Whether or not canola goes for a ride on the back of this is harder to determine. There you go, my WAG for the weeks ahead in US futures, by Christmas I’ll know if I should go back to punting futures or concentrate on selling leather lounges and carpet…….. how depressing.

Cash bids for white wheat out of the US PNW were flat yesterday and indicate APW1 port Newcastle is around A$30 under to Japan.