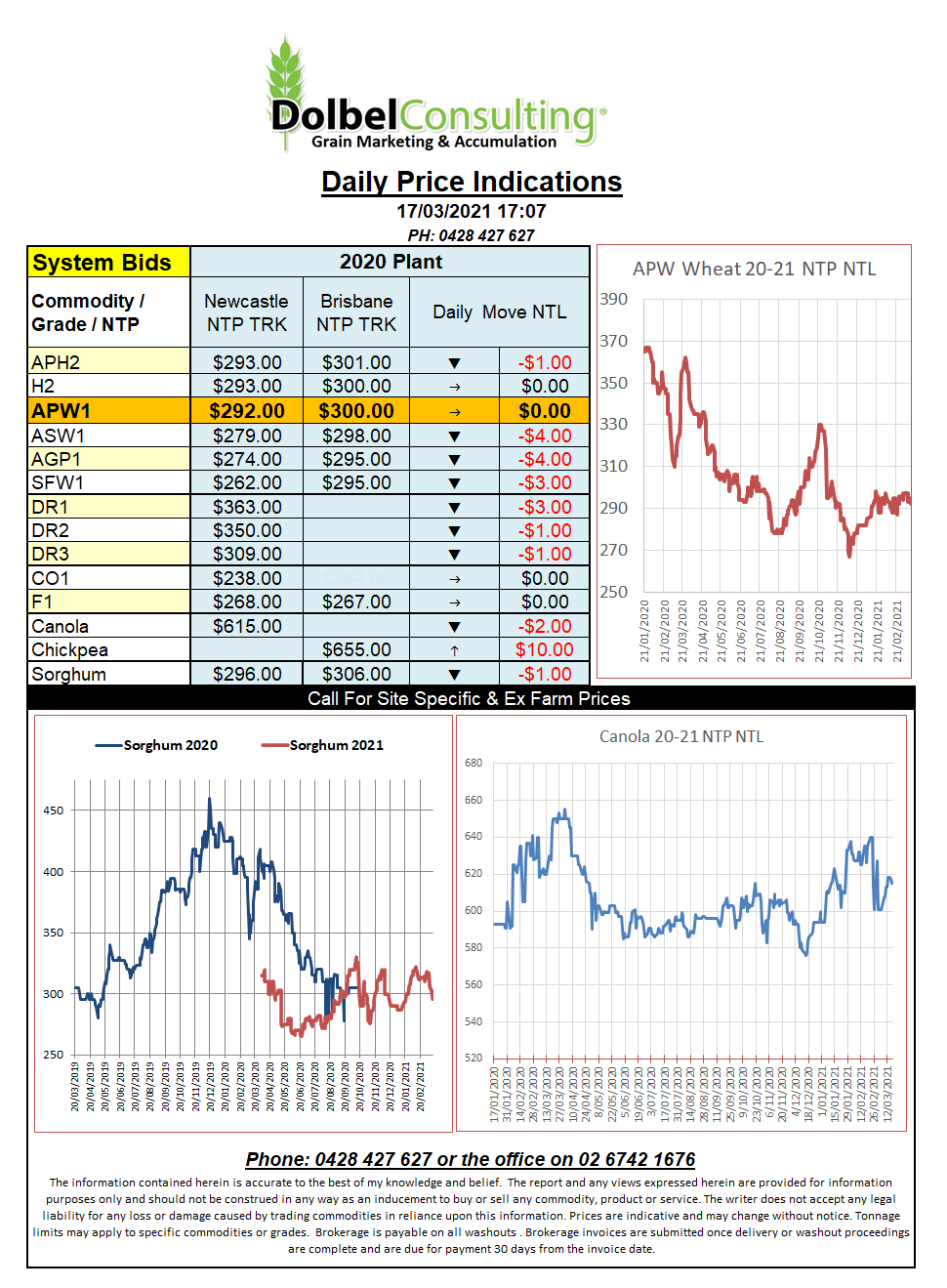

17/3/21 Prices

Generally international grain futures in the US and Europe were flat, +/- a little depending on the grain. The market moved in a non-convincing manner in either direction for most grains. US corn was about the only grain that showed a pulse to measure closing up AUD$2.16 per tonne. Technical buying was countered by fundamental weakness in the US as rain, and the forecast of more, is expected to assist the dry mid-west winter wheat crop as it moves through spring.

Looking at World Ag Weather the last 7 days has bought good rain to much of the US winter wheat belt. Nebraska seeing weekly totals topping 100mm in some locations. Parts of Kansas remain dry though, Salina, central Kansas for instance has seen just 20mm for March. Further south at Hutchinson 38mm has fallen while in western Kansas at Garden City March rainfall has been just 42mm. Overlay these rainfall figures against a US drought monitor map and you can see that the rainfall was useful and the dry is starting to spread to the far west. The punters are watching the 7 days forecast, which is calling for further falls across central and NE Kansas over the next 7 days. If this does not eventuate expect to see US futures take a jump. Iowa is also expected to receive 75-100mm of rain over the next 7 days, priming corn country if not making it a little too wet in places.

Elevator bids out of the PNW in the US mirrored the futures markets. White wheat values were flat while spring and hard wheats were fractionally higher to slightly lower.

Look for a sideways day locally and internationally. US, Russian and EU weather is generally benign to bearish prices at this stage.