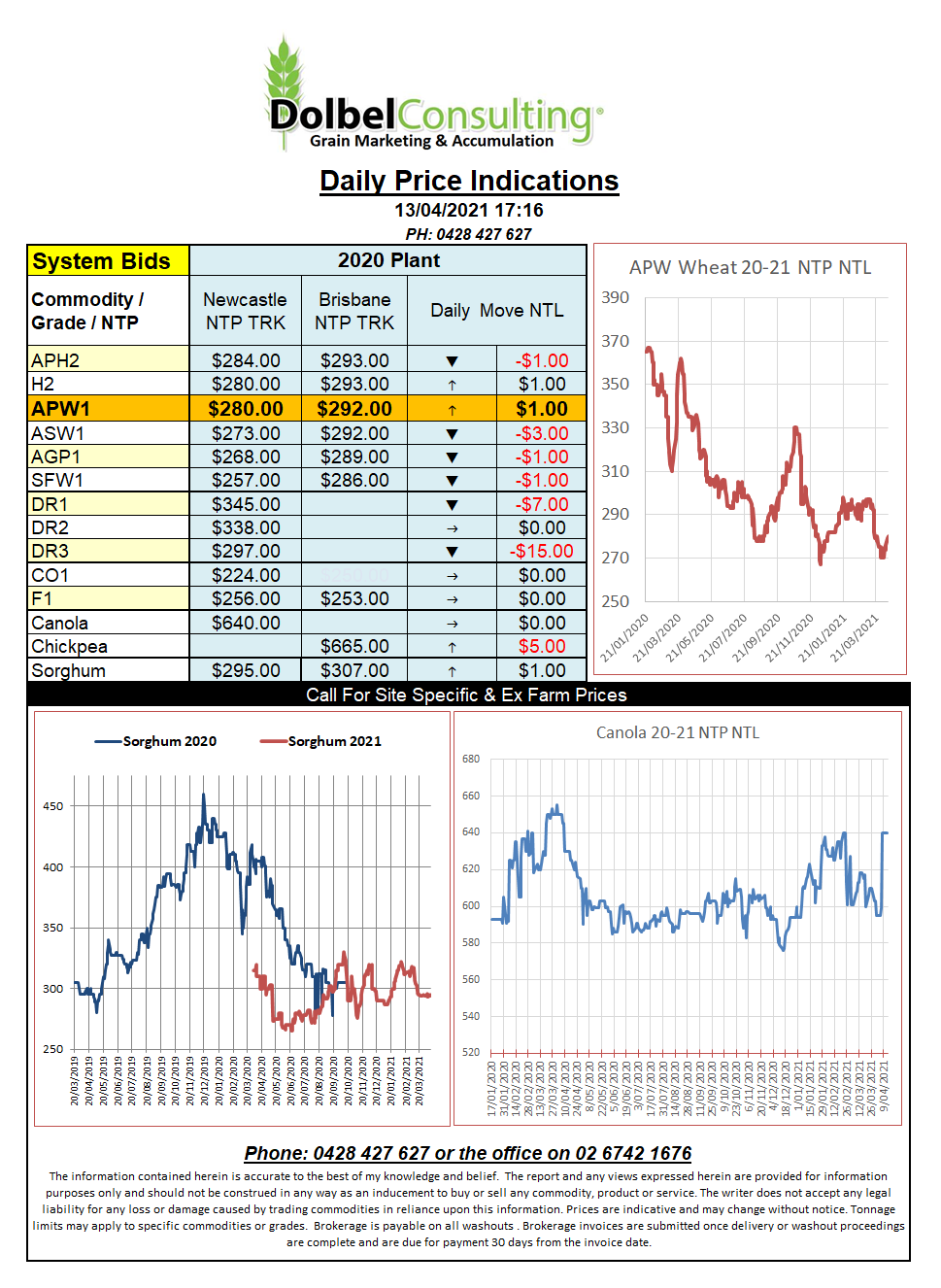

13/4/21 Prices

The march higher in US grain futures was put on a break overnight with corn, wheat and soybean futures all closing in the red. The punters appeared to have built a significantly long position in all three grains and a round of technical selling / profit taking was the counter measure. Looking at the charts we see wheat is overbought and was due for a couple of lower closes to square things up again. May corn was also overbought and due for a couple of lower closes. Soybeans, not so much, according to the stochastic for the May contract it’s relatively neutral so potentially we will continue to see further upside across futures depending on fundamentals in the USA in the near term.

Speaking of fundamentals we see 14 day rainfall for N.Dakota and much of the Canadian durum belt achieving as little as 20-40% of normal. There are some parts of north and west N.Dakota that have seen no rainfall in over 60days. Montana and the durum belt in Canada isn’t much better with just trace amounts, although recent snowfall will help there. This is not the case in Europe where the recent cold snap may have hurt crops recently sown or coming out of the winter dormancy. There isn’t a lot of concern over damage at present but it is worth watching in the near term.

Outside pressure on wheat prices came from an improved outlook for the Russian crop with private forecaster IKAR consultancy lifting the 2021 crop projection to 81mt. This is very close to the latest estimate from SovEcon who also increased their estimate last week by 1.4mt to 80.7mt. Higher palm oil inventories pushed the oilseed market lower with weakness in soybeans spilling over into canola and rapeseed.