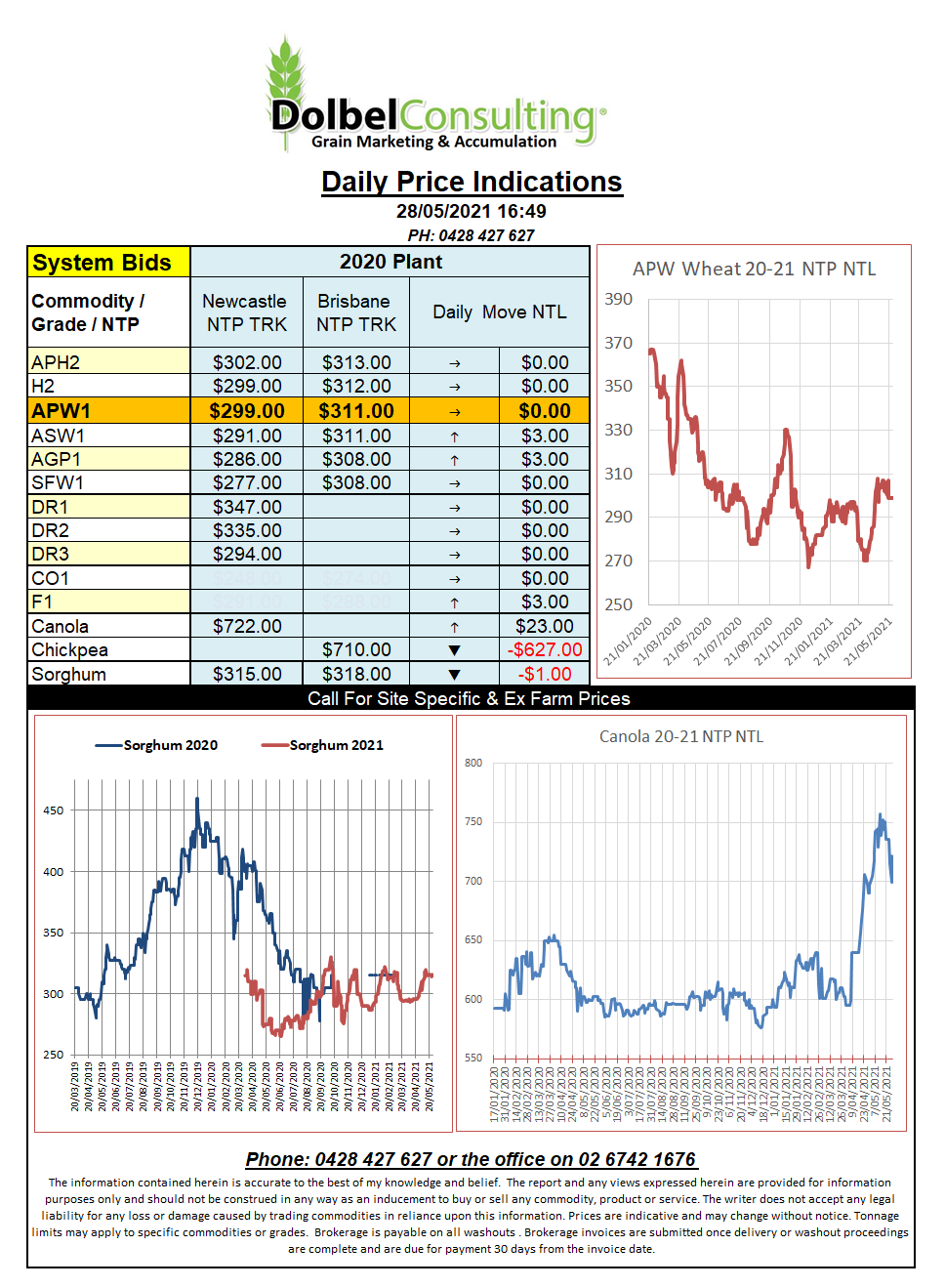

28/5/21 Prices

Corn lead the US grain futures market higher overnight. Corn was over-sold, it was due for a technical correction anyway and the size of US weekly sales were just the catalyst required. During the week reported the US sold 556kt of old crop corn and a massive 5.69mt of new crop. Granted these are just sales not loadings but these numbers are pretty impressive, not too many reports will carry weekly corn sales of 6.24 million tonnes. The USDA have total US corn exports for 2021-22 pencilled in at 62.23mt, so that is 9.14% of total projected export sales volume completed in one week.

Soybeans and wheat found support from spill over buying in corn. Cash bids for US soybeans were not as strong as the futures market may suggest with basis actually slipping as much as 10c/bu in one location. The good news is that the upside in soybeans spilled over into both the Paris rapeseed contract and ICE canola. Hopefully ending a two week long losing streak which has resulted in new crop values here spilling as much as $68/t.

Wheat futures were due for some technical buying and found the trigger from spill over interest in corn and beans. The persistent drought across parts of the US spring wheat belt and Canadian prairies lent some significant fundamental support to the wheat rally.

I don’t know how Tunisia will feel about last night’s rally after cancelling their recent tender for wheat because prices were too high.

Saudi Grains Organisation (SAGO) is looking for tenders on 720kt of wheat for July / Sept.