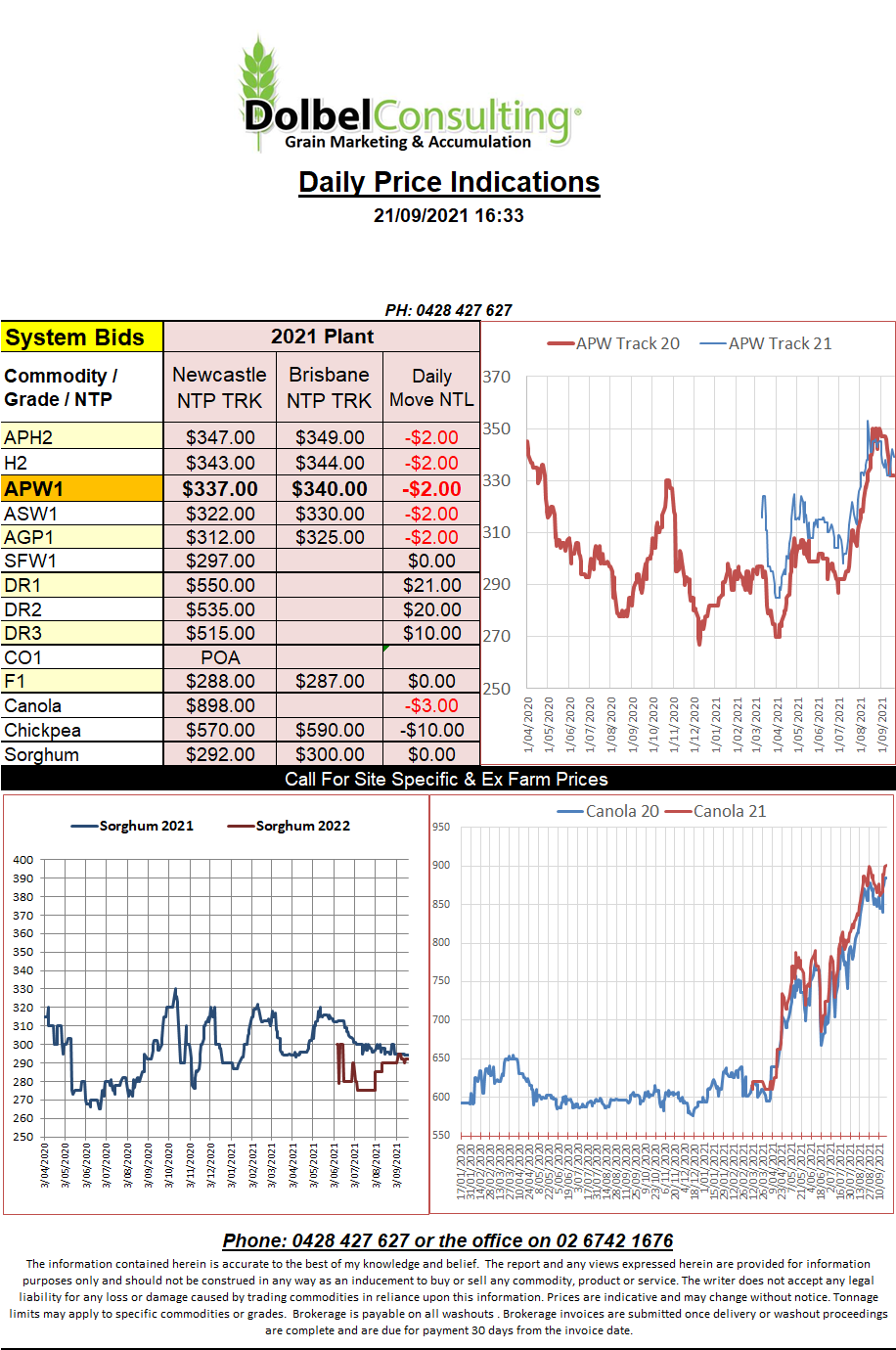

21/9/21 Prices

US grain futures were part of a broader sell off overnight. Fundamental strength in some grains were ignored as the funds took the opportunity to further liquid longs in corn, wheat and soybeans.

Soybeans were hit hard, Chicago beans were back 21.5c/bu (AUD$10.90) by the close, only fractionally above the sessions low. The weakness in CME beans rippled through to ICE canola and to a lesser extent Paris rapeseed futures.

The cash market for canola across SE Saskatchewan reflected the weaker futures market. A December lift slipped on average about C$12.50 per tonne to C$841.23 ex farm. Ukrainian values FOB Black Sea were also lower.

US soybean harvest is at 6% complete with about 58% of the crop now dropping leaves. Week on week the crop condition rating for US beans improved by 1% with the crop now rated at 58% G/E.

The US corn crop condition rating also improved in last night’s USDA crop progress report. At 59% G/E it reflects an improvement of 1% in the good to excellent rating.

Sorghum harvest in the US is progressing with about 5% of the Kansas crop in the bin. Texas is starting to wind up with over 73% of the crop now harvested. Sorghum values out of the Gulf were a touch higher on the cash market and reflect an equivalent Aussie price of roughly AUD$375 ex farm LPP. Argentine values are not so hot and reflect an Aussie value a little lower, closer to about AUD$330 XF LPP.

Algeria is tendering for 50kt of optional origin durum, tenders close on Wednesday. Shipment due through November.