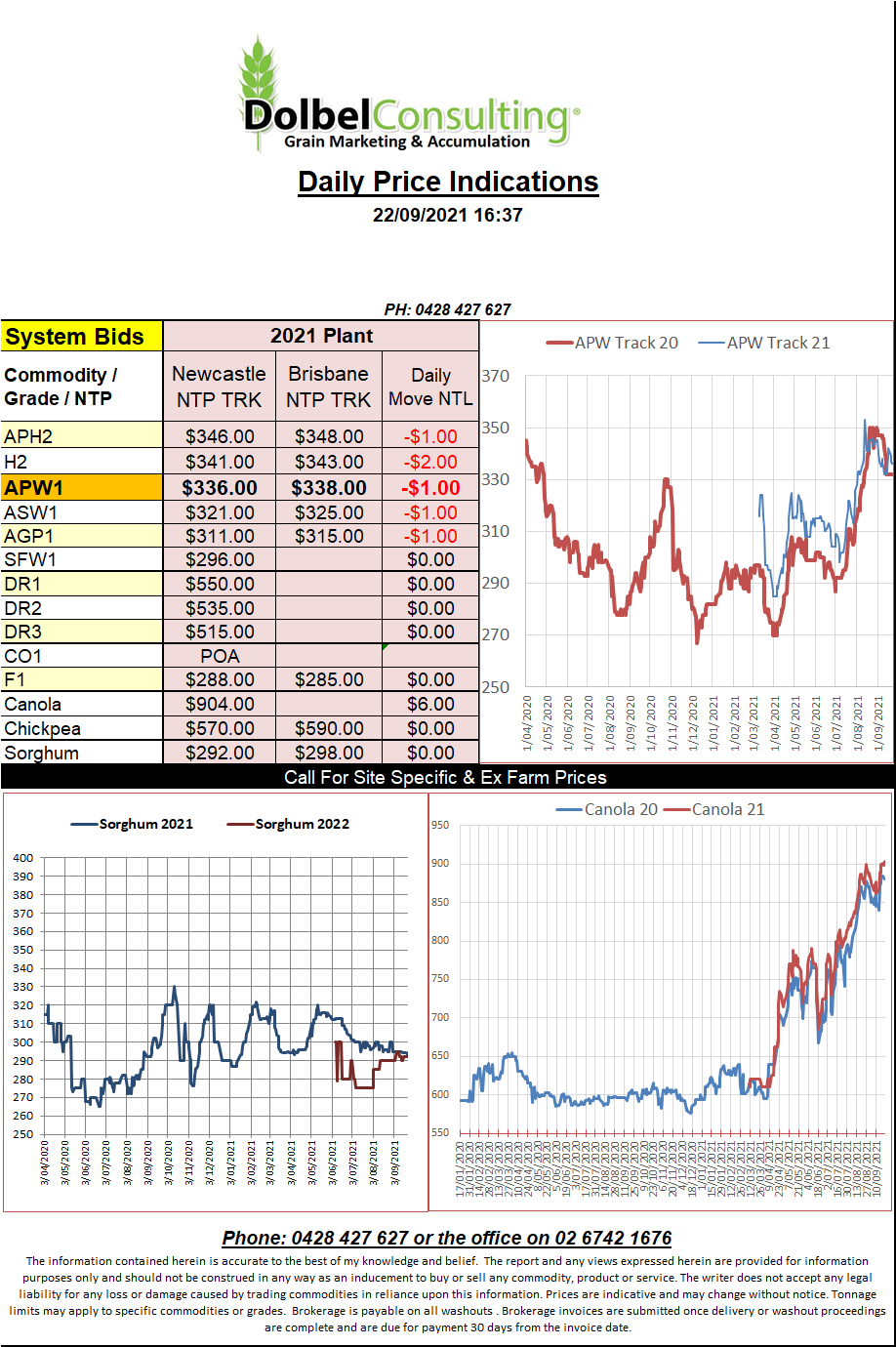

22/9/21 Prices

International news is a little light on this morning. US wheat futures continued to push lower with all three grades slipping away. Fundamental news was not that bearish. US weekly wheat export sales were good, demand is fair and the EU increased their annual export projection thus potentially reducing carry out. The futures markets for wheat at least continued to be pressured from outside markets which are treading carefully.

The repayments issues with China’s Evergrande property developers should come to a head this week or they will roll the debt 30days. Either way we’ll know one way or another this week if this is a nearby issue for currency values. Something to push the AUD 4 or 5 cents lower at the moment wouldn’t be a bad thing would it. It’s not like we are all jumping on an aeroplane to go on holidays this year.

The Russian wheat harvest is about 89% complete with around 72mt of wheat in the bin. SovEcon project that the Russian wheat crop will come in around 75.6mt, around 3.1mt higher than the current USDA estimate. SovEcon do include Crimea in their estimate though, the USDA does not. Crimea produced just under 1mt. Yields in the Russian spring wheat crop have also been a little better than expected. The far eastern regions of the spring wheat belt saw better rainfall than the western spring wheat area and Kazakhstan. Yields are said to be up about 16% year on year and potentially the best crop some have seen.

Philippines are looking for Oct > Jan feed wheat and barley by tender, we should have a result to compare over the next couple of days.