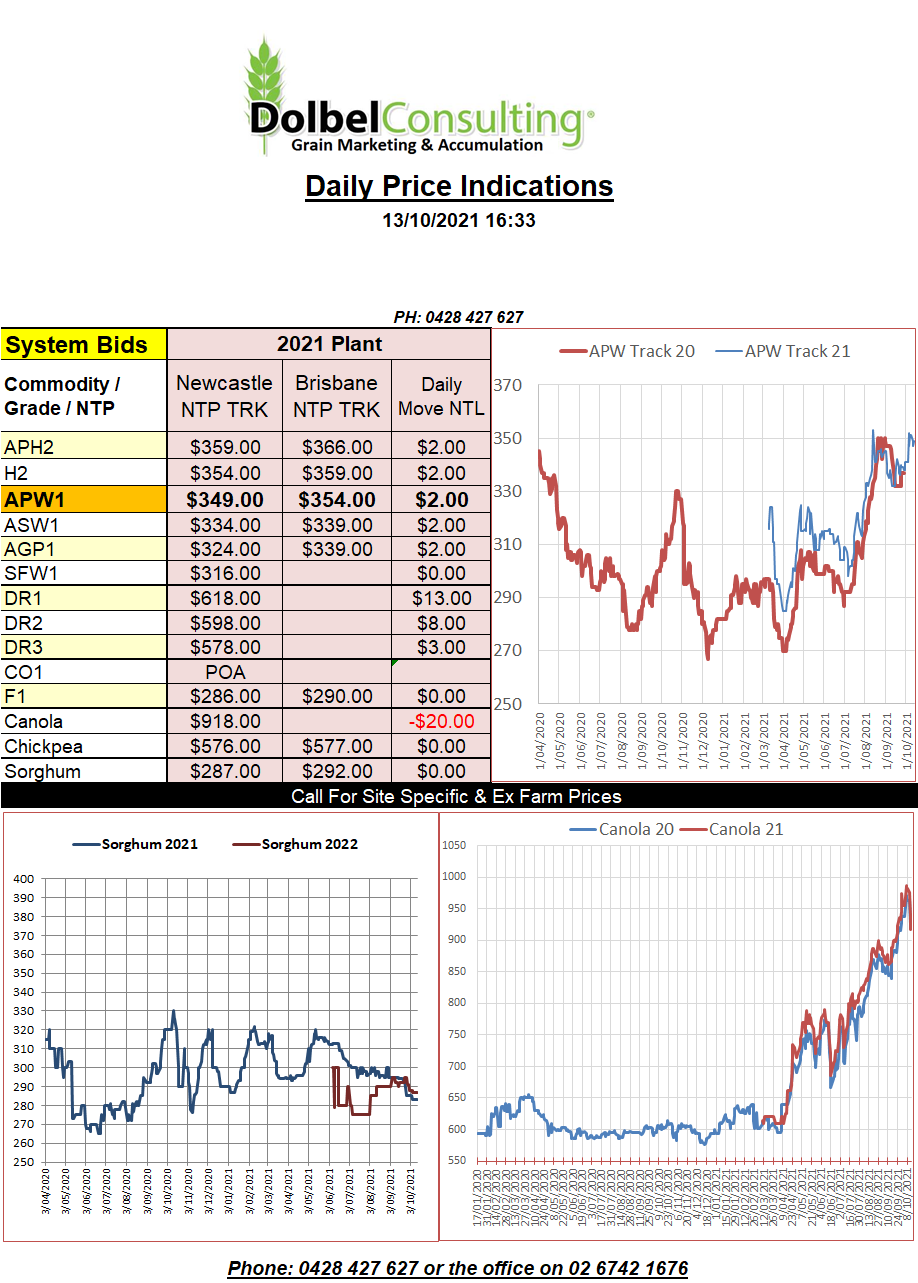

13/10/21 Prices

The USDA World Ag Supply and Demand report hit the market last night. Basically the report was more bullish than bearish for world wheat values but was considered bearish for both corn and soybeans. Futures responded as expected with US futures for all three wheat grades closing in the green while corn slipped 10.25c/bu (AUD$5.50/t) and soybeans were also hit hard, shedding 30c/bu (AUD$15.00) on the nearby contract. The weakness in soybeans moved through the oilseed complex creating losses in both ICE canola and Paris rapeseed futures both of which had seen significant upside right up until Thursday last week.

A closer look at the report shows world wheat production is back 4.41mt, exports are relatively unchanged but domestic usage is reduced a little. The net result being a month on month decrease in estimated world ending stocks of 6.04mt, not a bad outcome for wheat.

With northern hemisphere harvest all but complete these numbers should start to fluctuate a lot less from this report forward. Adjustments to the demand side of the equation now more likely than production adjustments. It’s interesting to note that both Argentine and Australian wheat production estimates were left unchanged at 20mt and 31.5mt respectively. Frost in SA, VIC and WA has claimed a few tonnes.

WASDE soybean data was not supportive. Supply was increased, both production and carry in raised and demand was reduced. The net result was an increase of 5.68mt to ending stocks. Like wheat, the high stocks to use ratio for beans will continue to act as an anchor on prices. The USDA did lower Canadian canola production 1mt to 13mt, this may see canola break away from soybeans again in time.