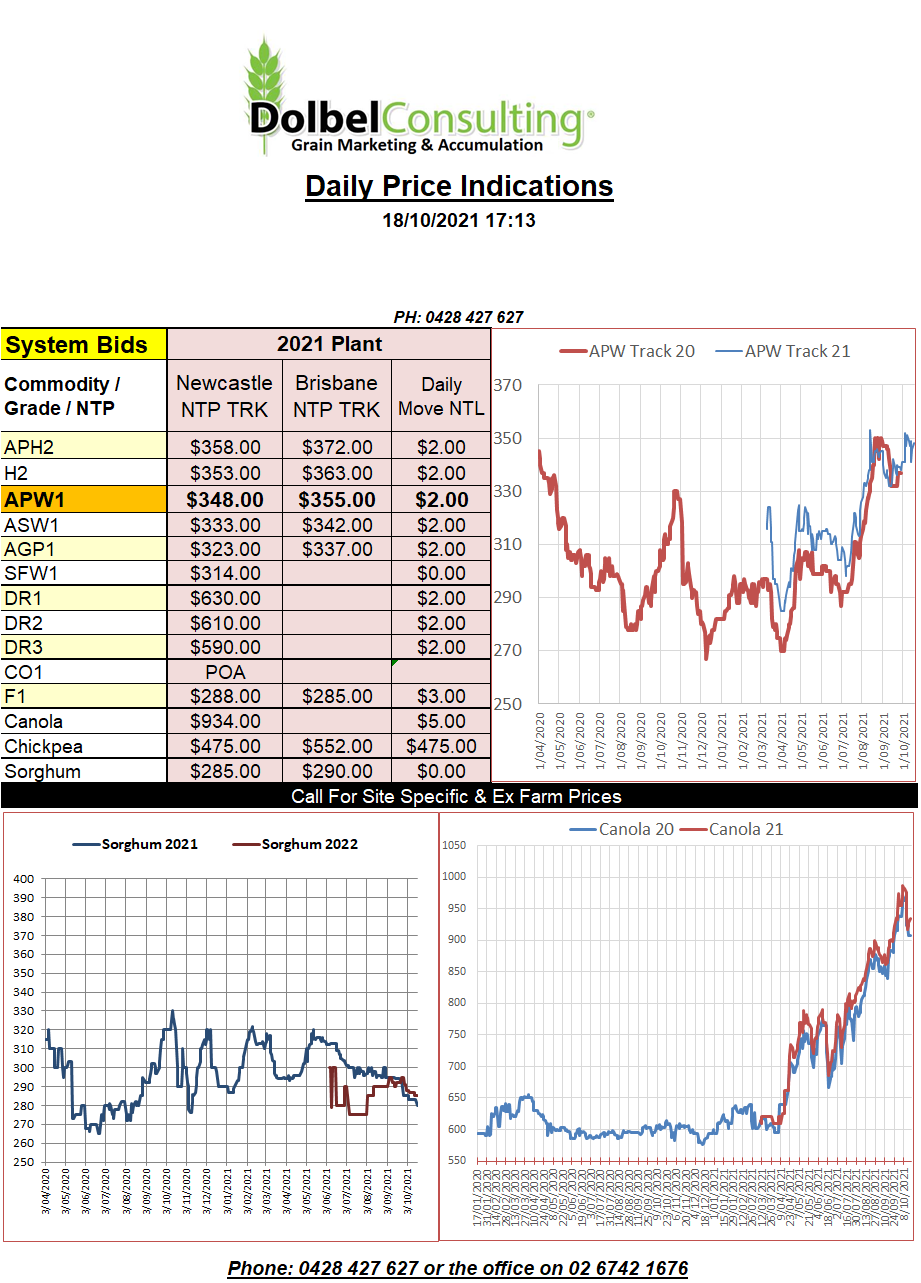

18/10/21 Prices

The Russian wheat export tax is set to rise to US$61.30 (US$58.70) next week. Russia continue to use export taxes to help cap domestic values and build stocks in the mid-term.

Barley and corn also have export tax applied to them, corn this week is at US$47.20 per tonne and increasing to US$48.40 per tonne next week. Barley is set at US$49.40 per tonne this week but is set to fall to US$45.90 next week.

The barley tax will still be much higher than it was in the first week of October when it was set at US$43.10 and also during the last week of September, when it was US$35.30.

The international feed grain complex isn’t getting any easier to navigate. Reports that Chinese corn prices have eased after a year-long run where they were well above feed wheat values is shifting demand. Consumers switching away from feed wheat, which is actually more plentiful in China this year than usual, back to corn is muddying the waters. Consumers price the cheapest feed grain into their ration. Substitution is based on price and price alone. Both grains are readily available. The question is will feed wheat values there fall away in an attempt to buy back market share or will Chinese feed wheat stocks build to become carry-over stocks. Who knows, at the end of the day China will do what they always do, harvest record yielding high quality crops and tell the world they have huge piles of ending stocks.

In the US corn futures saw double digit gains after reporting 1.038mt of weekly export sales. US Soybean and wheat also saw better sales.