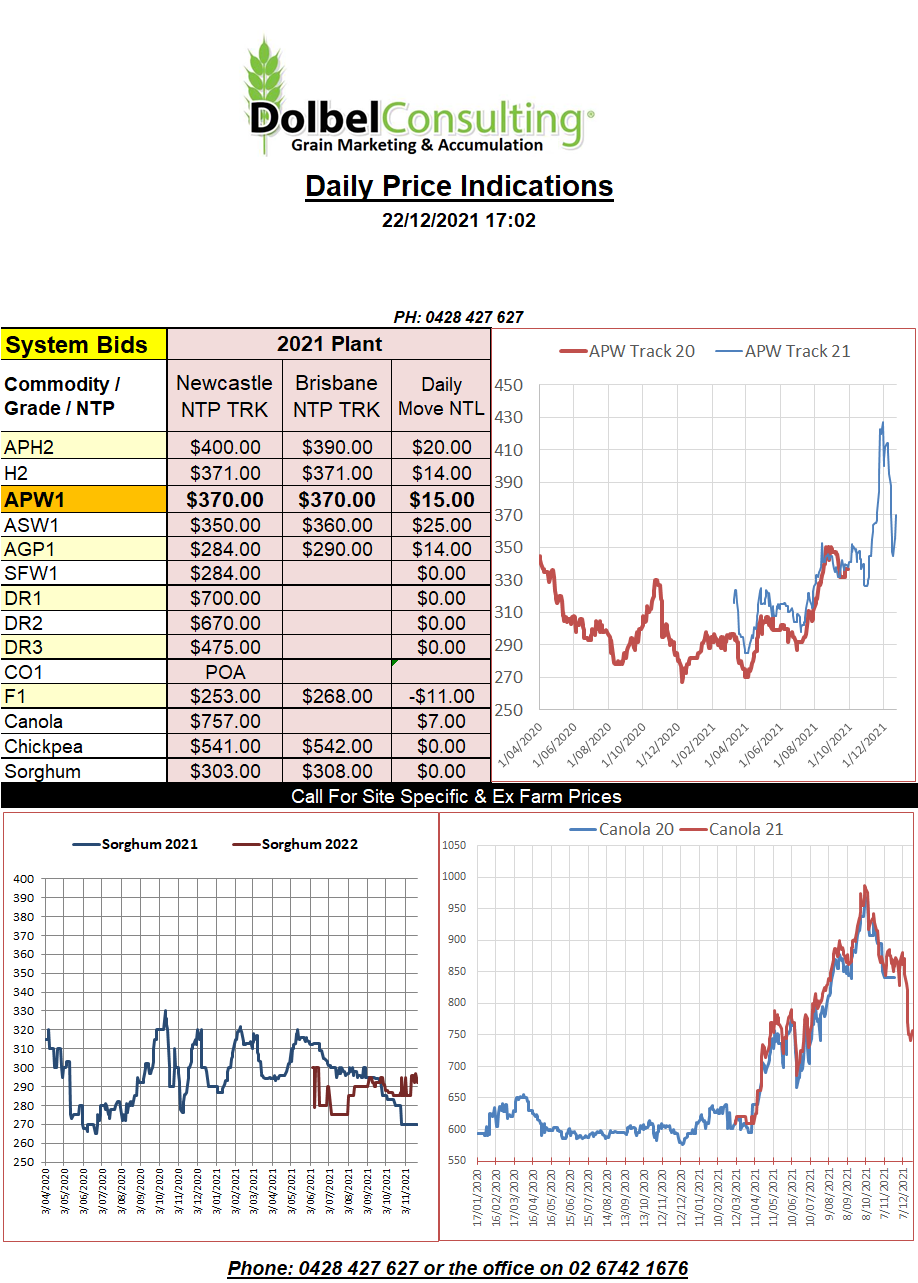

22/12/21 Prices

Internal values for Canadian durum jumped sharply higher again on Monday. SE Saskatchewan values are now at C$772.03 ex farm for an April pickup slot. Using a farm to FOB port basis of roughly C$80.00, which is probably a little low for this time of year. We come up with a FOB price of roughly US$659.

If we were to use Europe as an importer for this and then convert that delivered value back to an ex farm LPP value we come up with an ex farm number here close to $850 for a DR1 type of wheat. This Canadian value reflects some serious drought premium into the US market so a truer value is probably somewhere between the Canadian value and the prices we currently see for the French product, which converts to something closer to AUD$660 ex farm LPP.

Durum is starting to run into the same issues as canola when it comes to trade interest though. Both products are highly priced, thus the trade see them as a grain that will chew through their bank balance quickly for a relatively limited tonnage with similar returns per tonne as an alternative grain that’s cheaper like wheat or barley. This margin maybe argued in the case of canola given current basis but it still represents a smaller volume of grain for the same amount of money that could be spent on buying something like SFW1 into Asia

US futures markets saw double digit gains in both Chicago SRW & HRW and soybeans overnight. Corn at Chicago was dragged along for the ride closing a little higher. The stronger US soybean close rolled over into both ICE canola and Paris rapeseed, both closing higher.