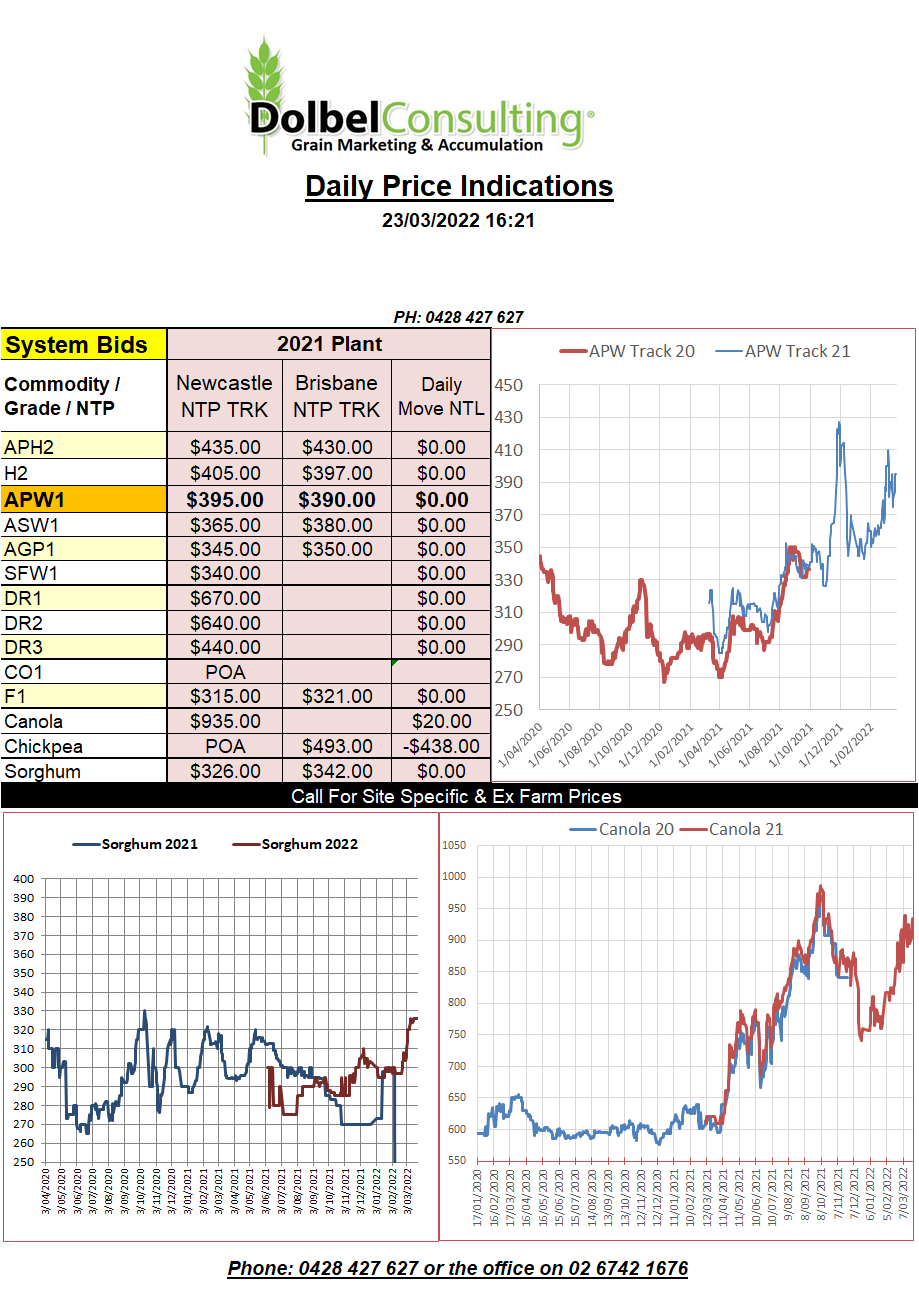

23/3/22 Prices

A disturbing consequence of the Russia / Ukraine war is the potential for instability in wheat import dependant countries like Egypt. The big news is the devaluation of the Egyptian pound by 14% as investors pulled the pin on Egypt. In an attempt to curb the out flow of investment money interest rates were increased 100 points with little impact on outflow.

Those in charge expect to see the move lower in the currency and the increase in rates stop the out flow of money and in fact create the exact opposite. The higher interest rates and the increased buying power of the USD should instead draw further investment into Egypt.

This is a very bad scenario for Egypt who now not only have to buy more expensive wheat (imported food) but also have to buy this expensive wheat with a greatly depreciated currency.

Is Egypt a litmus paper for other nations dependant on imported food and manufacturing products that are short in the market, like fertilizer, energy and much more. Will the shortage of fertilizer reduce global grain out-put even further than expected.

In the USA farmers and traders continue to try and work out how to benefit from the sharp rally in futures markets. One might think that the mechanism designed for exactly this reason should be easy to use, especially for Americans. Recent reports show that up country trading houses have simply stopped buying physical wheat though. Unable to guarantee traders will be able to sell it in the future at a profit but more importantly margin calls simply too high to cover if they hedge the purchase with futures. It leaves one to question who is actually driving the wheat prices higher if not the farmer, the trader or the end user, but we kind of know the answer to that don’t we.