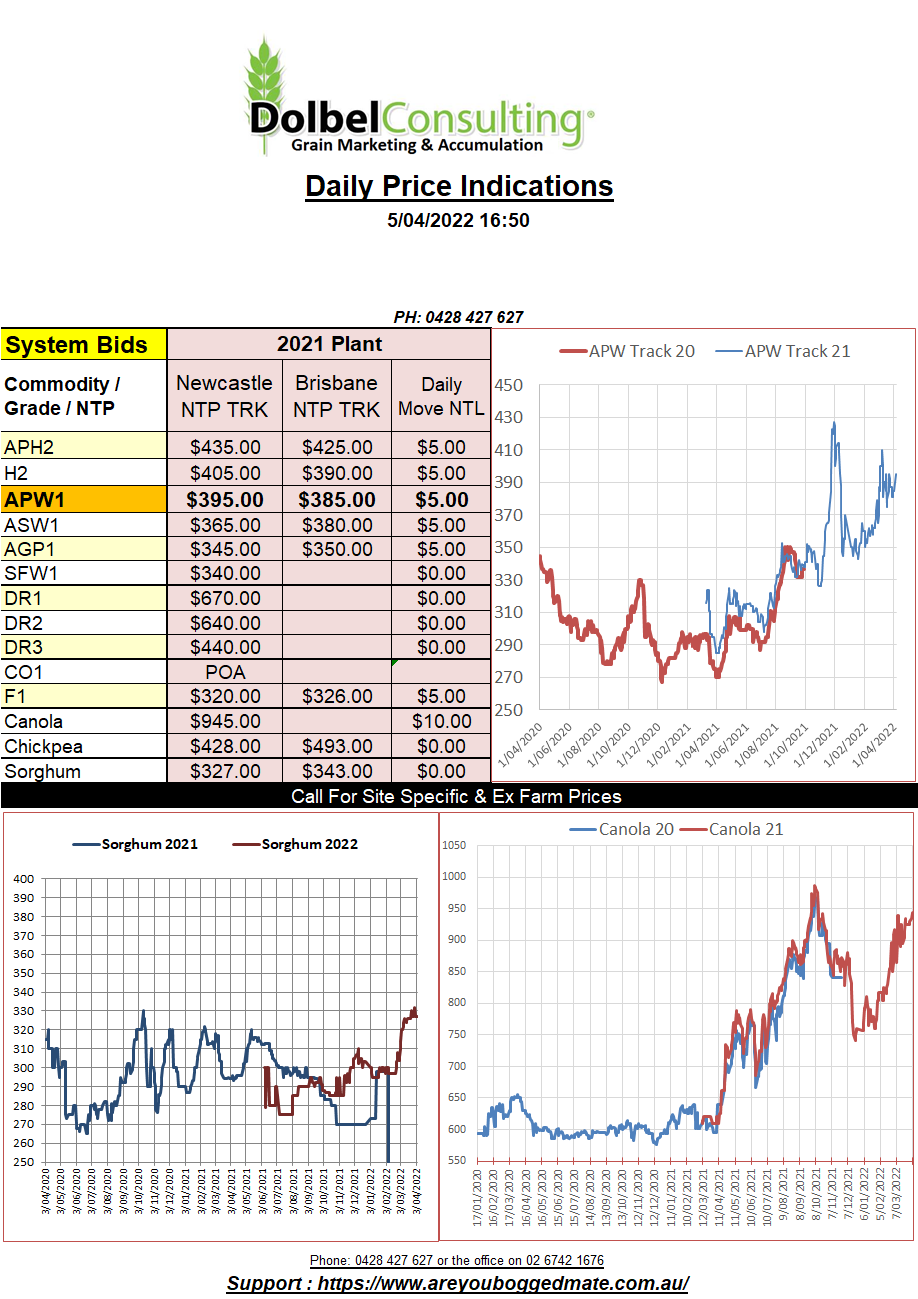

5/4/22 Prices

Saudi Arabia confirmed the purchase of 625kt of milling wheat yesterday. With an average price of US$422.47 / tonne C&F it is well above the last tender which averaged US$57.33 per tonne lower at US$365.14. The 12.5% hard milling wheat is scheduled for arrival between September and November. There were three sellers in the mix, Holbud Limited, Viterra and Olam, Holbud picking up the lion’s share. On the back of an envelope this would equate to milling wheat ex farm LPP of more than AUD$420 per tonne, confirming current bids are in the ballpark here.

In the USA wheat, corn and soybean futures at Chicago all closed higher. Hard red winter wheat and spring wheat also closed higher. At London feed wheat futures were up £3.70 for the Jan 23 slot and Paris milling wheat also closer €7.75 higher for the Dec22 slot. Uncertainty over Black Sea exports continue to be the key to international wheat values. Reports of extensive damage to export facilities at the Ukrainian ports of Odessa and Mariupol, in the Azov Sea, suggest high volume sales out of these ports will be unlikely in the mid-term, once the conflict is resolved.

Crop condition ratings across France continue to be very good, most winter grains are in better shape than this time last year according to government officials. World Ag Weather data continues to indicate that 30 – 14 days rainfall is lower than average across France, Germany and much of Poland. Romania and much of Turkey and the Baltic states are also drier than average. Across France and Germany 30 day rainfall totals are generally less than 30mm with few locations seeing above 50mm. Not exactly a drought by Aussie standards but still less than ideal for crops coming out of the winter there. Central Russia is seeing good average rainfall while the Volga Valley is a little dry. China remains too wet if anything, heavy rain in the east.