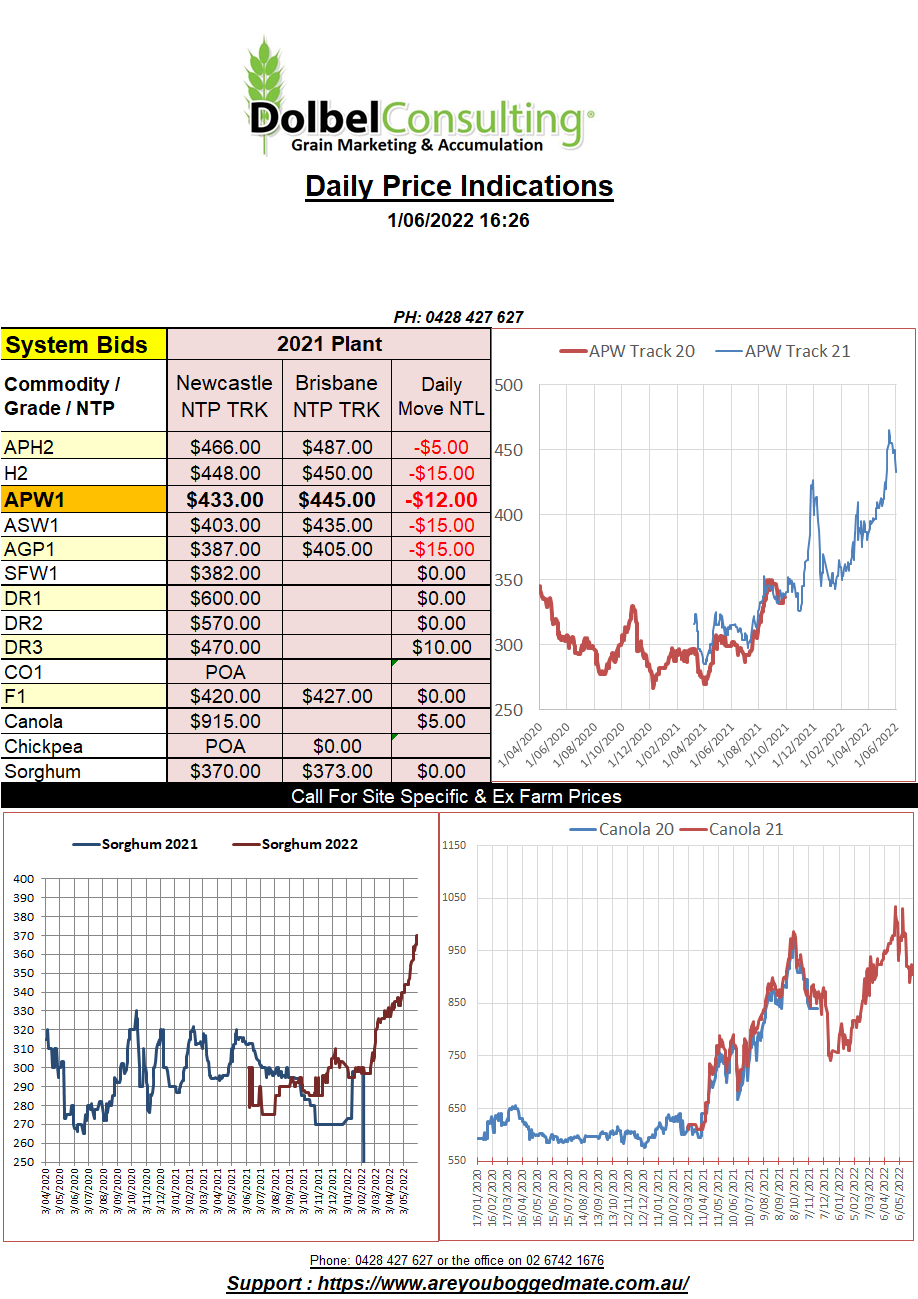

1/6/22 Prices

Crushed, hammered, beaten, it doesn’t matter what word you use the US futures market got a little ugly last night. All three wheat grades, corn, soybeans, even cotton was lower by the close.

Wheat was hardest hit, the CME nearby soft red winter wheat contract shedding AUD$35.83 per tonne. The December 22 slot was also back sharply, shedding around AUD$34.04 by the close. Hard red winter wheat and spring wheat futures were not spared, both seeing big losses.

Soybeans were off 49c/bu nearby, about AUD$25. One would have expected spill over pressure on ICE canola at Winnipeg to be significant but the canola contract sustained current values and actually put on some gains in the new crop months. Canola fundamentals in Canada remaining very strong at present. Corn at Chicago wasn’t spared, down 18.5c/bu on the nearby, just over AUD$10/t.

The downside was attributed to a few things. Slow exports out of the US a major headwind. Other factors were profit taking on an over inflated market and thoughts that the world will start to see increased exports out of Ukraine. Corn took a beating on the thought that there would be a big jump in sown acres in the weekly USDA crop progress report. The report, out after the close, confirmed this. Corn sowing now at 86% complete compared to the 5 year average of 87%. Emergence at 61% was also not that far behind the average of 68%. Soybeans were 66% sown (67%avg) and spring wheat was estimated at 73% complete, a big jump from last week’s 49% but still well under the 92% 5yr avg. The value of winter wheat rated G/E increased 1% to 29%, that’s still pretty bad and the value rated P/VP remained unchanged at 40%, that’s a lot. The US winter wheat crop is pegged at 72% in head (76%avg). The spring wheat sowing rate is above pre report trade estimates and may continue to put pressure on wheat overnight.