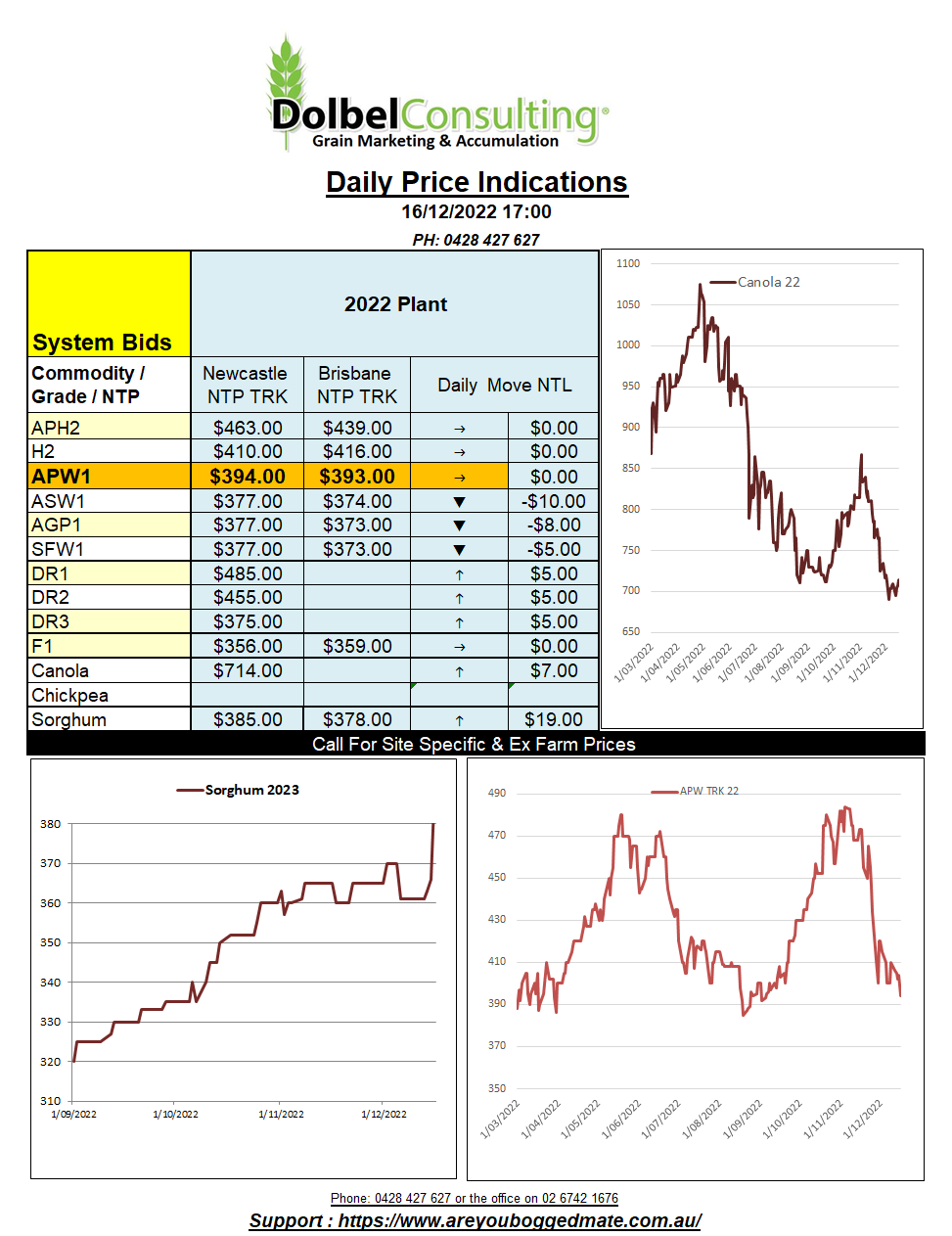

16/12/22 Prices

Some bargain hunting in the US wheat market was said to stimulate weekly export sales which amounted to about 468kt last week. This beat trade expectations and fuelled some technical trade, resulting in some upside in both SRWW and HRWW futures at Chicago. Cash values out of the US PNW were also a little firmer on the day, tracking the move in futures.

Supportive fundamental news came from a further reduction to the Argentine wheat crop by the Rosario Grain Exchange. The new estimate announced is just 11.5mt. Wheat harvest progress in Argentina sits at around 62% complete. The work in the field confirming the trades worst expectations there. Drought and frost greatly reduced yields across the central wheat belt in Argentina this year.

Tunisia picked up 125kt of Canadian durum at US$511.77. Prices ranged from US$504.50 to US$514.29. This values roughly converts to a price of around AUD$588 XF LPP, confirming that current cash bids are probably a little under-priced.

Algeria was also said to have picked up 520kt of wheat for somewhere around US$349. This would support current cash bids for H2 at the port, leaving a decent trade and execution margin.

Reduced rainfall across the major wheat producing regions of India has also pricked the ears of the trade. Recent showers across Madhya Pradesh have helped but further north and west the rain has been minimal leading many to think Indian production could be sharply lower come harvest in March / April next year. The dry weather may also have an impact on Indian Chickpea production.

Dalian corn futures were a little lower overnight, the May 23 contract slipping just Y7, to Y2817 or AUD$602.81 per tonne.