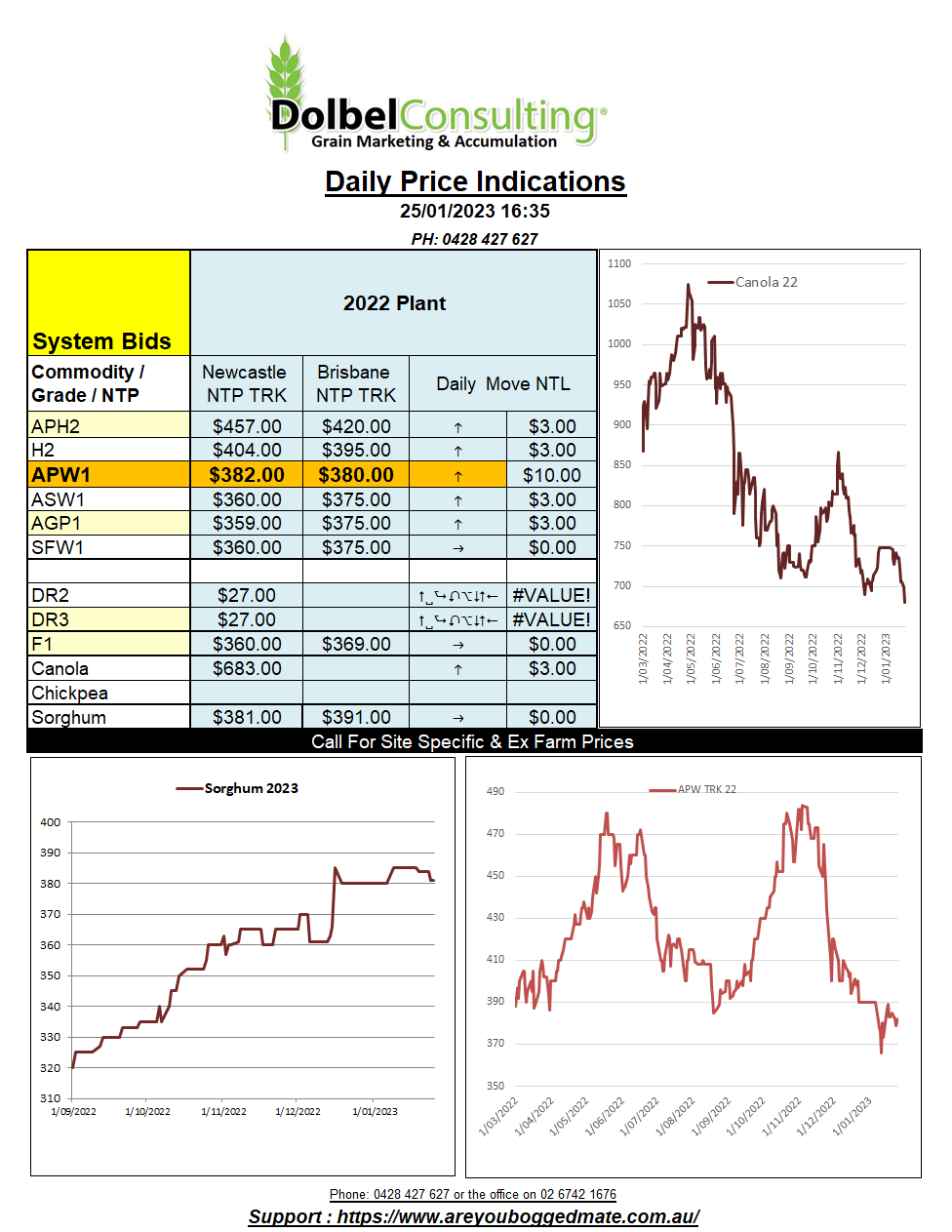

25/1/23 Prices

Technical Tuesday, call it what you will. US wheat futures found the need to recover from Monday’s losses. Although not recovering dollar for dollar a slight recovery was noted. Further strength in the AUD will somewhat counter the move here, the jump in the AUD worth is about -$AUD1.67/t. The recovery in SRWW futures at Chicago was worth about AUD$7.56.

Better US weekly wheat export inspections, speculation Indian may need to import wheat prior to their new crop harvest starting in a couple of months and talk of a reduced Russian wheat area in 2023 were all bullish factors. The fact that EU wheat exports are also very strong also helped. The main two issues capping further rallies, Russian and Australian wheat production estimates, should at least now be well factored into the equation.

Over the months of February and March the trade will begin to concentrate more so on the emergence and condition of the Northern Hemisphere winter wheat crop. There is much to consider, winter kill in Russia, dryness across the US HRWW and spring wheat belts. As we move into May the weather across Australia and Argentina will also play a role. I don’t think many punters have cottoned onto just how dry January has been across much of inland NSW and S.QLD. In Gunnedah, 39mm fell in December over 5 events, the heaviest falls on the 12th and 13th. Since that event just 26mm has fallen over 5 weeks, that doesn’t go far in the middle of summer. We may be in better shape than Argentina but it’s a long way from perfect.

The forecast for Argentina continues to improve, the 1-7 day outlook predicts 25-80mm across large swaths of Cordoba and east into Santa Fe, both major cropping regions.

AUD topped out at 70.52 overnight after a sharp rally mid to late session. Movement was mostly sideways to lower during the early morning trade.