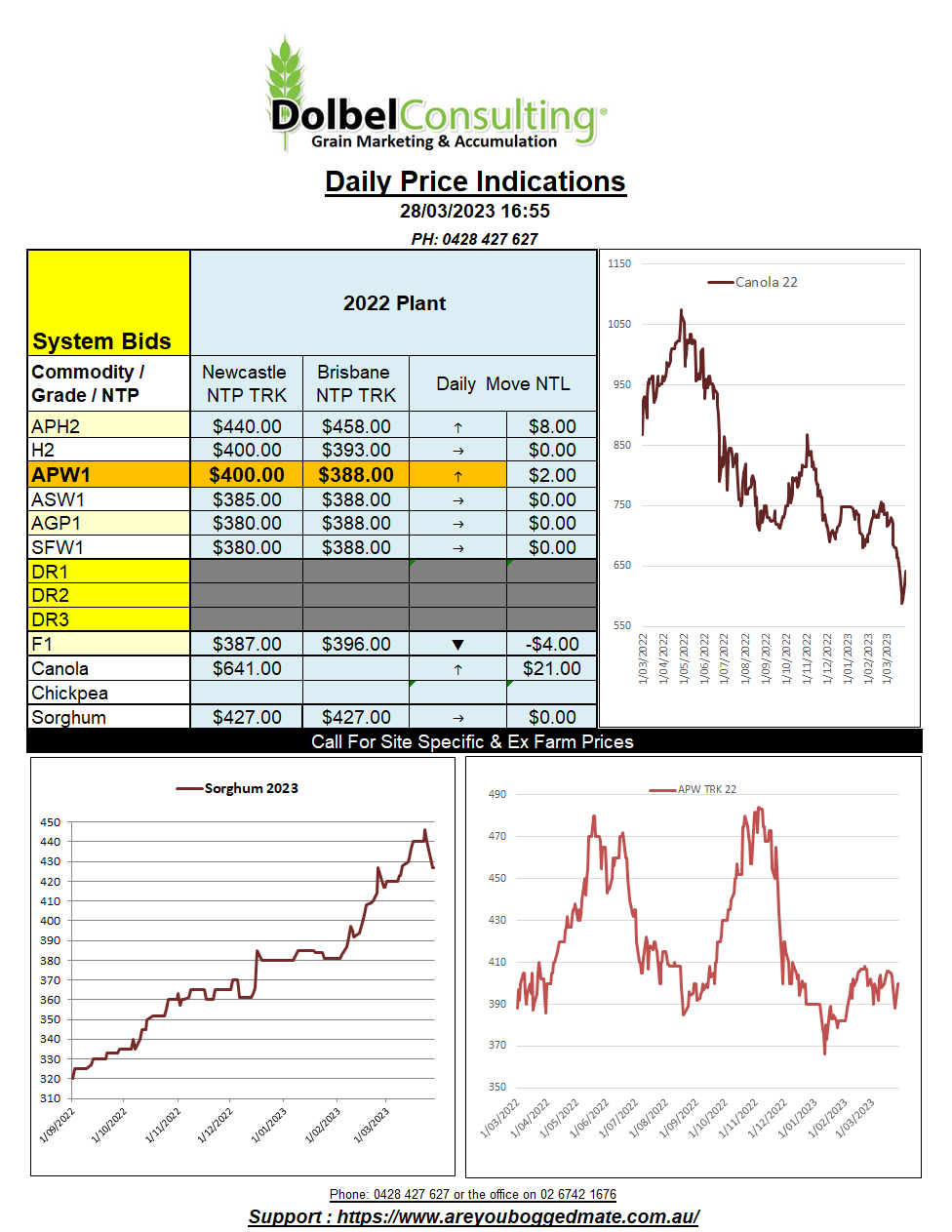

28/3/23 Prices

Indian weather is creating some concern for the quality and quantity of both the wheat and chickpea crop there.

Domestic Indian values have increased, chickpea putting on roughly AUD$18 per tonne when taking movement in the AUD / Rs into account as well. Harvest on what we would call winter crops usually starts in earnest in March but there are already delays in wheat arrival and most of the chickpeas in Madhya Pradesh are said to be still in the field. One plant that will take a big production hit is Ispaghol (psyllium), not good news for those of you that rely on Metamucil to keeps things active…… we are all getting older.

Wheat prices in India are yet to really respond. Prices usually fall during February as harvest approaches, this occurred again this year, shedding 800Rs/Qtl (AUD$146) from the January high like many other wheat markets.

A quick look at World Ag Weather confirms falls of 50 to 100mm across roughly 30% of the major wheat production areas. It’s not ideal but it’s not going to devastate the Indian wheat or chickpea crop. Keep an eye on short term spikes in new crop chickpea values here.

Paris rapeseed futures closed higher in overnight trade. The nearby contract led the way, gaining E14.75 per tonne while the Feb 24 slot was up E7.25 by the close. Longer term strength in rapeseed will depend on both the supply of rapeseed out of the EU and Canada, both of which are predicted to be similar to last year. Outside pressure will come not only from a huge Brazilian soybean crop but also from a sharply higher area of sunflowers in Ukraine and Europe. Once this technical correction is complete it is possible that rapeseed and canola values will stagnate at or near seasonal lows.

Argentine soybean production estimates remain steady at about 25mt, sharply lower than average due to drought.