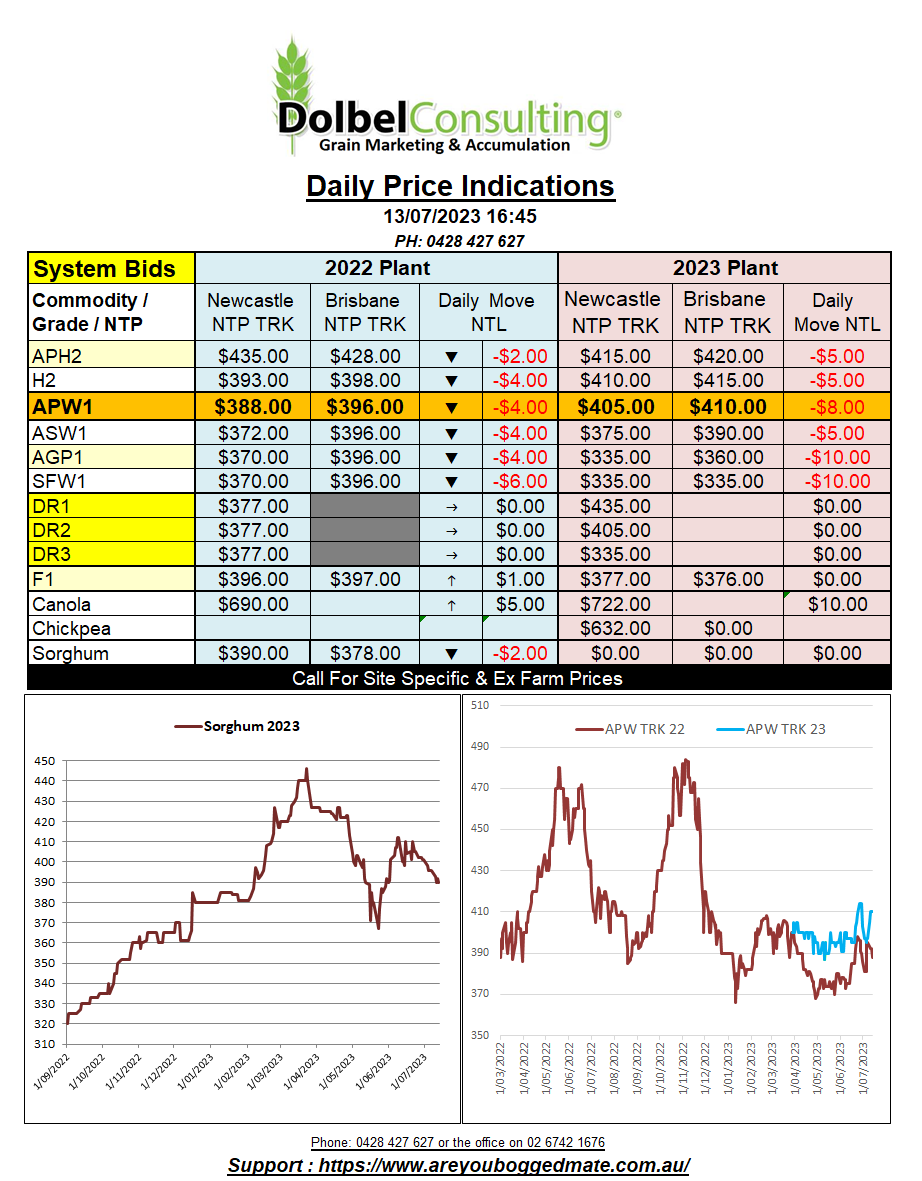

13/7/23 Prices

Category: Pulses News

A few things to look at this morning, these include the Chinese extending their decision to remove or reduce import tariffs on Australian barley. A USDA World Ag Supply and Demand Report and reports that the UN has folded and offered SWIFT access to Russia (in a form) in exchange Russia are to extend the Black Sea Grain Corridor deal. The easy stuff first, China had said all along the decision will take 3 - 4 months. The extension is taking it to their 4-month time frame, so not exactly unexpected. As indicated 3 months ago, this will put the decision in the market in the middle of the Canadian harvest. It will be interesting to see if the Chinese actually buy much Canadian barley though. Canadian barley is currently one of the most expensive barleys C&F China. Canada is also suffering through a dry period so production will be less and domestic demand there possibly much stronger. At current values, CiF China, the cheapest is Ukraine, then Aussie (less tariffs) and then Russian and then French. So, in theory the Chinese already have 3 suppliers cheaper than Canada. Allowing Australian barley will create more competition potentially, but prices may already be sharp enough. The UN has suggested that a subsidiary of the Russian Rosselkhozbank could be allowed to access SWIFT payment transactions for grain and fertilizer sales if Russia extend the grain corridor deal for several months. Sanctions are not set against Russian grain and fertilizer sales and Russian export volumes have been good, but the payments system in place is said to be limiting, according to Russia. WASDE, wheat, world production lowered 3.52mt to 796.67mt, not small, imports back 1.58mt, consumption up 3.31mt, ending stocks -4.18mt, still big.