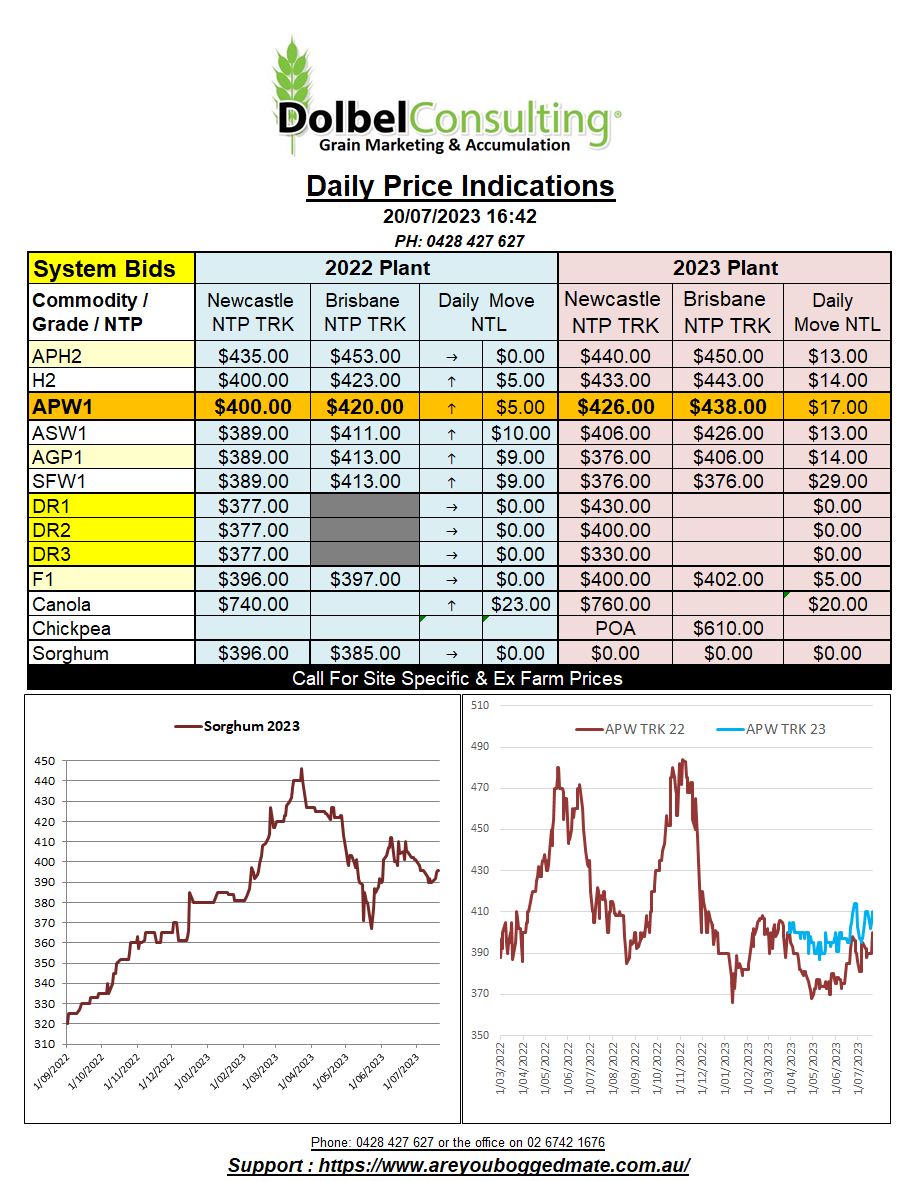

20/7/23 Prices

Russia continues to attack Ukraine grain export facilities. Every night this week export terminals have sustained damage, some superficial, some serious. The Viterra complex at Odesa appears to have lost a main elevator yesterday. This morning there are also reports of Chornomorsk port, south of Odesa, taking damage overnight.

The Russian defence minister has said that any shipping vessels in the Black Sea heading to Ukraine ports will be considered a target as they are possibly carrying military equipment.

In the July WASDE report Ukraine was pencilled in as producing 17.5mt of wheat and exporting 10.5mt, and a carryover of 1.59mt for Ukraine. World wheat ending stocks were expected to come in at 266.53mt. If Ukraine can only export half of the projected 10.5mt, and the shortfall is simply added to the world ending stocks, which become 271.78mt, that is only 1mt higher than the ending stocks number in the June WASDE report. In 2021-22 ending stocks were 272.6mt and in 2022-23 269.31mt.

The threat of a food crisis because Ukraine can not export half of the wheat they are projected to is rubbish.

But if we combine the slowing of the Ukraine export pace, a potential slowing of Russian exports, voluntary or not, with the decline in the Canadian, Australian, Argentine and US wheat crop size year on year, it does tend to point towards a short term tightening of supply from all the major exporters. A production problem for a major importer, like the Middle East, India, Pakistan or N.Africa, could tighten the market up quickly, increasing near term demand while at the same time near term supply is slowed even as ending stocks grow. The bigger issue is probably going to be quality wheat. With US spring wheat, Canadian DNS and Aussie prime wheat production all seeing severe production problems importers looking for quality will be pushed.