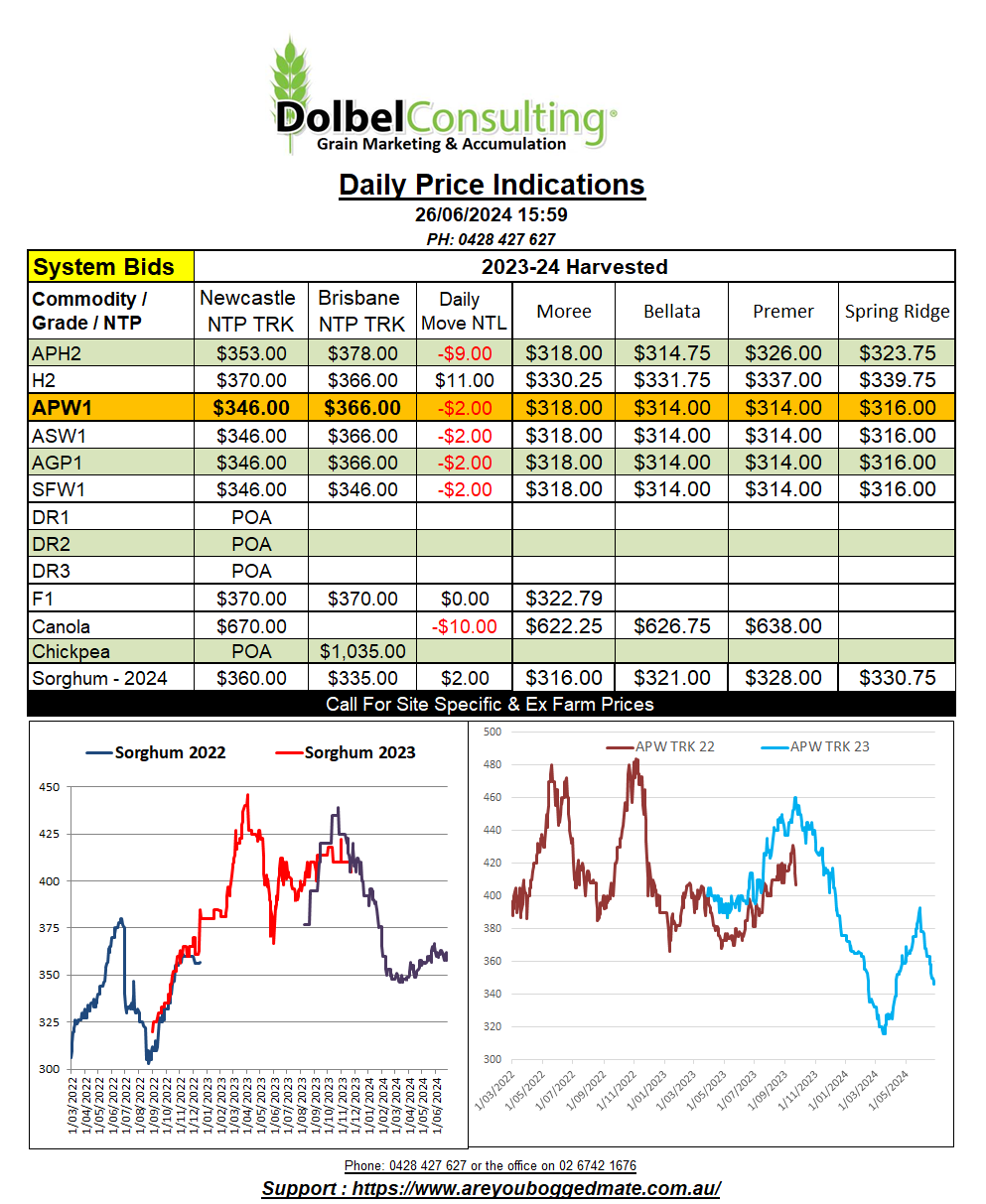

26/6/24 Prices

US wheat futures and cash values out of the Pacific Northwest continue to slip lower finding little support from the international market, or the punters in the futures market at Chicago or Paris.

Milling wheat futures at Paris slipped E1.50 (AUD$2.41) in the December 2024 slot. Chicago SRWW futures for the Dec24 slot were back AUD$6.36, the weaker AUD clawing back a measly 45c/t. The conversion of the loss to AUD / tonne is roughly AUD$5.91 for the Dec 24 slot.

The market in the US, and Europe for that instance, continues to be torn between the deteriorating fundamentals for both US and Russian wheat and the arrival of new season grain on the market.

This may result in some increased volatility in price as we move away from the northern hemisphere harvest window and towards our own harvest period in Nov / Dec. The level of volatility will depend greatly on the final quantity and quality of the northern hemisphere crop.

There are already some punters calling for a sharp increase in the premium paid for premium high protein wheat in the USA.

Egypt took the opportunity to grab another 470kt of milling from Black Sea suppliers. Bulgaria 50kt, Ukraine 60kt, Russia 180kt and Romania 180kt. The failure of EU wheat to rate a mention in the tender was said to have been one of the major bearish factors in Paris milling wheat futures last night.

Durum wheat values, both French and Canadian, slipped further overnight. The average cash price for 1CWAD13 out of SE Saskatchewan was said to be C$6.15 lower to C$353.15 per tonne according to Alberta Wheat commission price discovery tool PDQ. 1CWAD13 durum for pickup XF SE Sask in December was also lower, shedding C$7.76, with an average value of C$321.48/t ex farm. French values FOB La Nouvelle slipped just under AUD$5.00 per tonne.