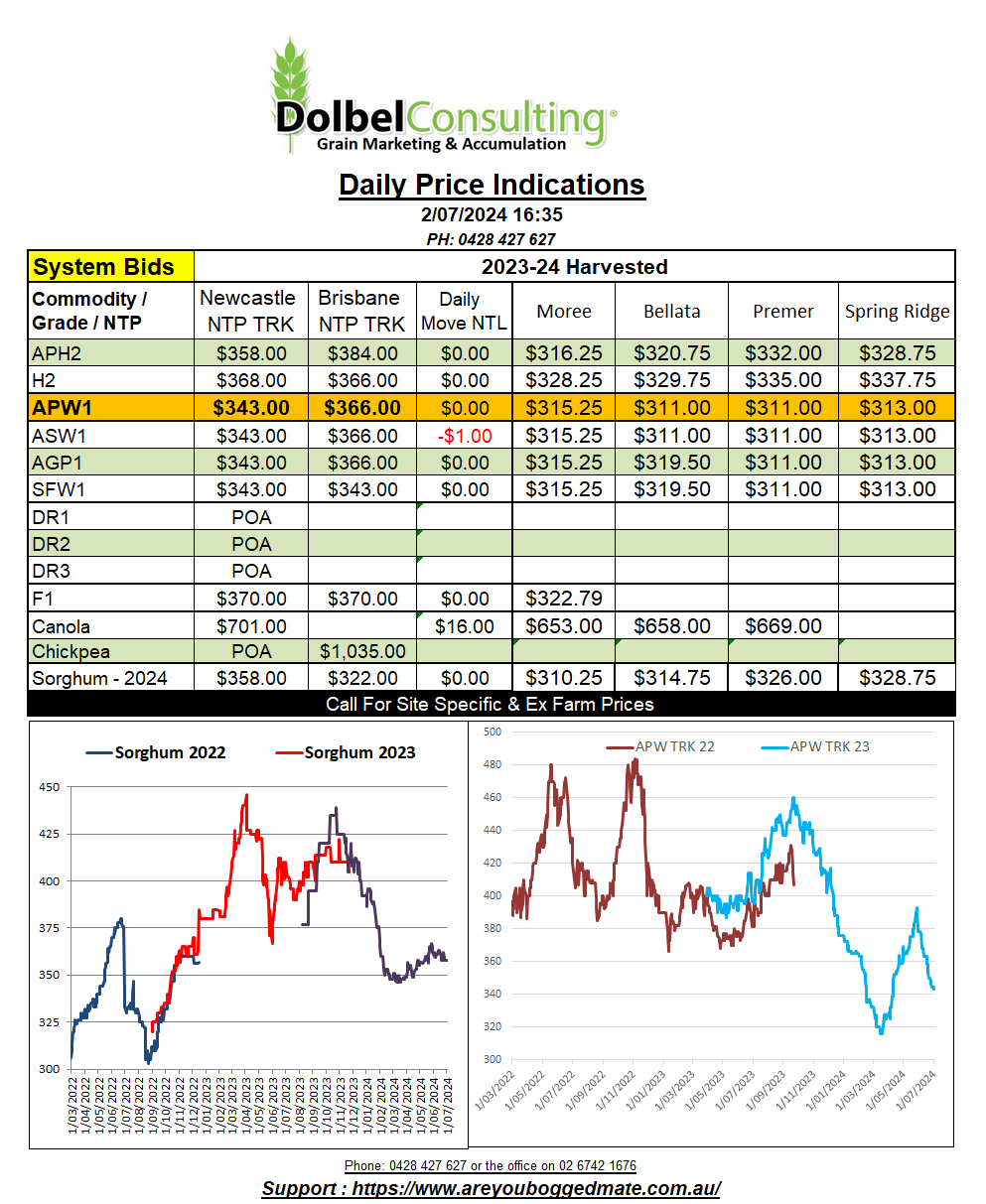

2/7/24 Prices

Weekly rainfall across the US central corn belt and the eastern spring wheat region continues to be problematic for some. The forecast for the same region isn’t predicting conditions to dry out anytime soon either. The next 7 days could see 50-100mm of rain fall across already saturated parts of Iowa, southern Minnesota, Illinois and Wisconsin.

The rain may be good for those that have corn up and away on better drained country, but the continued wet weather isn’t helping everyone. This is evident by the falling crop condition numbers for states like Iowa. Corn there last week rated 62/15 – 77% G/E, this week there’s been a reduction 57/16 – 73% G/E. The national US G/E rating for corn fell from 57/15-72% last week to 55/14-69% this week. The US soybean rating also fell 3pts to 67% G/E.

The winter wheat rating declined 1pt from last week to 41/10-51% this week. The southern states are winding up harvest now, Kansas is estimated at 80% complete. Nebraska is just 13% harvested while states further north across the corn belt are mixed but generally 60%-90% complete. Michigan state is at 3% harvested. With the weather there expected to remain exceptionally wet this may not see much week on week harvest progress. The G/E rating for Indiana fell from 58/21-79% to 58/19-77% this week, not a huge decline and given the state is 39% harvested it is a little surprising that the downgrade wasn’t higher.

The US spring wheat rating was estimated at 61/11-72% G/E compared to last weeks rating of 64/7-71% G/E, also a little surprising.

Paris futures for both rapeseed and milling wheat closed in the green. Rapeseed the clear winner of the two with a day to day gain of E8.25/t in the Feb25 contract. Milling wheat put on E5.75 in the Dec24 slot, roughly AUD$9.27 at the spot rate, roughly AUD$0.58/t better than the move in US SRWW futures in AUD/t. The AUD is also a little softer this morning helping the conversion. Chickpea prices at the Delhi market were slightly lower, back less than AUD$1.00 overnight. Wet weather in Europe continues to support both milling wheat and rapeseed values there. Fund short coverage also supportive.