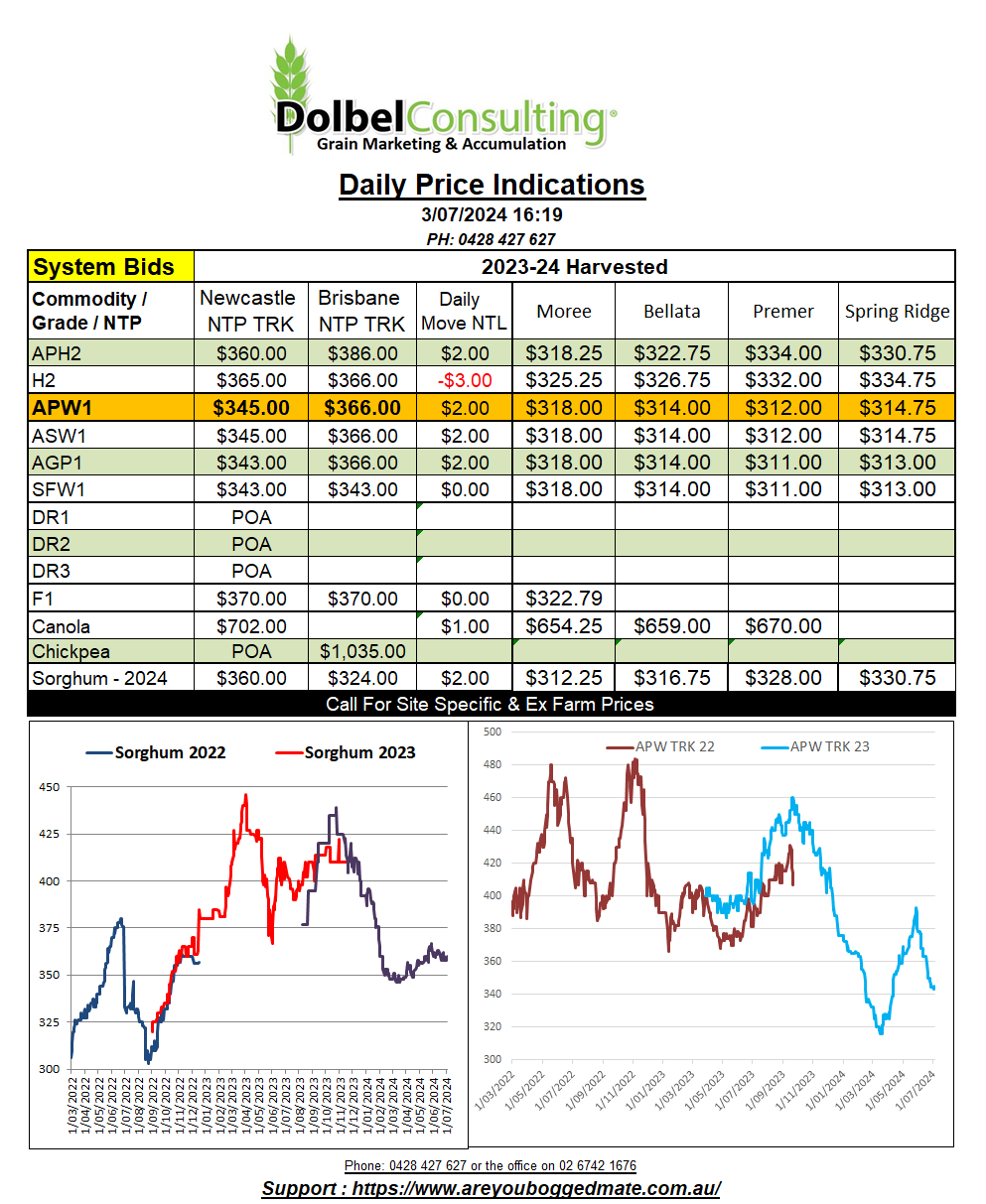

3/7/24 Prices

The big winner in last nights futures markets was ICE canola futures at Winnipeg. The move in AUD per tonne, taking variations in the AUD / CAD into account, is equivalent to roughly AUD$27.90 per tonne. This is a much larger move than the Paris rapeseed contract too, which gained roughly AUD$5.93 / tonne in comparison. The Canadians rushed the market after having a day off on Monday. After seeing Paris rapeseed futures up AUD$16.62 on Monday and AUD$5.93 last night, a total of AUD$22.55, the jump at Winnipeg is more than a catch up move.

There was outside assistance from palm oil which rose sharply after Indonesia threatened import tariffs on Chinese oil imports. Crude oil moved a little higher also helping. There was also some fundamental speculation that conditions in Canada, much like conditions in Europe, are starting to become a little too wet in places. The crop condition rating for canola in Alberta is still good. At 70% G/E it’s not exactly dying in the field. The wet weather does raise the chance of disease and moisture stress taking some of the yield potential out of the field though.

Both hard and soft red winter wheat futures at Chicago handed back some of the previous sessions gains. Spring wheat futures at MGEX were relatively flat though, the December contract there shedding just 1.5c/bu (AUD$0.82/t). The weather map for the US is all you need to see to understand why spring wheat is finding a little support. With recent heavy rain across the eastern spring wheat region, and more in the forecast, indicates acres may yet be reduced and wet weather could also create disease issues going forward. It is early days yet, but with the problems experienced in both Europe and Russia, it is starting to shape up as a year where quality supplies may become a little tighter than usual.

The huge import duty on Russian wheat into the EU states will impact on Italy more than any other state. Last year Italy picked up 435kt of Russian durum wheat as well as 543kt from Turkey and 455kt from Canada. It will be interesting if Russian durum flows into the EU through Kazakhstan or Turkey this year.