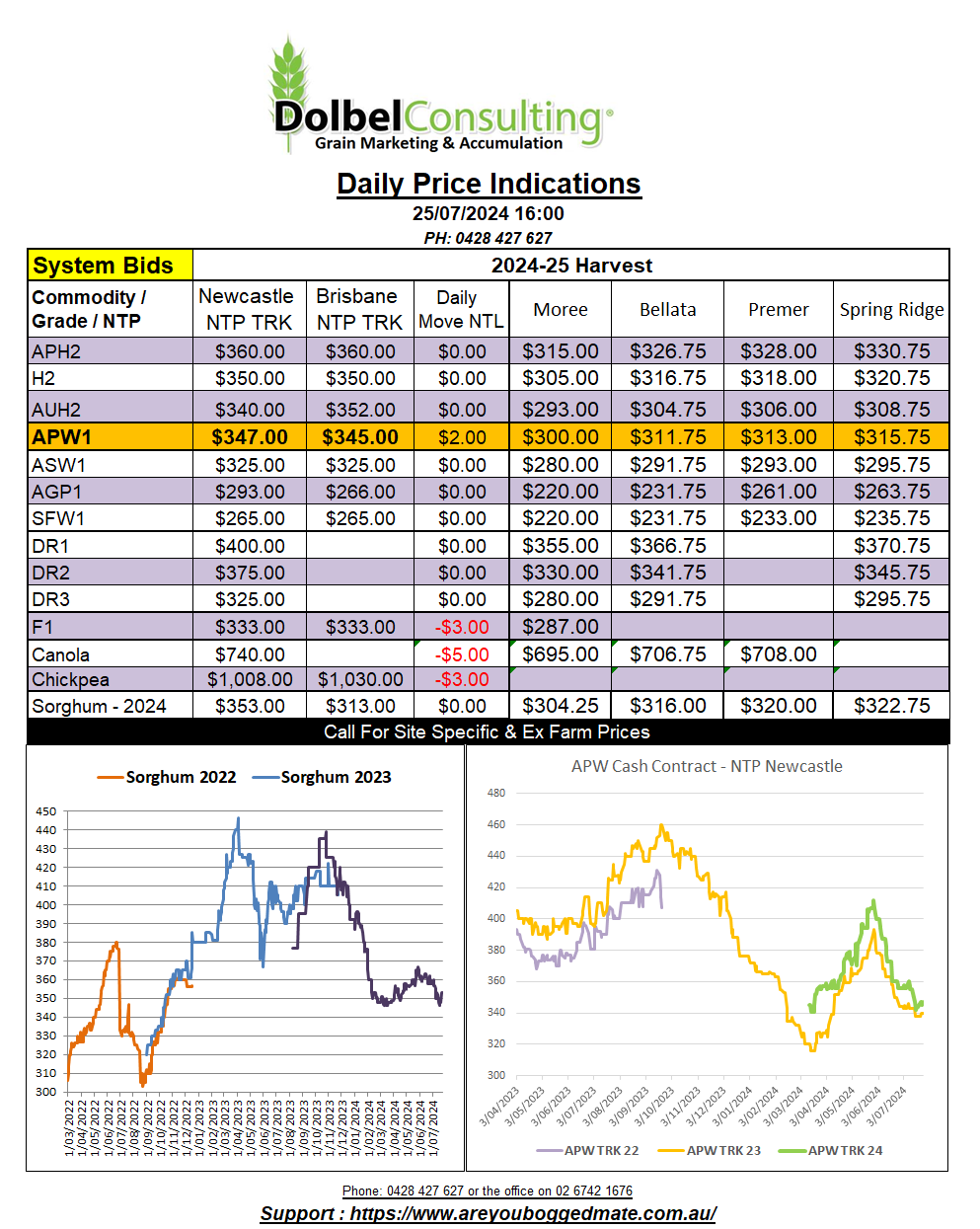

25/7/24 Prices

International grain futures markets appear to be consolidating around current values. That is except for canola and rapeseed, which have all but ran their own race over the last week or two. Both canola and rapeseed futures gave back some of the recent gains in last night’s session. Paris rapeseed shedding €6.00 in the Feb slot but was sharply lower in the August slot, the nearby slot, shedding €14.75 there as we near expiry. ICE canola futures at Winnipeg were also lower, the January slot there closing C$7.70 per tonne lower.

The AUD will go some way to countering lower futures values last night. It can’t counter the losses seen in the canola and rapeseed market but it should go a long way to counter the small decline in MGEX spring wheat futures. Both Chicago corn and SRWW / HRWW had small gains as the bottom feeders become active again.

Corn found support at the international level. A private analyst reduced the Ukraine projected production to 24.1mt, a reduction from their last estimate of 5mt due to hot dry conditions. In AUD terms Ukraine FOB corn values rose just AUD$2.00 per tonne, probably more to do with the AUD than the price of corn. If this estimate is correct we should see Black Sea corn values, and probably EU values, start to move higher over the short term. This may also have an impact of feed barley values out of the Black Sea in the short to mid term. Overnight Russian feed barley values were firmer in both US dollar terms FOB Black Sea and the AUD value when converted. The increase isn’t huge but when taking the day to day change in both the AUD and FOB Black Sea price into account it’s roughly comparable to just under a AUD$6.00 per tonne increase.

The US spring wheat crop tour is under way. Day 2 yield estimates were better than day 1. Southern and eastern regions were estimated to yield 52.5bu/ac (3.53t/ha). The eastern spring wheat belt in the US has had a much better season than the western spring wheat belt and the Canadian Prairies.