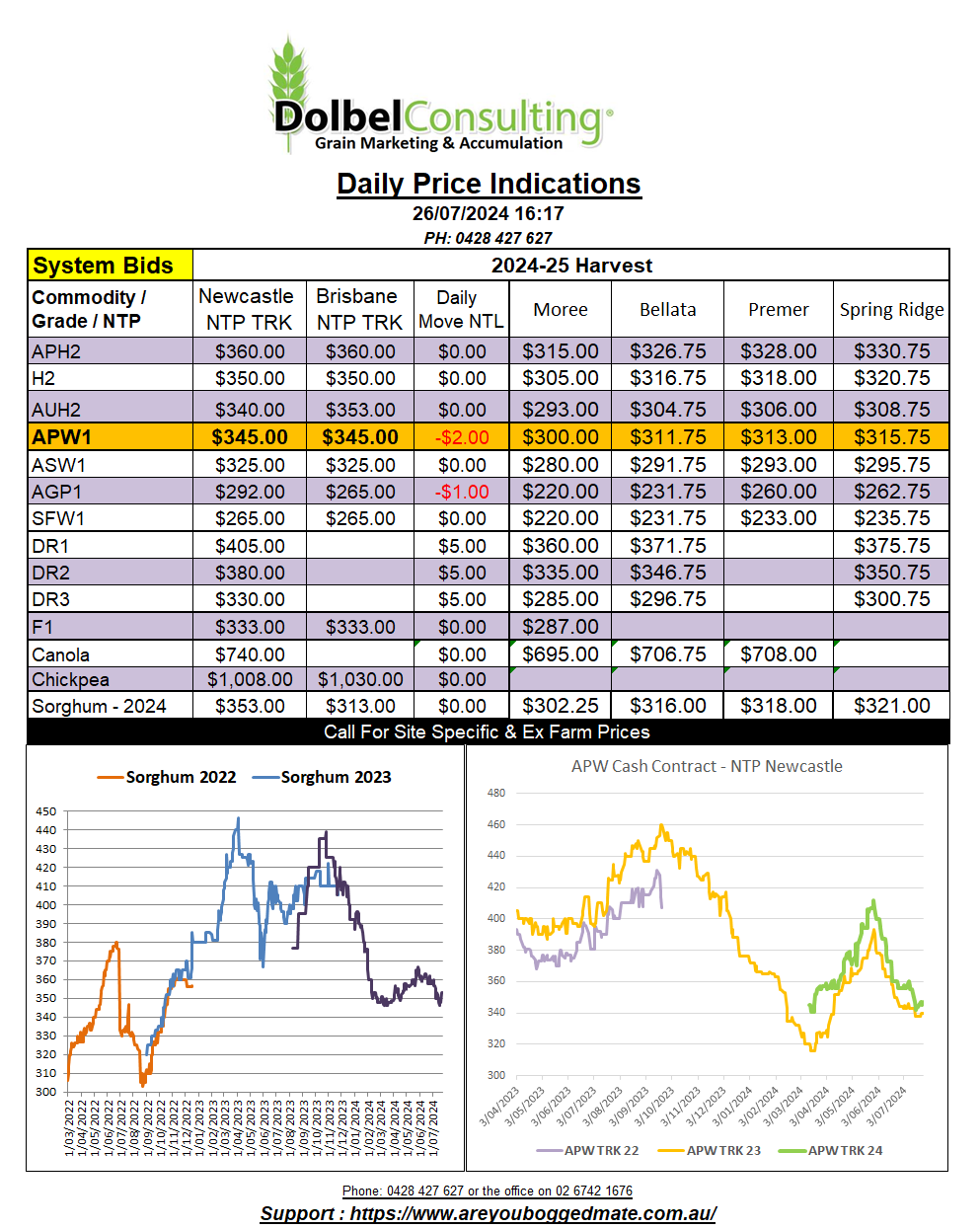

26/7/24 Prices

As much as the lower AUD is helping, it may not be able to counter 100% of the move lower in US, Paris and London wheat futures overnight. All three major grades of wheat in the US pushed lower. Paris milling wheat futures closed €4.00/t lower in the December slot, London feed wheat futures were back £2.40/t in the January slot.

Cash values out of the US Pacific Northwest were generally lower, the AUD did help a lot in the FOB cash conversion. HRWW falling roughly AUD$0.88c/t once the day to day fall in the AUD was factored in, spring wheat slipped roughly AUD$1.18/t while Canadian spring wheat was back roughly AUD$1.07, the weaker AUD countered a lot of the C$3.05 / tonne fall in the ex farm value for Canadian 1CWRS13.5 XF SE Saskatchewan. White wheat values out of the PNW were fairly flat in US dollar terms, allowing the AUD to convert the current values to a day to day increase of roughly AUD$3.51/t, keep that in mind when local prices come out here through the day.

Paris rapeseed futures saw weakness on the nearby August contract but otherwise closed higher across the 2025 contracts. Winnipeg again tracked the Chicago soybean market higher and reflected similar moves higher as Paris saw in the mid 2025 contracts. The reduction in expected European rapeseed yields continues to support the EU cash and futures markets, while hot, dry weather across much of the Canadian Prairies is said to be taking the maximum potential away from an otherwise very good Canadian crop. A reduction in Ukraine oilseed production will also help demand for both Canadian and Australian canola in 2024-25.

Italian durum protein is very good this year, a hot, dry spring hurting yields but keeping quality very good. The mixed, if not softer season in Canada may produce mixed results, but if disease stays under control production should be good. The US spring wheat crop tour saw yield expectations possibly a little better than expected across the eastern and central region. ND Durum yields estimated at 45.3bu/ac vs just 43.9bu/ac last year, 39-2022, and 24.3-2021.