31/7/24 Prices

Chicago soybeans were hit pretty hard again last night, shedding 17c/bu (AUD$9.55/t) in the Jan25 contract. The spill over pressure was evident in both the Paris rapeseed contract and the Winnipeg canola contract. Winnipeg closed C$18.30 / tonne lower in the January slot. Cash bids for ex farm pick up out of SE Saskatchewan were also lower. PDQ showing at average price of C$568.32 / tonne for a Dec lift, down C$18.30 day to day.

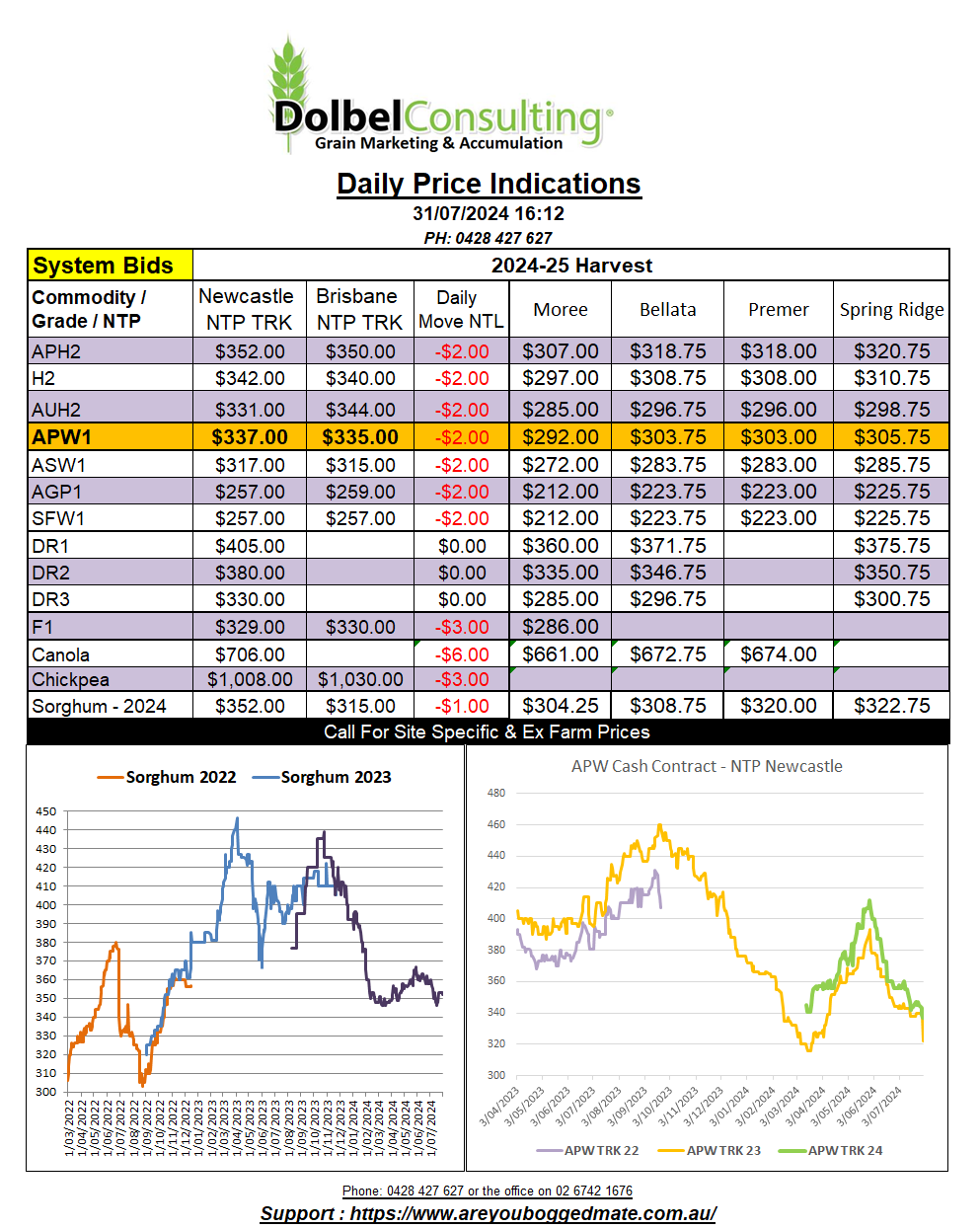

Pressure from beans and outside markets weighed on both corn and wheat futures too. Wheat handing back all but 1/2 a cent per bushel that was gained in the previous session. The lower AUD will only counter roughly AUD$0.49/t of the potential downside, so there’s some scope for lower prices here again today.

Overnight Tunisia picked up 125kt of milling wheat and 50kt of durum wheat. The durum purchase was split between Amber US$322.89 / t CIF and Casillo US$326.29 / tonne CiF. The lower offer value converts back to an XF LPP price of something close to AUD$320 – AUD$340. These values are comparable to current new crop DR2 bids.

Tunisia also picked up 125kt of milling wheat. The lowest offer appearing to be Black Sea wheat at roughly US$212 FOB. This stands up well against the current FOB price estimate of $211.25 being used by most analyst this morning, and shows that B/S wheat, in AUD/tonne at least, continues to move higher using spot AUD. It appears that the number of participants for Tunisian tenders is dwindling though, some talk of outstanding debts.

Although the last 14 days has been dry across much of the Canadian Prairies there are still some that predict head blight (fusarium, head scab) could still be an issue this year. The use of prophylactic fungicides has been widespread, and with drier weather over the last couple of week and drier weather also predicted for the next week or so, the risk should be greatly reduced. Canada is likely to produce both a good durum and spring wheat crop in 2024-25.