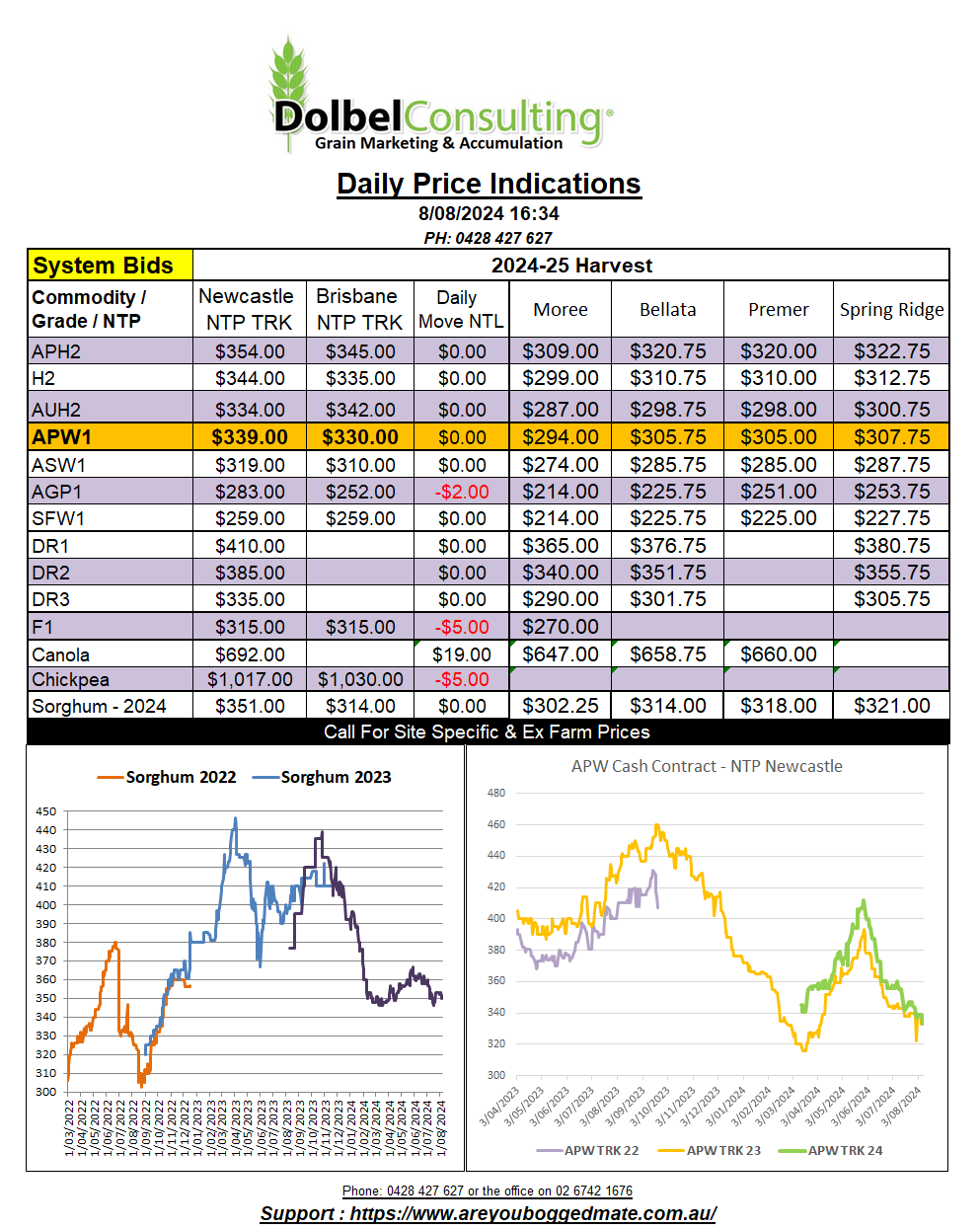

8/8/24 Prices

I see some technical traders now suggesting that Chicago corn is on a path to 300c/bu. We’ve not seen <300c corn since December 2008, corn did slip to 307/bu in August 2020. It’s not uncommon for corn to set the seasonal low during the August / September period. If the US crop is looking good and there’s been no major issues in the lead up to the S.American crop and there’s average demand the combination usually weighs heavy on US corn values and in turn sorghum and barley values.

If we work on a CPI of say 2.5% the 2008 value of 293.5c/bu on the 5th of December would be equivalent to about 425c/bu in today’s money. We are currently seeing 383c/bu, so in relative terms the US corn price is already crushed into the ground. To see a 300c/bu corn price now we would of had to have seen the Dec 2008 price an equivalent of something close to 207c/bu back at the end of 2008, using 2.5% CPI. The last time we saw nearby corn at anything close to that was in January 2006, 208.25c/bu. Using that values and date and the 2.5% CPI it would be close to 325c/bu at today’s money. This doesn’t mean 300c/bu is impossible, it just means that no producer could make any money out of corn.

Currently we see our sorghum priced at roughly a AUD$121.60 premium, NTP NTL, above Chicago corn. At 300c/bu, using that spread it would make sorghum here worth something close to AUD$270 XF. I’m not trying to justify that the last new crop bid I got of $340 delivered Newcastle was a great bid, it’s not, it fails to offer much of return to the producer at all, but in comparison to some global indicators that are being predicted, $300 ex farm is better than $270 XF. I guess it’s just showing that the coming sorghum crop may get a marketing program heavily weighted to the back end with little early grower selling.

Egypt announced a tender for 3.8mt of wheat, yes you read that right, 3.8mt. They’re not trying to pick the bottom at all are they, or have they already sold futures lower and reversed that position. Anyway, this equates to about 70% of their annual wheat imports. This tender is likely to be Black Sea wheat.