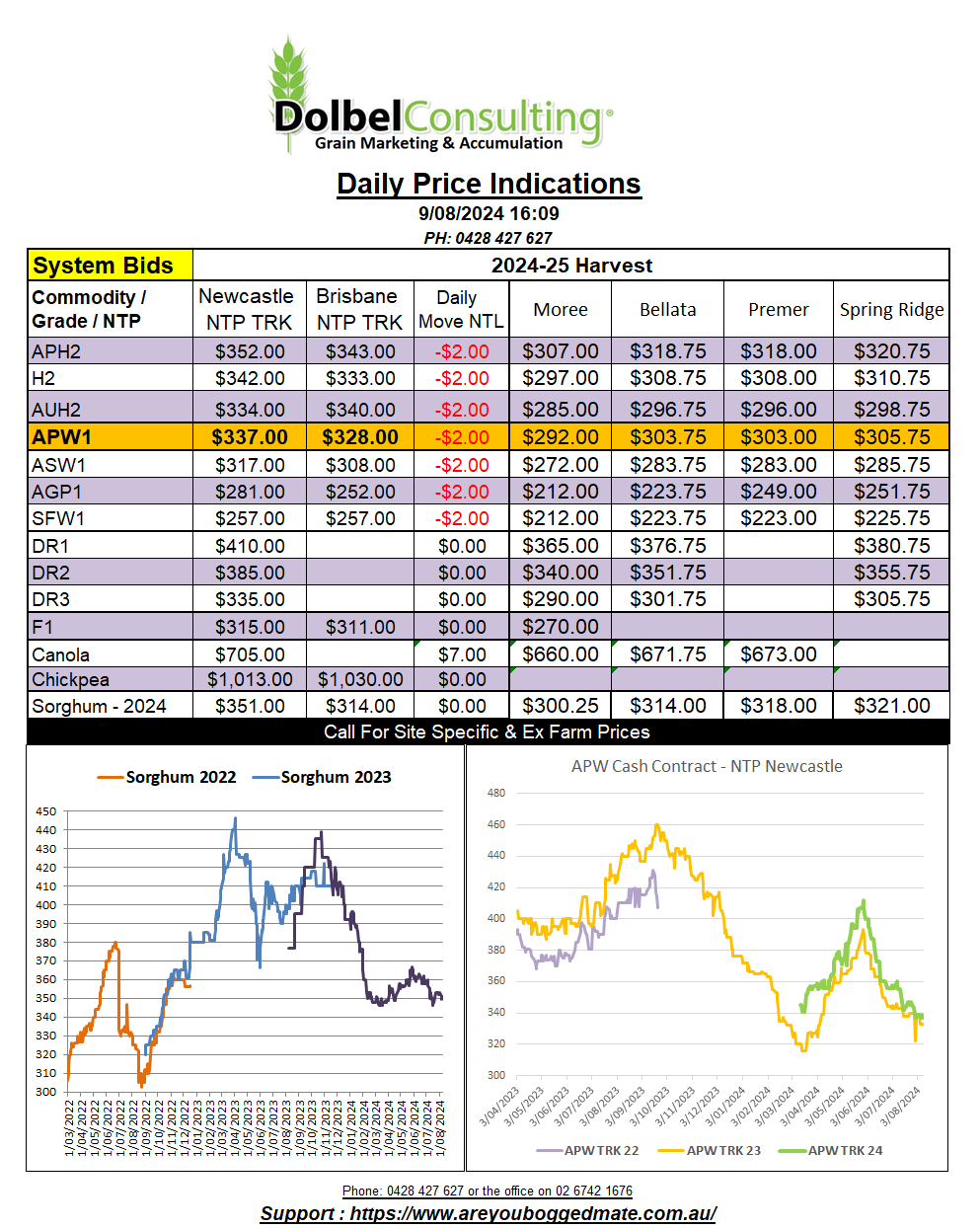

9/8/24 Prices

US wheat futures were generally lower, the premium grades continue to move lower at a fast pace than SRWW. HRWW and spring wheat shed 3.5c/bu and 1.5c/bu respectfully, compared to a loss of just 0.5c/bu for SRWW at Chicago.

Cash values out of the Pacific Northwest pushed lower than futures may have indicated, the firmer AUD not helping the conversion to AUD per tonne. White wheat out of the PNW was unchanged in USc/bu but in AUD/tonne the WW price slipped about the same amount as the SRWW value did at Chicago, roughly AUD$3.70 per tonne, thanks mostly to the AUD. HRWW out of the PNW fell away about AUD$5.58 and US spring wheat fell about AUD$4.42 compared to yesterdays AUD / tonne conversion. Canadian spring wheat values although lower on a day to day conversion, only shed about AUD$2.46 out of the PNW.

Canadian cash and futures for canola were firmer. The average cash price ex farm SE Saskatchewan was estimated at C$548.92 / tonne, up C$2.20 for a December lift. At Winnipeg the canola contract for the Jan25 slot was also C$2.20 higher, closing at C$612.90 per tonne. The hard to swallow part of this will be the conversion to AUD/ tonne day to day comparison. The AUD is stronger against the CAD and actually turns these slight C$ gains around to a potential AUD$3.74 loss. Paris rapeseed was firmer, the Feb25 slot gaining €7.75 per tonne. Even with the stronger AUD, this still equates to a day to day improvement in the conversion of roughly AUD$4.25 / tonne here.

Still no further news on the 3.8mt Egyptian wheat tender but the trade is reporting that Algeria has purchased between 600-700kt of milling wheat. Algeria do not make their tender results public but trade assumptions are never too far off the mark. The price was said to have been around US$250 to US$252 C&F. The price does tend to indicate that Black Sea wheat is the major point of origin, be that Russian, Romanian, Bulgarian or from the Ukraine is not known.