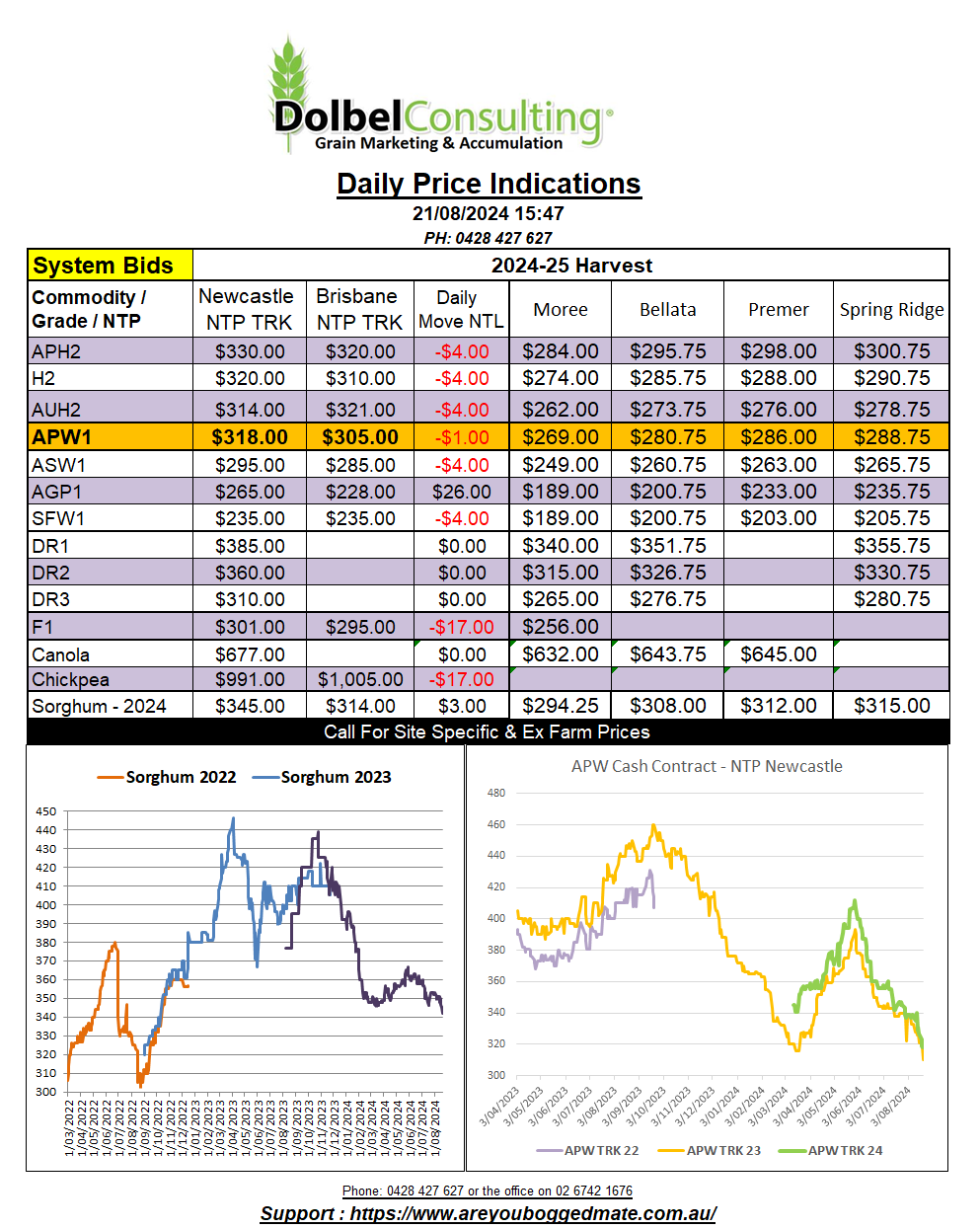

21/8/24 Prices

Strong Chinese demand for both US and S.American soybeans continues to underpin the oil seed market. Compared to this week this time last year Chinese imports of US soybeans is much higher, 475kt vs 143kt, but S.American supplies continue to make up the lion’s share of imports into China.

One of the future restraints on import demand by China may come from the EU, who are proposing an import duty, sorry, anti dumping duty between 12.8% and 36.4% on Chinese bio diesel from Friday this week. Most of Chinese bio fuel uses corn as the feed stock. Second hand veggie oil use is growing.

Indonesia have revised their domestic price cap higher for palm oil, hoping to increase supply.

It appears that government intervention will be the main price driver for the oil seed values in the short term. The main fundamental movers are getting closer to being behind us, with both EU and N.American canola / rapeseed season end approaching. The US soybean crop now also looks unlikely to suffer any major set back in the lead up to harvest, and is currently in good shape.

Futures markets for Paris rapeseed and Winnipeg canola were mixed. Comparing yesterday’s conversions for the Feb / Jan contracts while taking the slight move higher in the AUD into account we see Paris is up roughly AUD$1.24 per tonne, while Winnipeg is lower by AUD$8.74 per tonne.

Canadian canola works into the EU market for roughly US$495 – US$500 C&F. Aussie values may need to be closer to AUD$600 port to compete with the Canadian exports to the EU. Currently we see the domestic crush market bid closer AUD$680 Newcastle.

International wheat values were relatively unchanged, generally firmer apart from slippage in Black Sea values. US values out of the Pacific Northwest were firmer by AUD$2.00 to AUD$4.00, white wheat there up a couple of dollars day to day. US wheat is still priced lower into the central and northern Asian markets than Aussie wheat but the gap is narrowing.