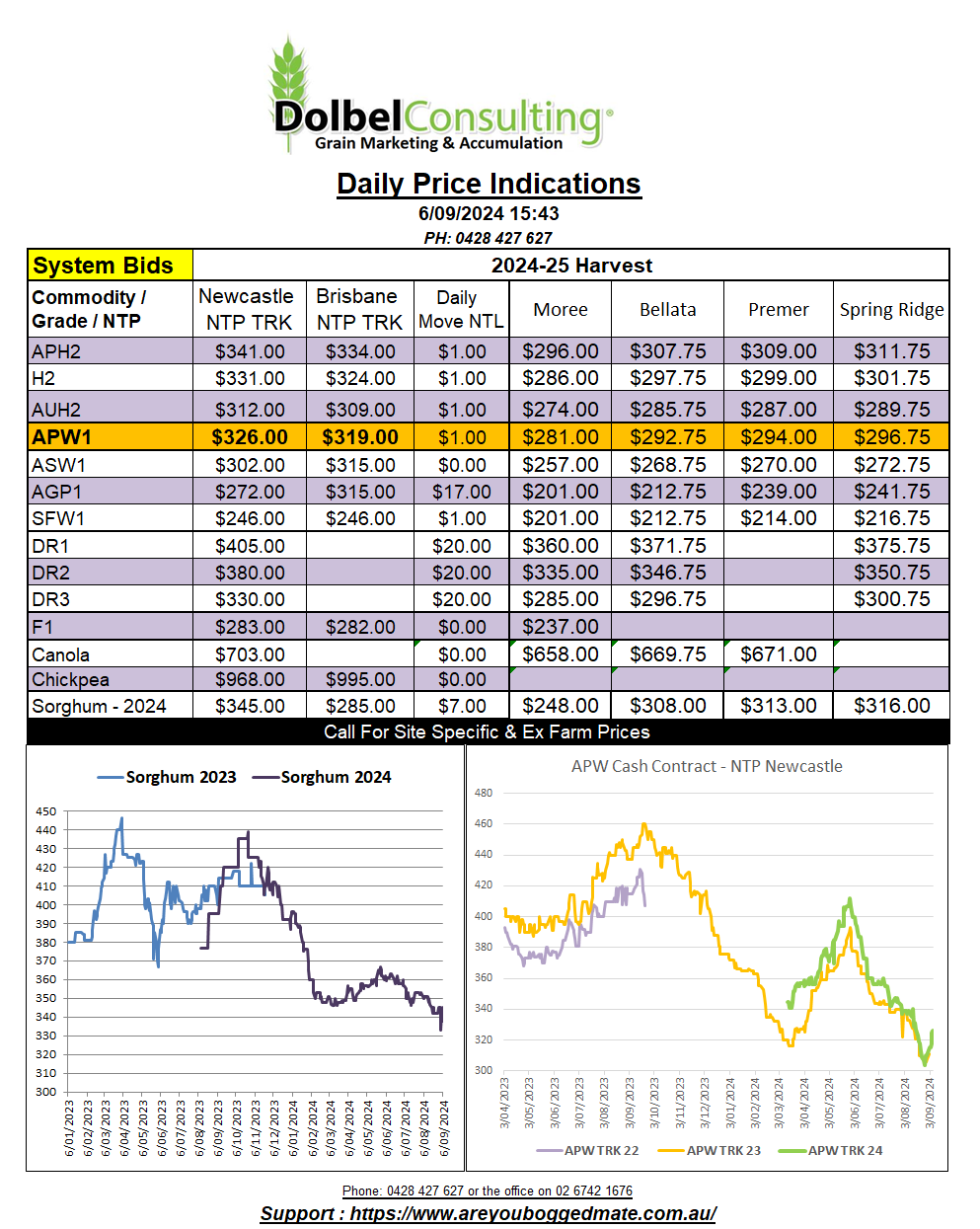

6/9/24 prices

US wheat futures ran out of steam last night after putting in some good gains over the last 6 sessions. Since the 27th soft red winter wheat futures has gained 52.75c/bu (AUD$28.75/t) nearby and 39.25c/bu (AUD$21.39/t) in the December slot. Hard red winter wheat over the same time frame is up 42.25c/bu (AUD$23.02/t) nearby and 42c/bu (AUD$22.89/t) in the December. Local new crop H2 bids have moved higher by AUD$21.00/t while basis has moved from +35c/bu to +14c/bu in the same window, the AUD back about 50pts.

When converting US HRWW out of the PNW to a C&F price to say China, and then converting that price back to an equivalent FOB Newcastle price we see HRWW is now roughly AUD$7.00 higher than H2. The recent rally has eroded the advantage it had over Aussie wheat.

With the Labour Day holiday on Monday delaying this week USDA sales and exports data we’ll have to wait until tomorrow morning to see if the rally in price has had an impact on US demand into Asia. Pre-report speculation has a range of 300kt to 600kt as the expected US sales number.

A French producer group has estimated the French wheat crop at just 25.98mt, 340kt below the French Ag Ministries official estimate and a massive 26% below last year. Export activity out of the French port of Rouen is reflecting the smaller crop, failing to make any export loadings again this week.

A push by the Indian government to produce more corn based ethanol has suddenly turned India into a net importer of corn as opposed to their traditional standing as a net exporter. The change in local procurement price for corn based ethanol moved the Indian ethanol market away from sugar cane based ethanol and towards corn based. This in turn has put pressure on their domestic feed grain values. With summer crop harvest now under way in many location another month of wet weather was not what India needs. The 30 days anomaly map shows very wet conditions in the NW. The 7 day forecast is also wet.