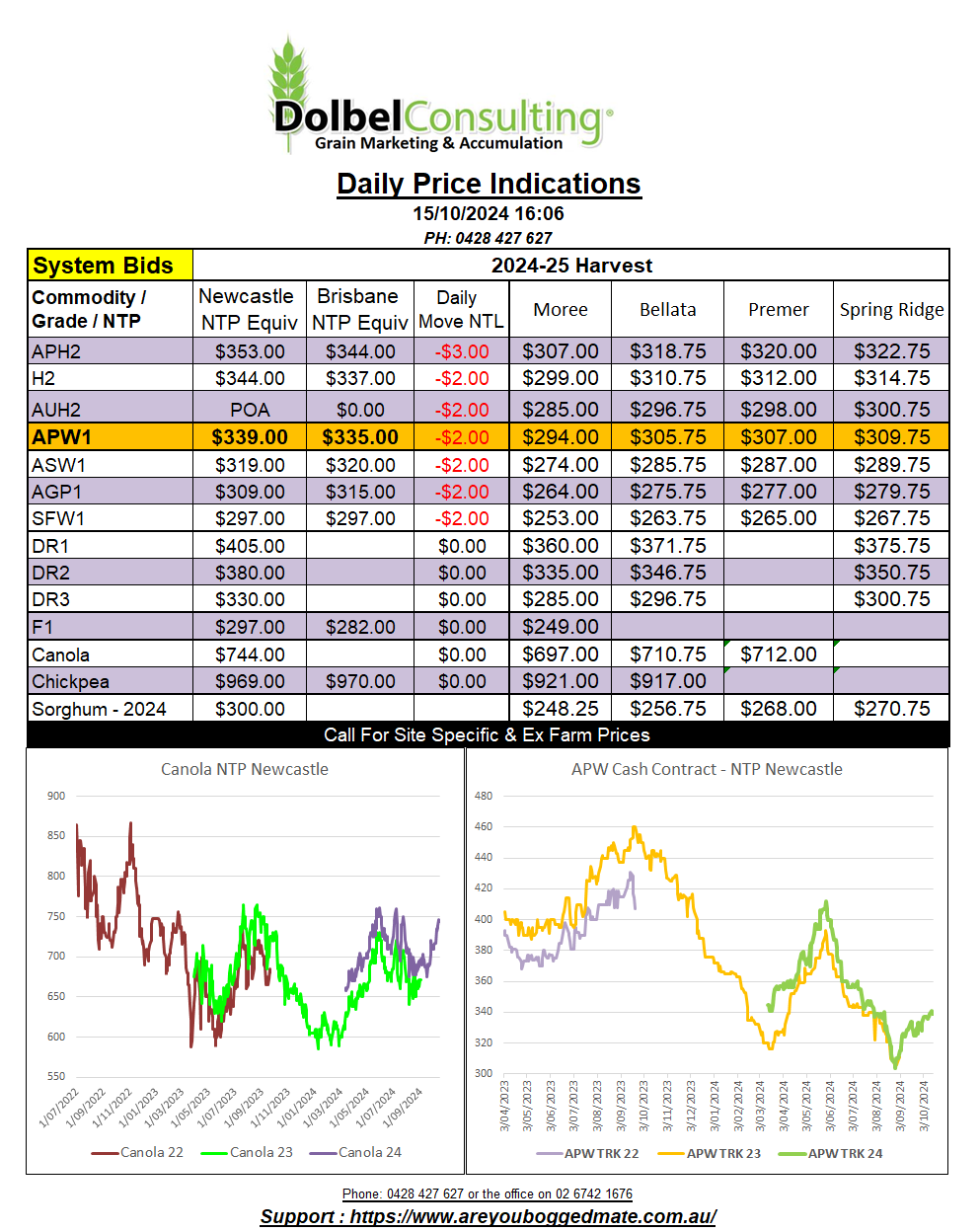

15/10/24 Prices

Technical selling in the wheat pit increased at Chicago last night, pushing all three primary grades down into double digit loses. The WASDE on Friday night wasn’t friendly wheat, raising world ending stocks but reducing US stocks. One may have thought this could have supported US futures a little, but the sellers dominated Monday’s session. Both London feed wheat futures and Paris milling wheat futures followed the trend in the US wheat futures market, both shedding value. Paris milling wheat wasn’t hit too bad though, down just €0.50 / tonne in the December slot, roughly AUD$0.81 / tonne at this mornings exchange rate. Paris rapeseed futures also closed –€2.50 lower in the Feb 25 slot.

Cash wheat values were lower out of Canada (which was on a long weekend break), the US Pacific Northwest and Europe, but not the Black Sea. US values FOB PNW were back as much as AUD$8.73 for DNS when compared to Friday’s conversion. PNW club white wheat was unchanged in USD, the conversion to AUD / tonne was actually higher given the weaker AUD.

Black Sea wheat values were higher, both in native currency and when converted to AUD / tonne. The AUD making up the bulk of the move though.

The difference between Aussie wheat and US PNW wheat into the Asian consumer remains minimal, so little fundamental shift in price is needed.

The next RBA meeting is on the 4th & 5th of November. The punters are again tipping a rate cut, the majority appear to be assuming a 25pt cut in December, some punters more, some less. The minutes from the Sept meeting apparently offer no concrete clue in their near term direction. The punters appear to think that the RBA may need to see unemployment increase to justify a move lower in rates. From what I’m hearing there are many small business owners who are simply retiring if they are unable to sell their business, I guess in time they’ll need to employ someone in the NDIS system to “look after them”.