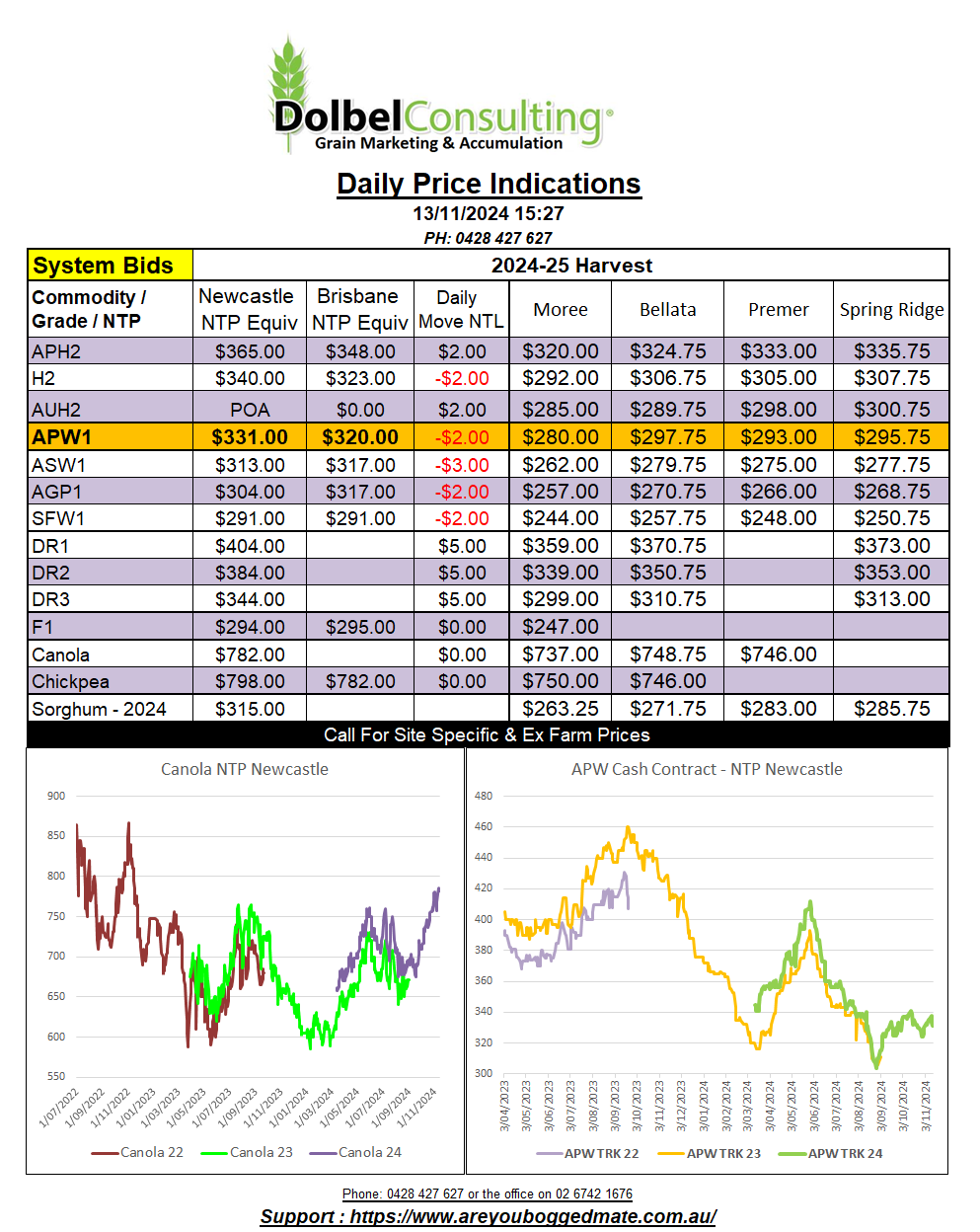

13/11/24 Prices

Good weekly US wheat export inspections data was overlooked as both futures and cash prices fell away. FOB values out of the US Pacific Northwest were lower day to day in AUD / tonne. The weaker AUD helping to counter some of the move lower but not all. Hard red winter wheat futures at Chicago shed 13c/bu nearby. At today’s exchange rate that’s about AUD$7.31 / tonne. FOB values for HRWW out of the PNW did not follow the Chicago futures market lower dollar for dollar, in fact once the AUD is taken into consideration the conversion of yesterdays values back to an equivalent price XF LPP compared to this mornings identical conversion using today’s exchange rate actually shows a slight improvement in HRWW FOB value.

White wheat values out of the PNW were down less than one Aussie dollar once taking the move lower in the AUD/USD into account.

Wheat out of the Black Sea was lower day to day by roughly AUD$2.00 to AUD$3.00, Argie values were also lower, shedding roughly AUD$2.22 day to day. The biggest loser was FOB Rouen values for milling wheat, shedding almost AUD$10.00. EU futures were a sea of red, following the lead from the US market. London feed wheat, Paris milling wheat, corn and rapeseed futures all closing lower. Paris milling wheat shed €2.00 in the December slot and €3.00 in the March slot. News that the French wheat crop should is sown but away in less than ideal conditions again this year was slightly bullish, but most punters are factoring in an average EU wheat crop for 2025 now.

Paris rapeseed was back in line with loses for both Chicago soybeans, meal and oil, and Winnipeg canola futures. Malaysian palm oil was a tad higher across the Dec / Jan / Feb slots, but did not influence the bean or canola markets. Bids for canola across SE Saskatchewan were lower by C$8.30 for a January lift. Canadian canola can arrive C&F France for roughly US$560. Ukraine rapeseed is valued at US$640 C&F France, while Aussie canola is roughly US$610 there at current track bids. Canadian exports have been strong, countering the potential impact of Chinese import tariffs. The Canadian crop was a little lower than average but can handle the current export pace until winter makes access more difficult, potentially turning EU buyers back to Aussie imports.