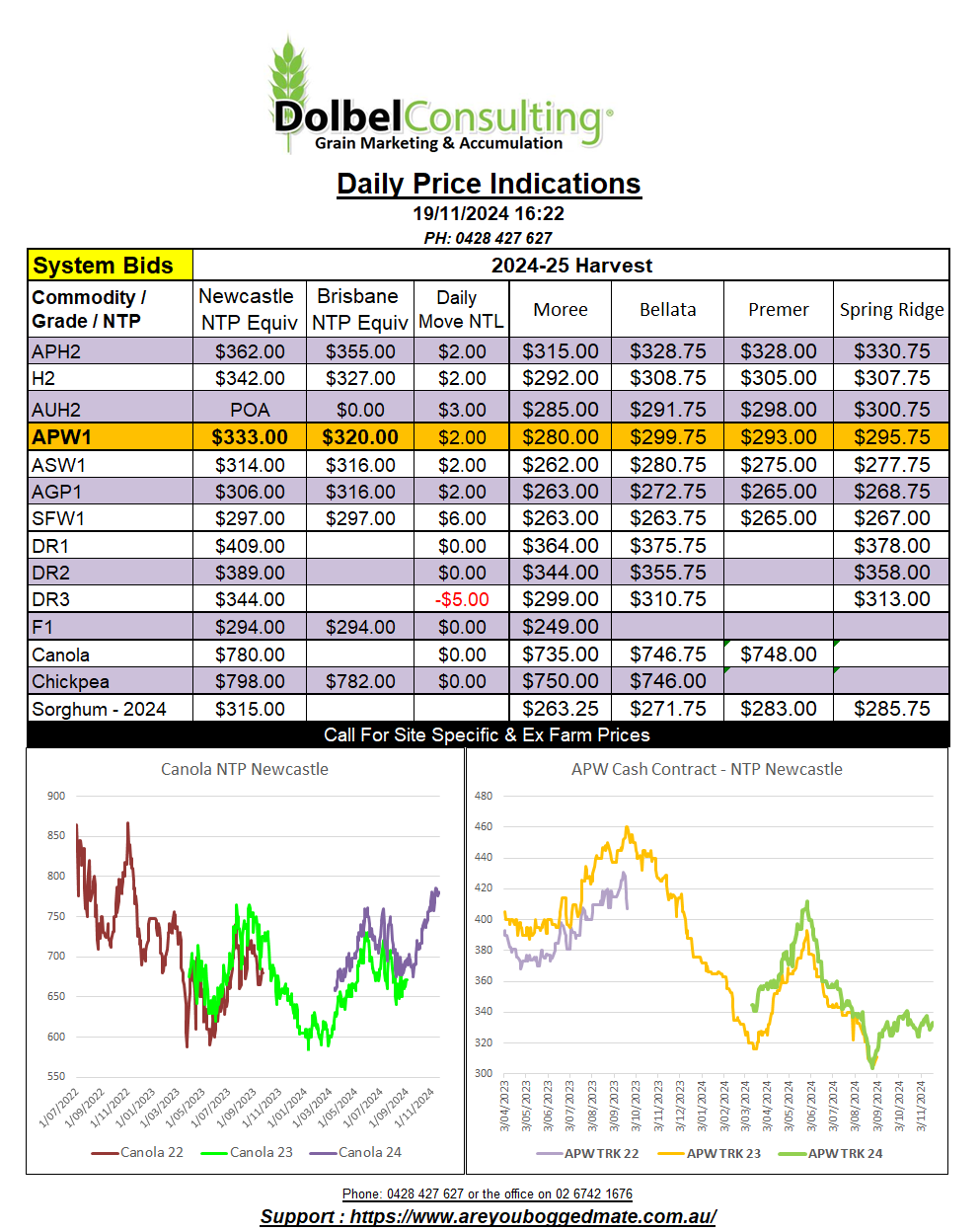

19/11/24 Prices

International Commentary

The Australian harvest moves on with CBH in WA taking 3.2mt last week, taking receivals to date to 7.2mt and roughly 40% of projected receivals. On the east coast Graincorp sites saw 1.5mt of additional deliveries taking harvest receivals to 6.67mt. Harvest is winding up on the Downs and the far north of NSW, but is still in the early to mid stages south of Narrabri, with rainfall delaying progress a little. Quality remains very good, wheat a little lower in protein than average in the north but oil content in canola remains very good.

International grain and oilseed futures closed in the green last night. Paris milling wheat futures joining the US markets with day to day improvements. Paris Dec milling wheat closed €1.75/t higher while the March slot was up €2.50/t by the close. Both Paris rapeseed and Winnipeg canola had unconvincing closes, improving in value, but not by a lot. Chicago soybeans were stronger, gaining 11.25c/bu in the January slot while palm oil was flat to a smidge lower.

An improvement in the AUD will counter some of the move higher when converting futures to AUD / tonne this morning. Not so much in wheat as the moves were good, but in canola and rapeseed the AUD could turn a slight positive into a slight negative. Local wheat basis to Chicago SRWW futures did move lower yesterday. Local cash prices not reflecting the recent downward or upward volatility in US futures. Cash values out of the US Pacific Northwest were higher overnight. HRWW FOB values increased by roughly AUD$6.88/t compared to yesterday’s FOB Aussie equivalent price. Spring wheat values out of the PNW were also firmer, roughly +AUD$4.47/t, while club white wheat was actually off a dollar.

Increased military action between Russia and Ukraine was seen as supportive wheat. Russia deployed an additional 50k troops in the SE while Ukraine got the go ahead from the Biden administration to use the ATACMS system that has a range of 300km, Moscow is roughly 450km away from the front line.

Domestic Commentary

Volume on the offer side for track wheat increased yesterday. The trade initially bid at or close to the offer value, pushing numbers above the public bid in some locations. Bids remained very site specific though, rail loading capacity having a lot to do with where the trade, mainly the exporters, were happy to take ownership at this time of year. The trade were cherry picking sites with the fastest train loading capability. This made for some interesting price disparity, especially across some western sites. Then there was the desire of some traders to compete more aggressively at some sites, Bellata a prime example of that.

The disparity between Burren Junction and say, Merah North has to do with train costs more than Graincorp fees, apparently. It takes three days to load the same train at Merah North but just two days to load at Burren Junction. It’s a bit like trying to unload a road train at a smaller consumer, the trailer needs to be disconnected and the truck and trailer need to be unloaded separately. The same applies for train loading at the compared sites.

This may just be a short term issue though as the trade rush to fill prompt export orders with limited accumulation time allowance. As other commodities, like chickpeas, vacate the system, the urgency may withdraw a little, the costs won’t change, but the desire to load from slower sites may change, or will these sites be allocated to domestic traders for domestic markets. The question is will the cost of carry be covered by increased wheat prices in 2025.

The Biden administration has authorised Ukraines usage of longer range missiles capable of delivering war further into Russia. This has seen an increase in the tension in the Black Sea region, countering the negative impact rain had on prices last week. The punters are also net long, December will be interesting.